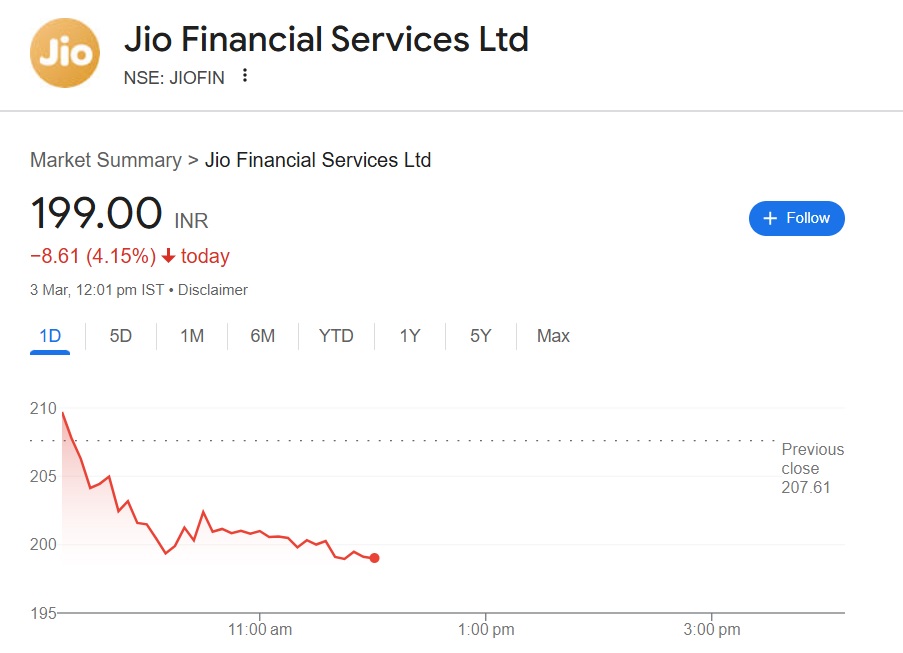

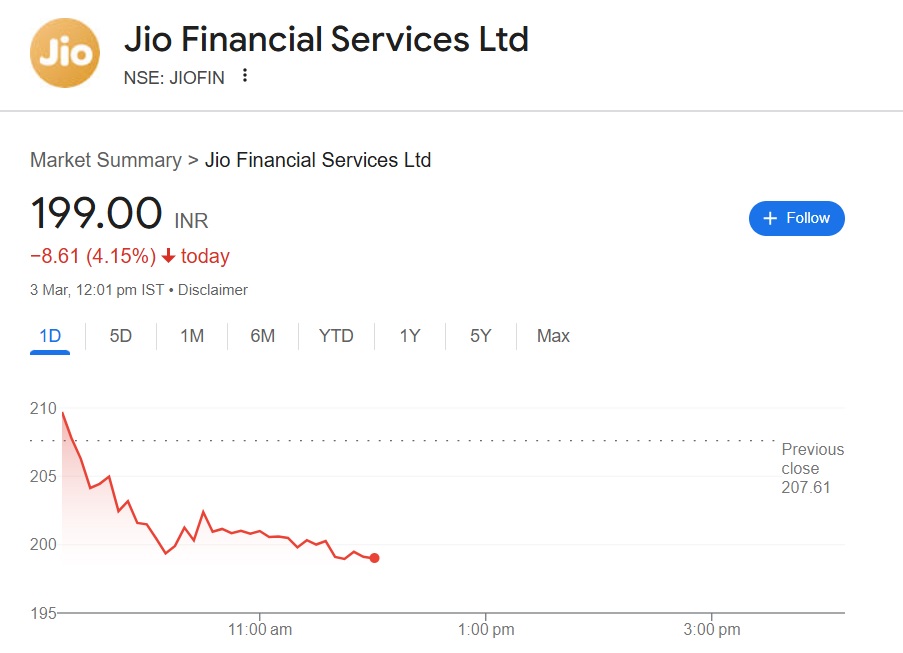

Jio Financial Services (NSE: JIOFIN) has crashed below the Rs 200 mark on Monday’s opening bell. It is now trading at the Rs 198 mark and is attracting bearish sentiments in the indices. The stock is now well below its launch price of 214 when it first hit the markets in August 2023. Therefore, everybody who invested in JIOFIN in the last 18 months is all under massive losses.

Also Read: IRFC Shares Might Crash Another 15%, Reach 90-92 Level

Sensex and Nifty crashed 350 points and 110 points on Monday, respectively. The index is down double digits in the last six months and the downturn is likely to continue as foreign institutional investors (FII) exit the Indian markets taking entry positions in the US and Chinese stocks. Now that Jio Financial shares are below the Rs 200 mark, is this the best time to accumulate the stock?

Also Read: Sensex And Nifty Crash: Top 3 Stocks Reach 52 Week Low

When To Buy Jio Financial Shares?

Taking an entry position in Jio Financial shares is not advisable as the market’s downturn could continue. Buying JIOFIN now is as good as catching a falling knife, which is considered a dangerous move. JIOFIN is down nearly 43% in the last six months and could take many months to recover. The downturn is quick but scaling up in the chart is the hardest part.

Also Read: De-Dollarization: Global Bank Predicts Future of the US Dollar

The Indian rupee has fallen to a low of 87.33 against the US dollar this month. The market exodus from FIIs is making the markets head south leaving retail investors at their mercy. In addition, a Bombay Court has ordered an FIR against SEBI chair Madhavi Puri Buch and five other top executives for alleged stock market fraud and regulatory violations. Therefore, it is advised to remain in the sidelines and wait for things to play out before taking an entry position in Jio Financial shares.

Investors are reacting to these developments that’s causing the market mood to dampen. It is best advised to wait and watch for further downturns before taking an entry position in Jio Financial shares.