The XRP ETF filing marks a groundbreaking development as the SEC formally accepts Grayscale’s application to convert its XRP Trust into an exchange-traded fund. This milestone comes as the growing interest in cryptocurrency regulations and potential shifts in crypto investment strategies are also increasing. The acceptance of the XRP ETF filing opens multiple new paths for XRP price movements. Several key market shifts are also expected as numerous institutional investors pursue regulated channels for digital asset exposure.

NEW: There it is — The SEC just acknowledged @Grayscale & @NYSE’s 19b-4 filing to list an XRP ETF

— James Seyffart (@JSeyff) February 13, 2025

(this was mostly expected but officially means the clock will start soon for this and Dogecoin) pic.twitter.com/IQgTqPiiOe

Also Read: 3 Oil Stocks That Can Surge If Trump’s ‘Drill Baby Drill’ Policy Goes Live

How Grayscale’s XRP ETF Could Impact Cryptocurrency Regulations and Price

SEC’s Acceptance Signals Market Evolution

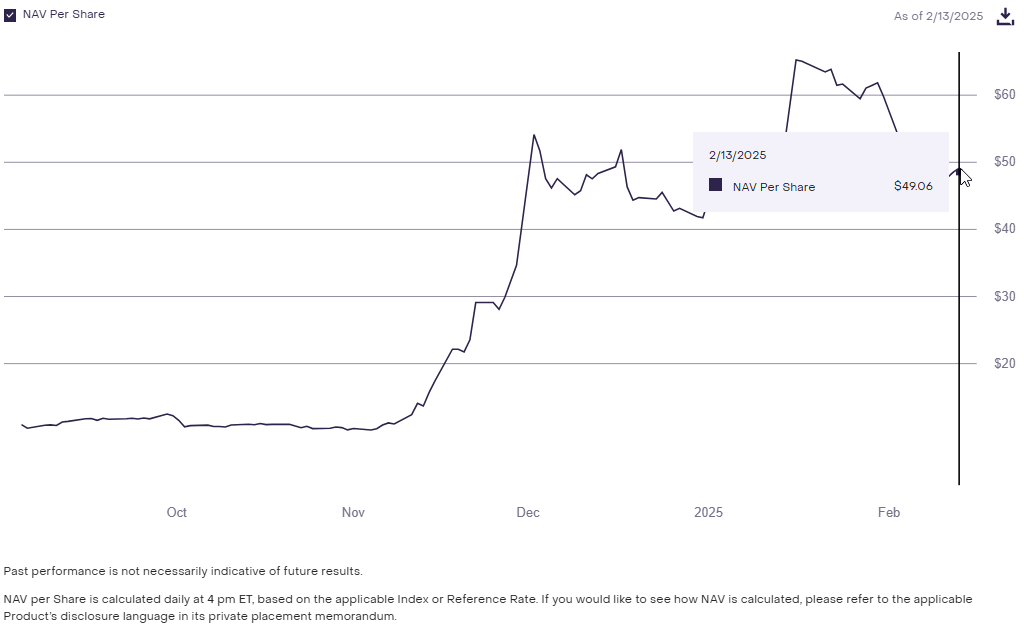

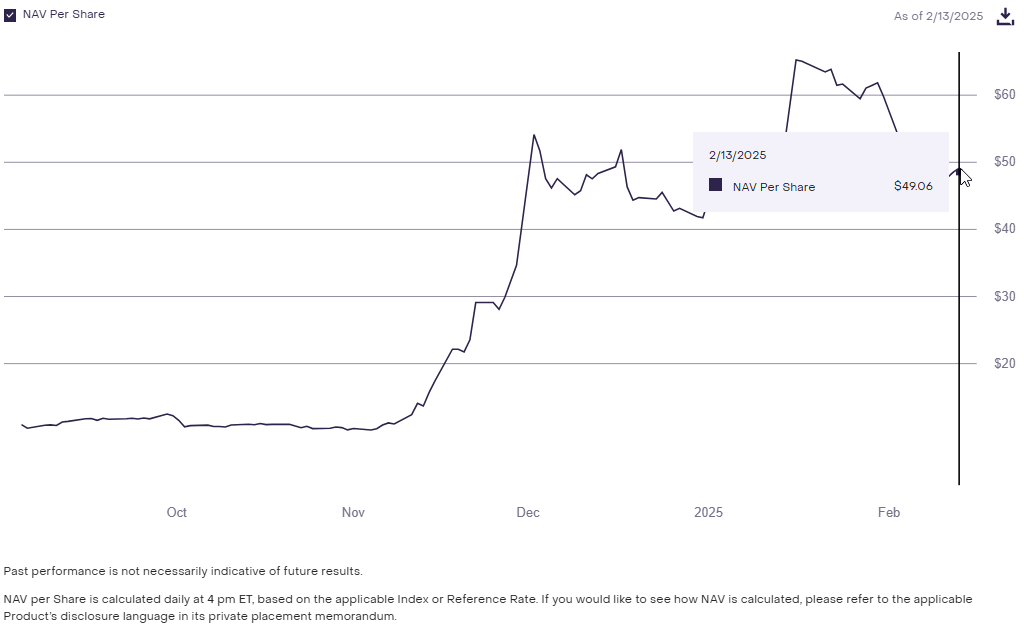

The Securities and Exchange Commission’s acceptance of Grayscale’s 19b-4 application unlocks multiple transformative shifts for cryptocurrency regulations. It sets several new benchmarks for market standards. The XRP ETF filing progresses steadily as the $16.1 million trust fund undergoes detailed SEC evaluation. This signals a structured approach to digital asset oversight in established financial markets.

Fox Business reporter Eleanor Terrett stated:

“The U.S. Securities and Exchange Commission (SEC) has officially accepted the 19b-4 application submitted by Grayscale and NYSE, intending to convert the Grayscale XRP Trust Fund into an ETF.”

Market Response and Price Implications

The XRP price responded positively to the ETF filing news. Market analysts have created varied valuations, projecting that XRP could potentially hover between a value of $3.00 and $5.00. The Grayscale XRP trust conversion opens new regulated investment channels, drawing multiple institutional investors into the digital asset space. The strengthened regulatory framework has energized various market sectors, with numerous financial institutions now exploring streamlined crypto investment opportunities. With multiple pathways now opening up and several major players taking positions, market watchers should keep a close eye on these developing institutional movements in the digital asset space.

Also Read: Cardano ADA Echoes 2021 Pattern: Parabolic Rally Incoming?

Investment Accessibility and Market Growth

🚨SCOOP: $XRP depository receipts will soon be available for purchase by accredited investors through @ReceiptsDepo and @DWP_advisors, @FoxBusiness has learned.

Much like traditional ADRs (American Depository Receipts) that represent shares of foreign companies, the XRP DR…— Eleanor Terrett (@EleanorTerrett) February 7, 2025

The proposed ETF structure would simplify XRP investment for retail traders, eliminating the complexities of cryptocurrency wallets and exchanges. The XRP ETF filing represents a crucial step toward mainstream adoption. The XRP price could benefit from increased institutional participation. This accessibility boost aligns with broader crypto investment trends, as traditional financial institutions seek regulated exposure to digital assets.

Regulatory Framework Development

The SEC’s stance on the XRP ETF filing signals evolving cryptocurrency regulations. A clear regulatory framework could stabilize Grayscale XRP products and attract additional institutional capital. The acceptance process will be closely monitored by market participants for implications across the broader cryptocurrency sector.

Also Read: Coinbase (COIN) Posts Q4 Earnings, 23% Higher Than Expected

The SEC’s acceptance of the XRP ETF filing is unleashing numerous possibilities for market expansion and institutional adoption. As several aspects of Grayscale’s application move through various regulatory channels, multiple retail and institutional investors are gearing up for some pretty significant market structure changes. The development points to a maturing cryptocurrency market. Numerous traditional financial products are merging with digital assets, establishing several groundbreaking standards for crypto investment vehicles.