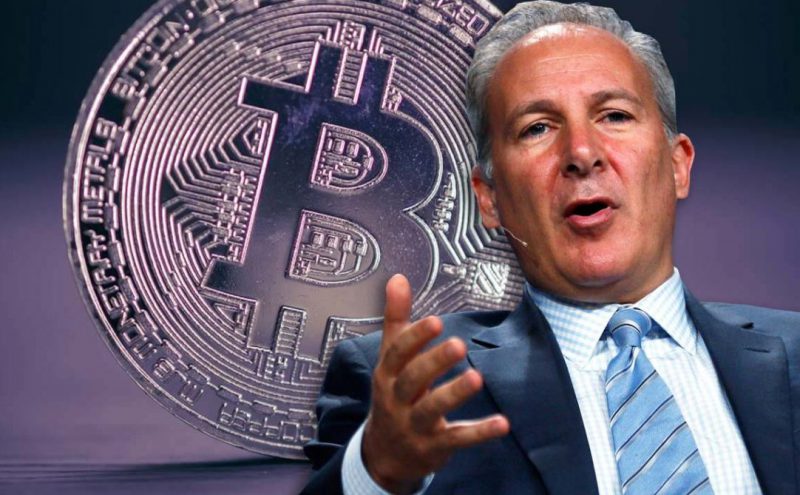

He has been one of the loudest voices proclaiming that Bitcoin’s falling price is a sign of cryptocurrencies’ end. Peter Schiff has seemingly insisted that “crypto winter” is better coined as an impending “crypto extinction.”

The CEO has been outspoken in his perception that cryptocurrency is a weak and speculative market. Moreover, with current developments leaving little room for optimism, he has doubled down on remarks. Yet, is there truly a reason to be as pessimistic as Schiff?

Schiff Insists on crypto’s end

The recent weeks have been tumultuous, to say the least, for the entire cryptocurrency industry. All of which stemmed from the destruction and downfall of one of the most prominent cryptocurrency exchange platforms on the planet, FTX.

Last week saw the news break of the platform’s plummeting price. It was a headline that preceded an even more devious demise. Subsequently, it was revealed that the platform’s now-former CEO, Sam Bankman-Fried, was misusing customer assets to fund bets via his other company, Alameda Research.

Billions worth of debt is now accumulated, and the company was forced to file for Chapter 11 bankruptcy protection as a result. However, the impact on the entire industry was far worse than a bankrupt and defunct platform. Customer concerns around the safety of cryptocurrency, particularly on centralized exchanges, followed. Additionally, bad publicity has been detrimental to an already volatile market.

It was these headlines that have impacted cryptocurrency prices across the board. This was seen clearly in the deteriorating price of the most prominent cryptocurrency, Bitcoin. The development led goldbug Peter Schiff to deduce that a crypto winter could develop into crypto extinction.

Taking to Twitter, Schiff delivered a harrowing message to investors. “This is not a crypto winter.” Schiff stated, “That implies spring is coming. This is also not a crypto ice age, as even that came to an end after a couple of million years. This is crypto extinction.”

Is he wrong?

Schiff concluded his message by stating, “But #blockchain will live on. #Gold will rise again to lead a new breed of asset-backed cryptos.” This tweet emphasized what has been Schiff’s long-held belief that gold is the truest dependable currency.

Although his prognosis on the cryptocurrency market may be false, the grim state of the contagion spread by FTX is a reality. In a subsequent Tweet, Schiff remarked that “The lesson of #FTX is for investors to do better due diligence and not just foolishly jump on speculative band wagons.”

And although it is misguided, it is not entirely wrong. “Lessons” is the optimal word in that statement. The reality is that cryptocurrency is still young, and these mistakes and near meltdowns are unfortunately necessary for the market to build, progress, and move forward.

Cryptocurrency is not going extinct. Although quite speculative in nature right now, there are too many intelligent individuals dedicating their genius to ensuring that it moves forward as a payment medium. Gold will always have a place, but it won’t come at the expense of the cryptocurrency market. The latter will heal, and it will progress.