Institutional investors seldom lose faith during turbulent market phases. They usually consider such periods to be good for accumulation and keep buying Bitcoin dips. However, not all institutions prefer exposing themselves to the king crypto-asset directly. Veiled investment products that provide indirect access to BTC, like exchange-traded funds, usually come in handy at such times.

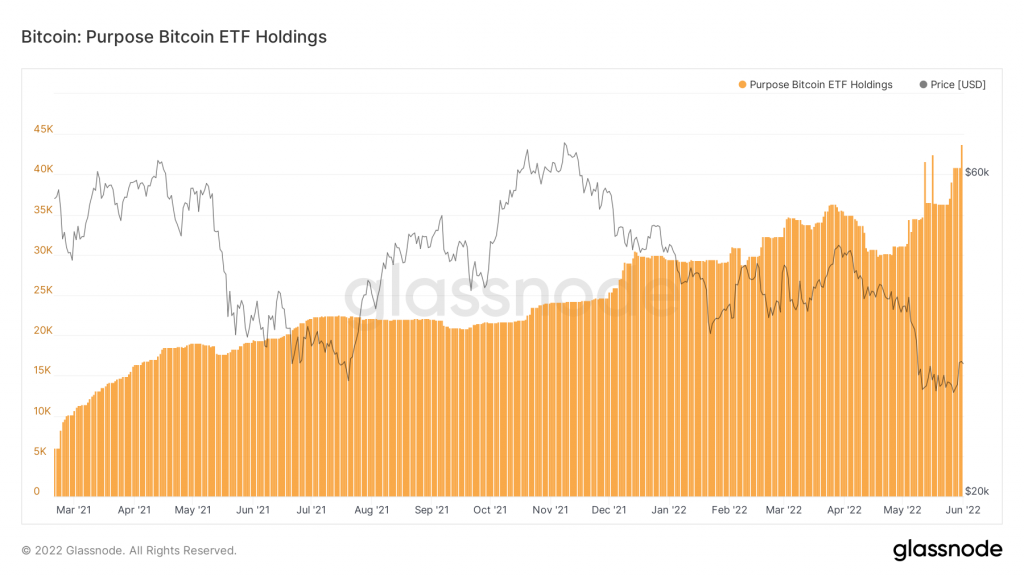

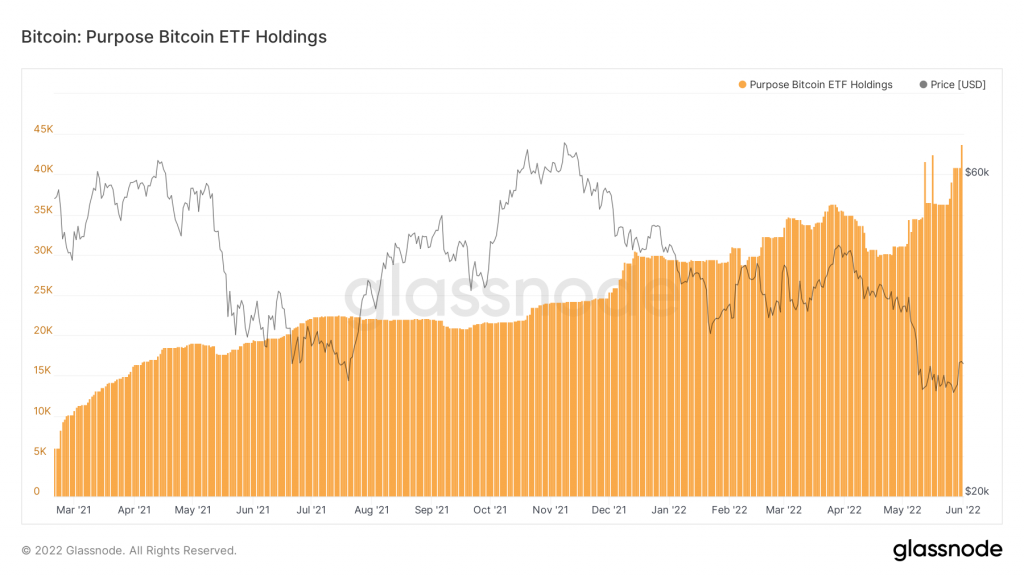

Well, of late, the said trend is in play and Canadian institutional investors are busy diversifying their portfolios. The Purpose Bitcoin ETF has been noting back-to-back inflows over the last past few trading days. The fund’s assets under management clinched a new ATH as it to 43,701.7 BTC as of Tuesday.

The highest inflows over the past few days were noted last Thursday and this Tuesday when the fund purchased 2,006 BTC and 2,780 BTC respectively.

Interestingly, the said inflows align with the broader institutional purchase. As highlighted in a recent article, digital asset investment products saw $87 million in cumulative inflows last week, with Bitcoin products accounting for the most [$69 million of that total].

What about the OG GBTC?

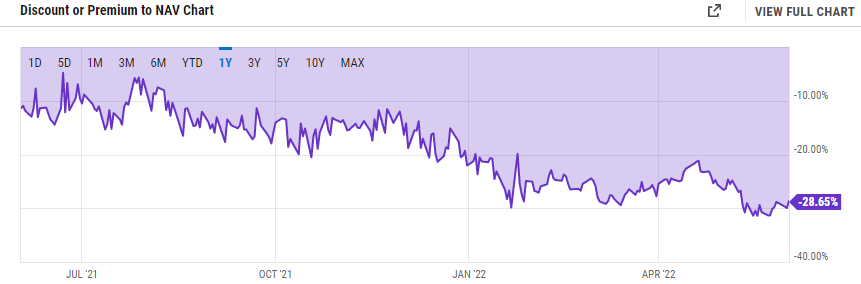

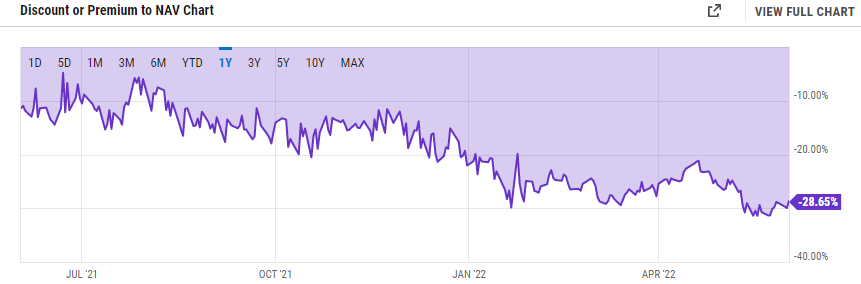

Grayscale’s Bitcoin trust [GBTC] is one of the oldest crypto investment products that institutions prefer diverting their finds towards. Simply put, the GBTC HODLs large amounts of Bitcoin, which means that as the price of BTC rises or drops, the value of the shares of this trust changes accordingly.

It has been more than a year since the GBTC has been trading at a discount. Their value started diminishing at a much faster pace during the beginning of the year when the fund’s shares were trading at merely two-thirds of their value. At the moment, the discount stands at close to 30%.

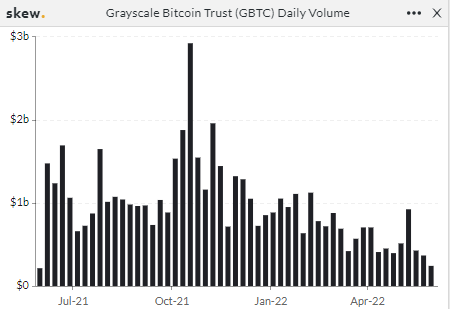

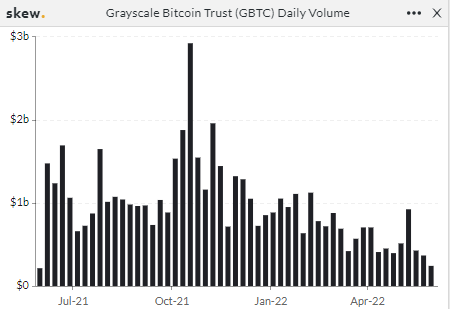

Given the unappealing returns, institutional players have been exiting Grayscale’s playing field. As can be noted below, the GBTC’s daily volume has been on a macro downtrend. When compared to this time last year, the average volume has dunked by approximately 4-5 times, bringing to light the eroding interest of institutions.

While things on the institutional landscape seem to be in good shape, on the whole, the state of GBTC brings to light that Grayscale’s grasp on the game has started dwindling with other players stepping into the field. Given the fact that the organization intends to transition its fund to a Bitcoin Spot ETF, losses can be expected to be alleviated going forward if the SEC provides a green signal.