For decades, the US dollar has seemingly dominated international trade and capital flows. Yet, as the BRICS nations have risen to prominence and brought with them an ideological opposition to its prevalence, things are changing. Thus, understanding de-dollarization and the global economy’s relationship with the greenback is vital.

How the US dollar rose to prominence and what has happened to reverse that has become a focal point of economic discourse this year. Moreover, as the US has experienced economic fragility, the shifting global power creates a situation that could eliminate the dollar from global trade entirely.

How the Dollar Became Dominant

The first facet of understanding de-dollarization and the global economy’s relationship to the US dollar is knowing how we got here. Moreover, how the greenback became such an important aspect of global trade.

Seemingly overnight, the US was the leading financial power after World War I. Subsequently, the war in 1917 ended with the United States emerging stronger than countries in Europe.

Thereafter, the US dollar began to quickly replace the pound sterling as the international reserve currency. Additionally, the trajectory was set and received a boost in 1944 with the arrival of the Bretton Woods agreement. Alternatively, that agreement in 1944 created an international currency exchange that was pegged to the US dollar, which was pegged to gold.

Decades later, the 1960s saw Europe and Japan compete with US exports. Subsequently, a global supply of dollars allowed President Nixon to end the convertibility of the US dollar to gold in 1971. Thus ending the gold standard, and the limit on how much currency could actually be printed.

Since then, the dollar has remained the international reserve currency. Yet it has continually suffered from rapidly depreciating purchasing power. A development that has begun to introduce the aspect of de-dollarization, with the global economy seeking ways to usurp its relevance.

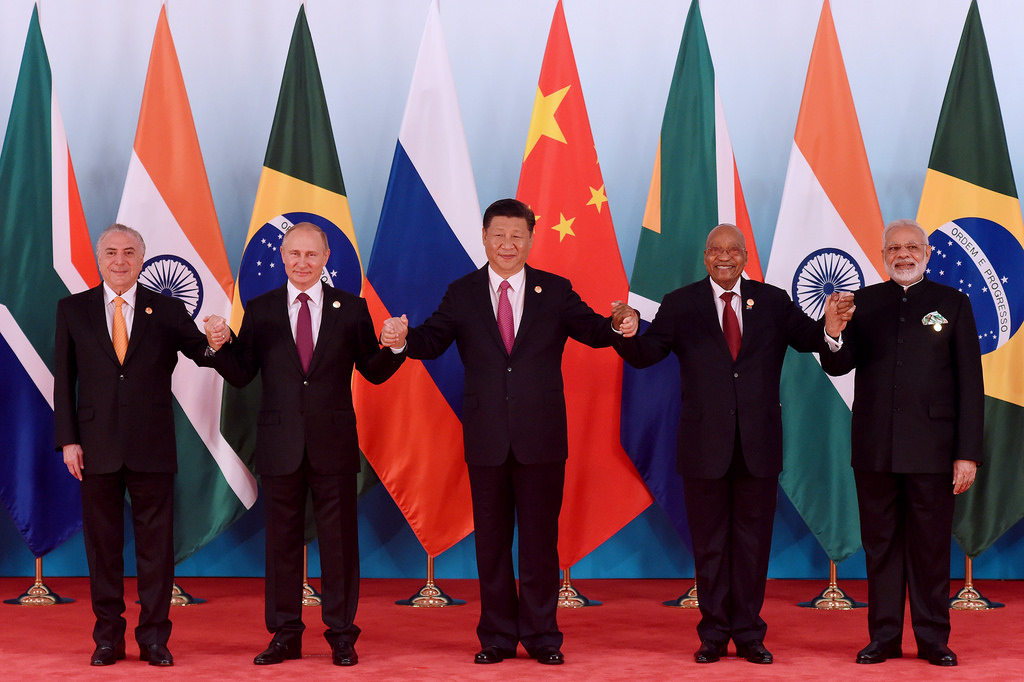

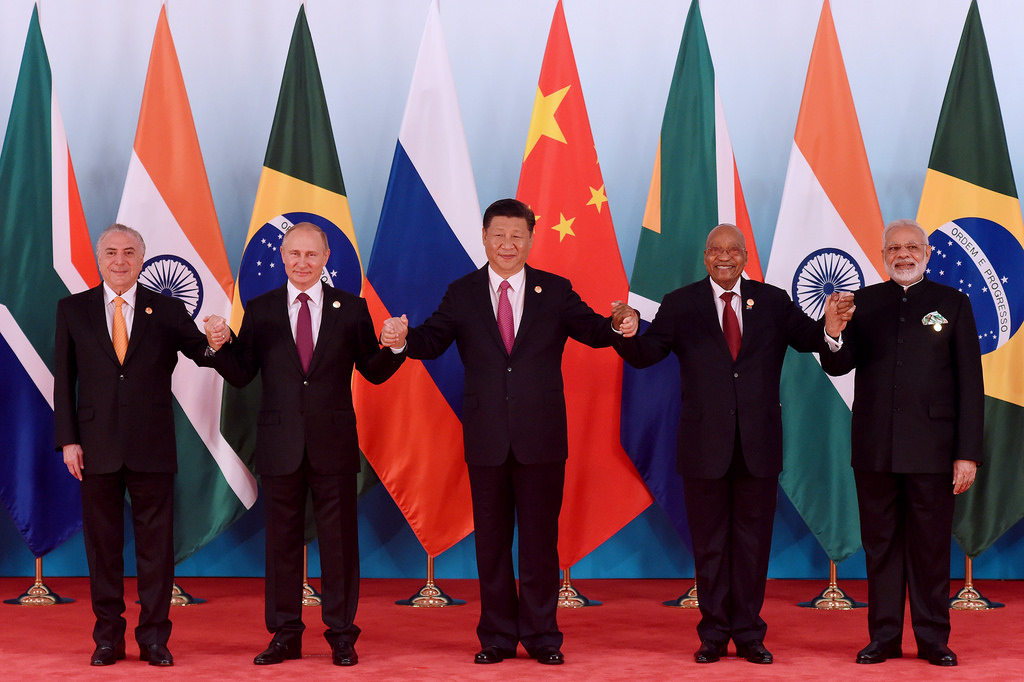

BRICS and an Alternative Currency

The primary de-dollarization efforts have come from the BRICS collective of nations. Specifically, the bloc of China, Brazil, Russia, India, and South Africa has set forth a pursuit of supplanting the relevance of the greenback.

Primarily, the efforts began when the US imposed sanctions on Russia following its invasion of Ukraine. Moreover, countries have already executed trade deals with Russia in different currencies. Proving that the sanctions may have set in motion de-dollarization as a requirement for international trade that refused to deviate due to the Ukranian war.

Additionally, trade between China and Russia has increasingly taken place in their native currencies. Specifically, 70% of settlements occur in the Russian ruble or Chinese yuan. Moreover, as the macroeconomic factors of the United States continue to threaten it and the potential for a national debt default looms, the dollar continues to be vulnerable.

De-Dollarization Spreading

Amidst both China and Russia, other nations have emerged in their de-dollarization efforts. Specifically, Brazil and Argentina have adamantly spoken about an alternative currency. Moreover, those nations represent two of the largest in South America.

Additionally, both the UAE and India have utilized rupees for trade in non-oil commodities. Saudi Arabia has expressed its openness to trading in alternative currencies. Conversely, there are few who believe the dollar will be eliminated any time soon.

Currently, central banks still maintain 60% of their foreign exchange reserves in the US dollar. However, there’s no denying that de-dollarization is in full swing, and the global economy is firmly entrenched in decreasing the prevalence of the US dollar.