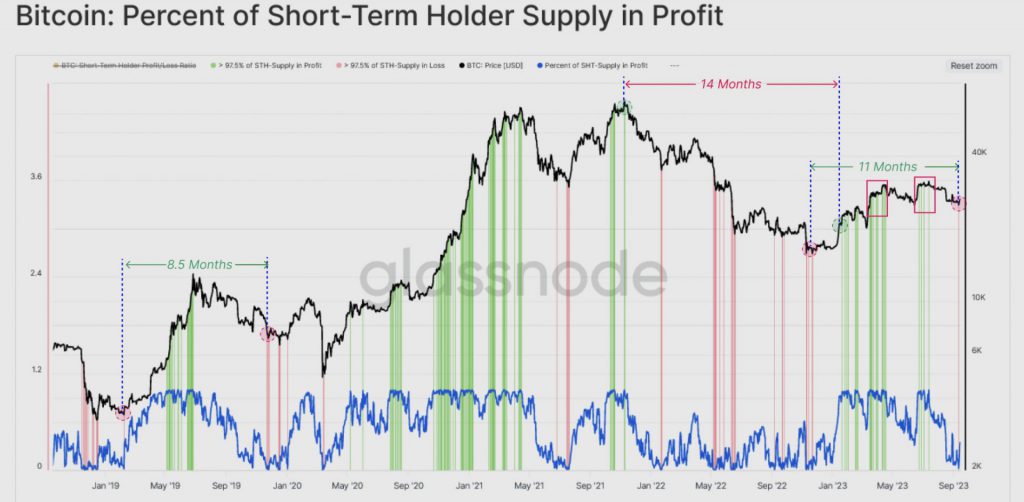

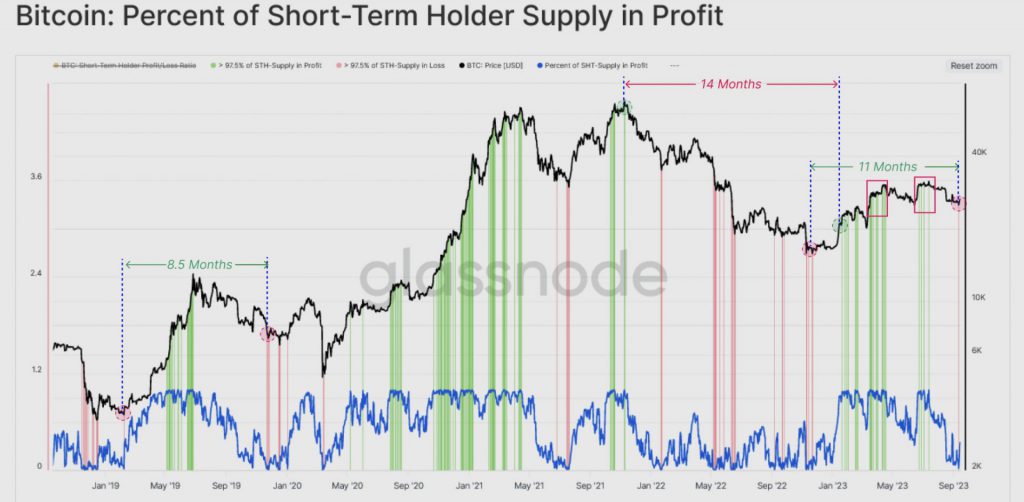

A significant chunk of short-term Bitcoin holders are currently underwater. In fact, the current proportion of holders with losses is at its highest level since FTX collapsed. A recent analysis report by Glassnode brought to light,

“Since selling off below $26k in recent weeks, more than 97.5% of STH supply is now held at a loss.”

Even though this statistic is far from appealing, there is a silver lining to it. During bear markets, whenever more than 97.5% of the short-term holders are at a loss, the chance of seller exhaustion increases rapidly. This means the current conditions do not provide any incentive to holders to exit the market.

Also Read: 95% of NFTs Have a Market Cap of 0 Ether

Bitcoin Investor Confidence Unfavorable

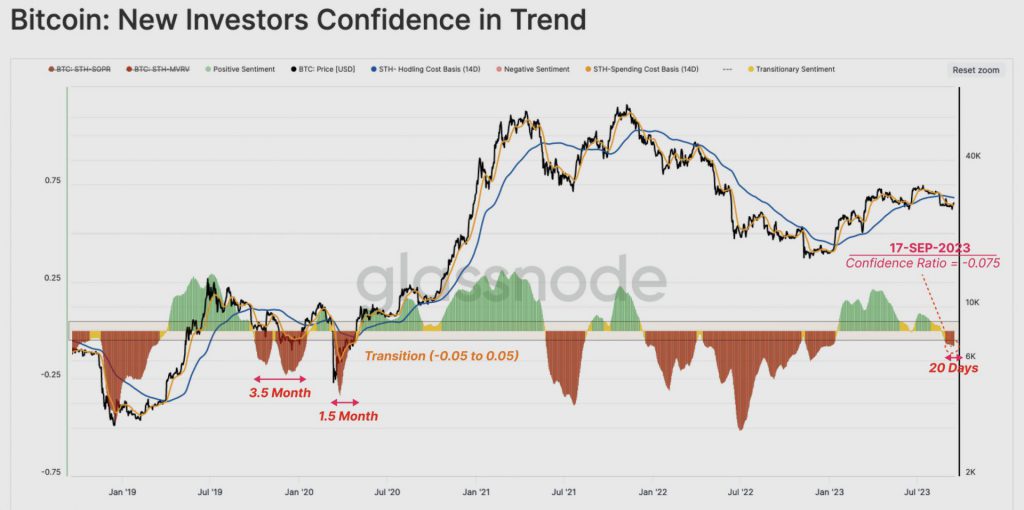

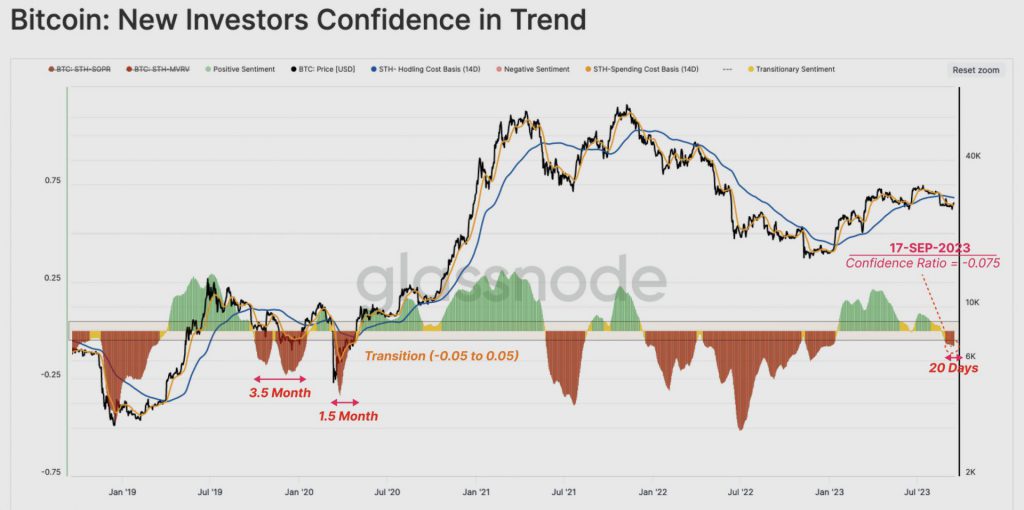

The sell-bias exhaustion does not guarantee a price trend reversal. It only assures that the asset will be able to cover its losses. For the uptrend to start, the accumulation trend has to get stronger, and it’s quite crucial for investor sentiment to be favorable for that to transpire.

At this stage, the BTC market is characterized by panic. In fact, the negative sentiment has taken hold in the near term. Of late, the confidence ratio has been hovering in negative territory, i.e., around -0.075. Only when the trend starts rising back towards the transitional and subsequently to the positive territory [> -0.05], the capital will possibly start to flow back into the market. In retrospect, it will signify that holders are back in a more favorable position.

Also Read: BitBoy Raises $50000 in 5 Hours: Crypto Community ‘Pissed’

On the daily timeframe, Bitcoin has broken below its ascending channel and has been consolidating in the $26,000–$27,000 bracket over the last couple of days. If the asset loses its support around $26,600, then it could drop up to $24,800 over the short term.

In the weekly timeframe, Bitcoin has created a bearish fractal, similar to what was registered in 2021–2022. At that time, BTC created three local tops [the second being the highest and the third being the lowest] and then significantly shed value. In 2023, Bitcoin has followed a similar trend and created highs at $31,000, $31,804, and $27,483.5. If history were to repeat itself, BTC’s downtrend would likely commence over the next few days. The mid-term target would be around $20,000, a level coinciding with an unfilled CME gap.

Also Read: Ramaswamy’s Crypto Framework is 75% Ready: To Release by Thanksgiving