The collapse of the well-established crypto exchange FTX has instilled fear in the minds of participants. Of late, they’ve been moving their funds en-masse towards self-custody wallets and decentralized platforms.

As analyzed a day back, the DYDX ecosystem—as a whole—seemed to have benefitted from the ongoing crisis. The decentralized exchange’s native token has been trading at around its quarterly peak.

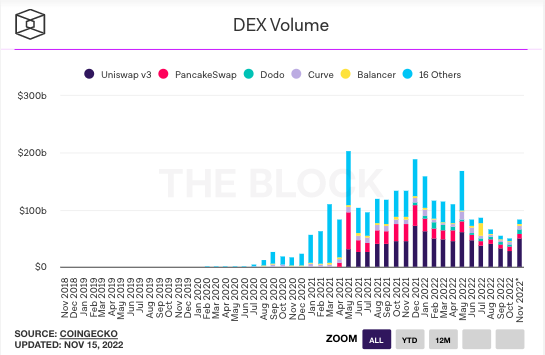

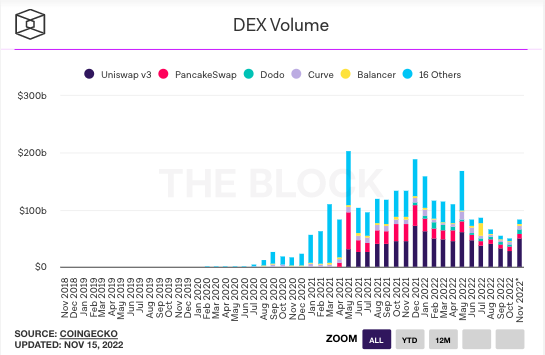

In fact, when zoomed out and viewed, it seems like the downfall of FTX has been a boon for the entire DeFi space. Decentralized Exchange [DEX] volume had been in a downtrend over the past few months. Just half the way down November, the number already stands around its 4-month high.

From last month’s total of $50.82 billion settled, the number is already up to $84 billion at the moment. If the same pace continues over the next fortnight, November’s aggregate number could head toward the pre-established peaks.

The Decentralized x Centralized Battle

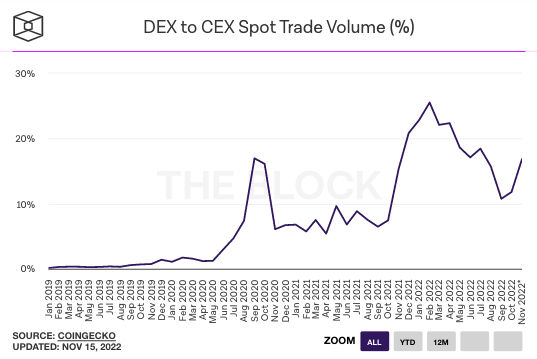

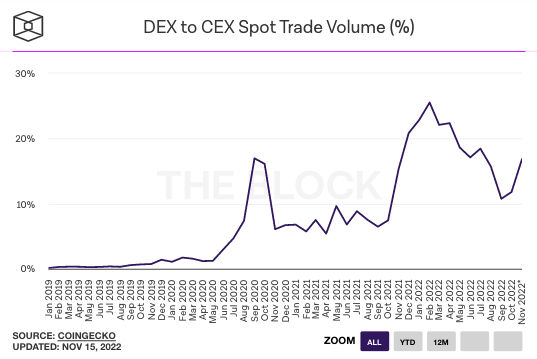

Interestingly, the DEX to CEX spot trade volume has also been on the incline. In September, the figure stood at a local low of 10.76%. Now, however, it has already risen to 16.84%, indicating that the DeFi is getting back on track.

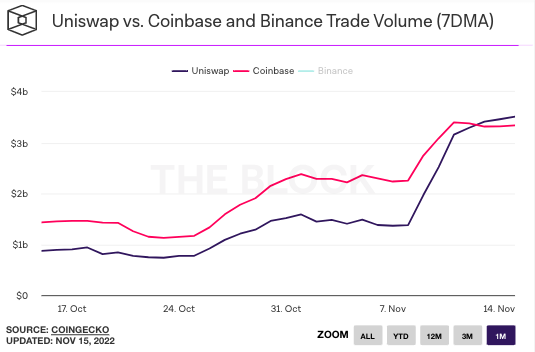

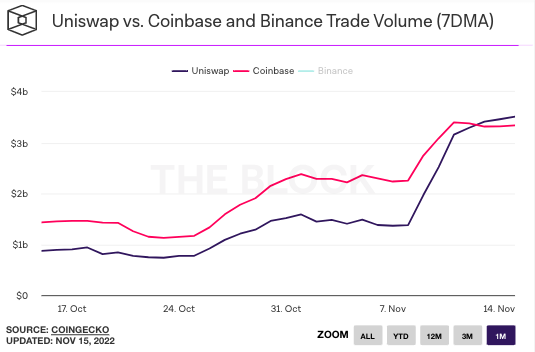

In fact, at this stage, it should also be noted that decentralized platforms have been able to put up a better show than their centralized counterparts. The trade volume settled on Coinbase and Uniswap has remained almost neck and neck over the past few months.

The gap started bridging even further of late. Coinbase was mostly in the lead until recently. Now, nonetheless, there’s a different tale to narrate. As illustrated below, on November 13, Uniswap—the apex DeFi protocol—overtook Coinbase—one of the top centralized exchanges—on the trade volume front.

Over the past day, the former settled $3.51 billion on its platform, while the latter’s number stood slightly lower at $3.34 billion.