Bitcoin might be down, but the leading crypto remains ever-present in the financial world. Despite its high volatility, thousands of investors dream of owning a minimum of 1 Bitcoin in their respective wallets. Now that BTC slumped in price compared to 2021, it is more affordable to investors in these bearish conditions.

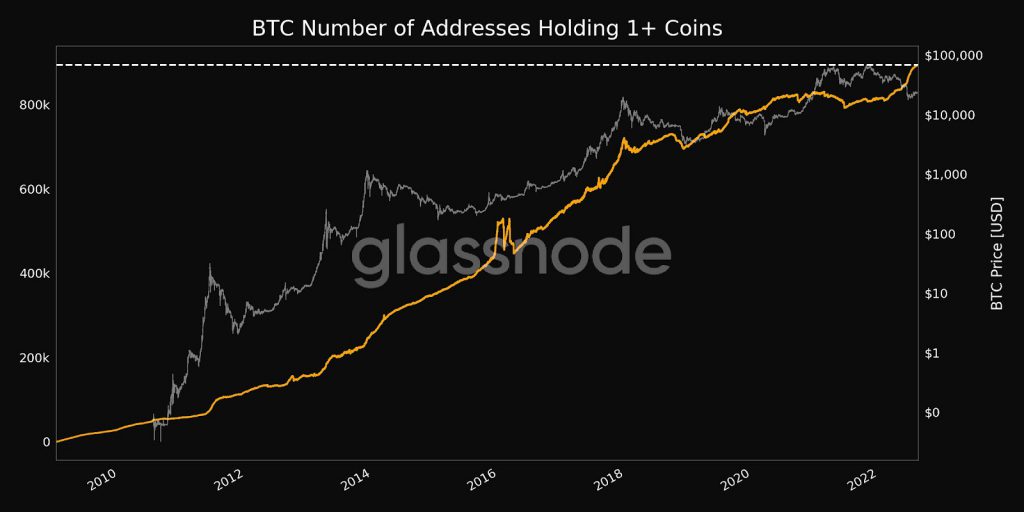

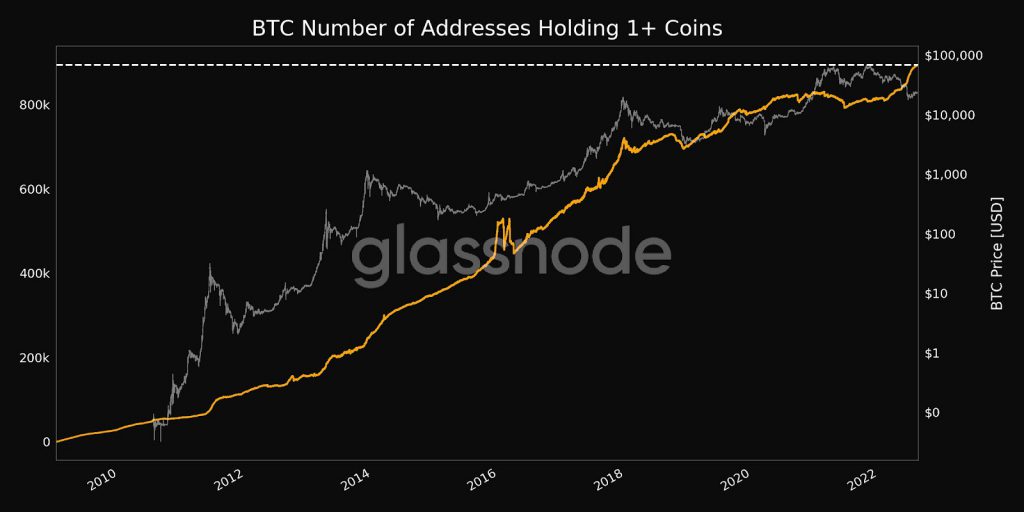

On-chain market intelligence and analytics platform Glassnode published a report that shows investors are flocking toward Bitcoin amid volatile markets. As of today, the number of addresses that hold a minimum of 1 Bitcoin has reached an all-time high.

Also Read: Bitcoin Reaching $100,000 Is A Matter of Time: Bloomberg Analyst

Glassnode indicates that wallets that hold at least 1 Bitcoin currently stand at 894,303.

The development suggests that investors are making use of the price slumps by accumulating BTC at every dip. The king crypto has given plenty of opportunities this year to buy the dips before the bull run starts. Even if BTC plummets further, the buying opportunity will be seen as lucrative.

Bitcoin is known to deliver the desired results and is capable of reaching unimaginable heights in the next five years. Therefore, an investment in BTC now during its lows can set the stage for stellar returns down the years.

Also Read: Bitcoin Crash: How Many Investors Are Suffering Mid-2022?

Bitcoin Whale Movements

Apart from retail investors flocking to own 1 Bitcoin, whale activity in BTC has seen a steady increase. A whale picked up more than $3 billion worth of BTC last month in three different transactions. In June, another whale splurged $2.56 billion worth of BTC and accumulated 1,418 in four different transactions. The whale had picked up:

300 BTC on June 7

425 BTC on June 13

488 BTC on June 14

214 BTC on June 15

BTC at $25,000 remains to be a prime investment and any slump hereon is considered brownie points for accumulators. However, several analysts have predicted when BTC might bottom out before kickstarting a bull run. Read a price prediction on Bitcoin bottom here.

Also Read: Opinion: How the Economy, Stocks & the Crypto Markets Could Recover

At press time, Bitcoin was trading at $24,516 and is up 6.3% in the 24 hours day trade. The crypto is down 64.6% from its all-time high of $69,044, which it reached in November last year.