For the first time since April this year, US inflation has dropped. Per the latest data release, CPI eased slightly to an 8.5% annual rate and was relatively flat compared to June. The expected CPI for July was 8.7%.

Well, a drop in inflation is, arguably, good, for it would aid in diluting the Fed’s hawkish stance, and eventually lead to a drop in rates. The major indices that closed in red on Tuesday reacted positively to the said development. Futures for the Dow Jones Industrial Average jumped 400 points [1.2%]. Alongside, S&P 500 futures gained 1.7%, while Nasdaq 100 futures jumped 2.4%.

In fact, the crypto market that was trading in red until a few hours also managed to flip to green.

So, will the price hike for Bitcoin continue?

Well, Bitcoin’s correlation with the broader market has been falling of late. In fact, per one of Kaiko’s recent analyses, the king coins recent correlation with bonds and tech equities has hit a quarterly low. This means, that the markets have not necessarily been moving in tandem and replicating each other’s movements.

However, per Kate Kurbanova—the Co-Founder and COO of risk management platform Apostro—a “strong correlation” still exists between the broader traditional stock market and the digital currency ecosystem. In a textual commentary to Watcher Guru, the executive spoke about the transmission of shock from one industry to the other. She said,

“One key demerit is the fact that the correlation presents a systemic risk as it permits the transmission of shock from one industry to the other. This is literally what has played out thus far, and the safe haven in divestment is notably neutralized.”

What’s next?

Just like we’ve seen shock transmit from one industry so far, going forward, the tables might reverse, and we might note collective liquidity injections.

However, the same might not necessarily materialize immediately, for the crypto market’s correction has been long overdue. Of-late pumps have more or less been linked to the hype associated with The Merge. So, with Ethereum and the alts rallying, even Bitcoin has been following suit.

Read More: Altcoin season index peaks: Ethereum, Cardano, XRP to rally?

Furthermore, over the last couple of days, the exchange inflows have been on the rise. Per data from CryptoQuant, on 7 August merely 10.8k BTC were sent to exchanges. Tuesday’s number, however, stood at an inflated 36.7k BTC, bringing to light the altering sentiment.

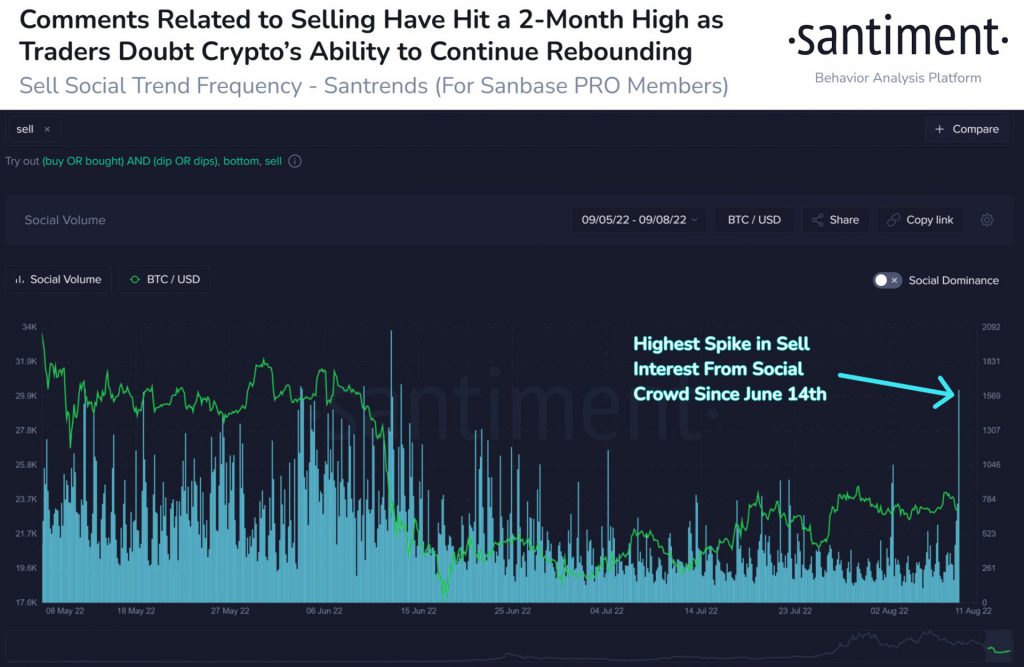

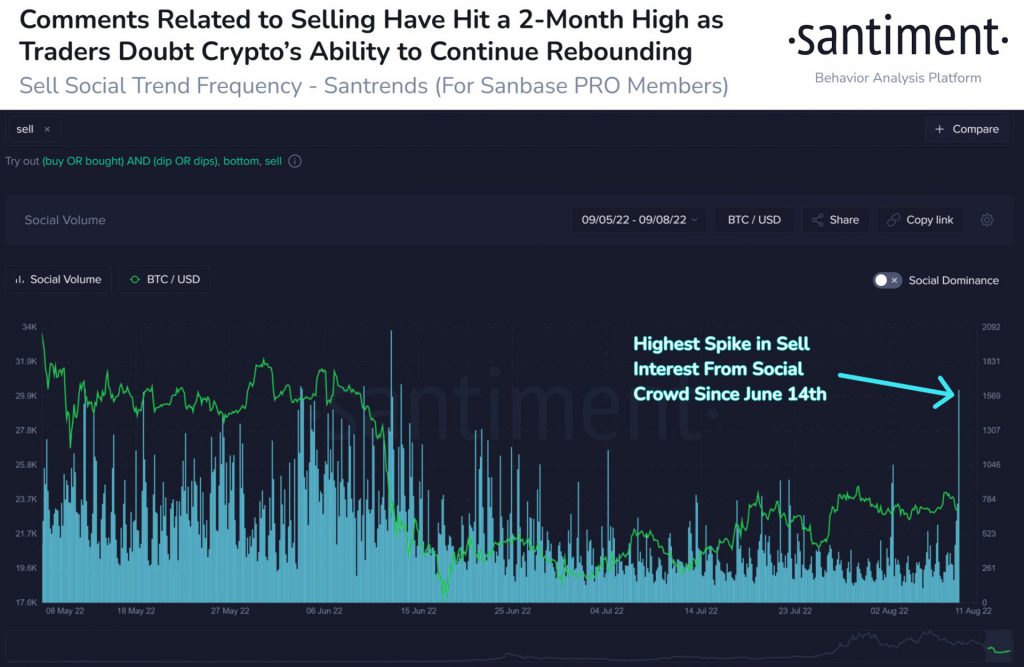

Supporting the same was one of Santiment’s latest analyses. It revealed that the number of “sell” mentions on social media platforms like Twitter, Reddit, and Discord has hit a 2-month high peak. Per the analytics platform,

“The crypto community doesn’t appear to believe in Bitcoin and other assets continuing to rise back to prosperous levels.”

Per the aforementioned factors, yes, it does seem like the pump is temporary and Bitcoin will likely continue shedding value, despite the positive data release.