ApeCoin’s market flashed mixed signals as a crucial breakout lingered on its chart. Receding volumes and social media presence were pitted up against bullish developments on the 4-hour indicators. Investors can take a cautious approach considering the current market dynamics and trade APE only once a breakout is in effect.

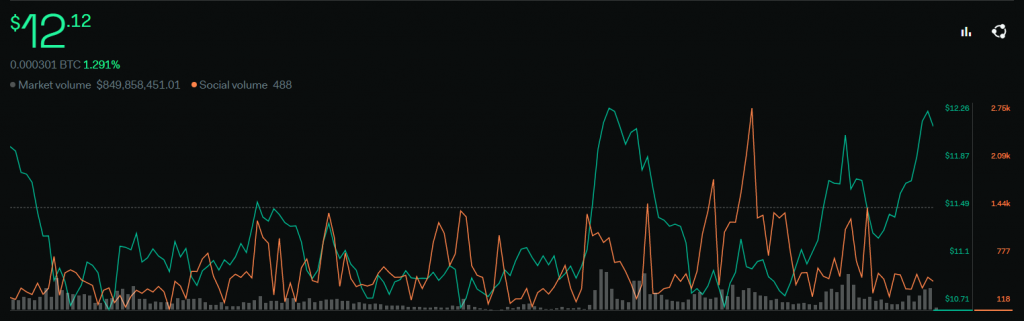

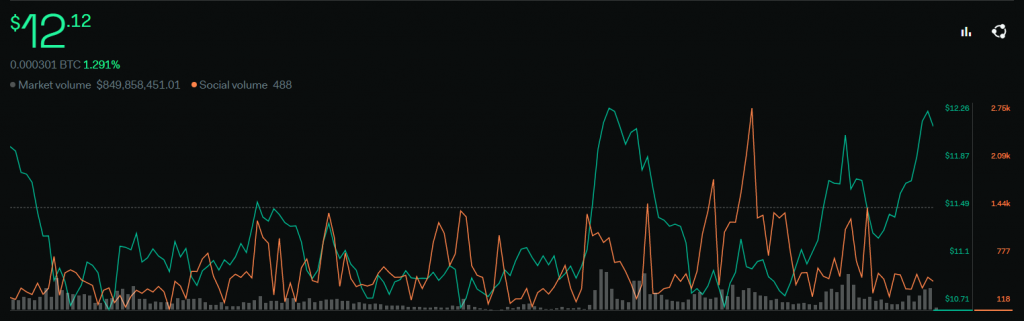

Following the announcement of a potential ApeCoin movie trilogy by crypto exchange Coinbase, APE noted a flurry of buy orders across exchanges. Social volumes (orange) across websites also spiked to a weekly high in tandem with a 5% price increase.

However, the market was beginning to show signs of cooling. No advancements in the 24-hour trading volumes and a sharp decline in social media mentions hinted that bulls were taking a back seat after two consecutive days of gains.

ApeCoin 4-hour Chart

Unfortunately for ApeCoin holders, a decline in buy orders wasn’t ideal as the price challenged the daily 20-SMA (not shown) and an important resistance at $12.3. Moreover, a double top was present at around $12 and the bearish technical pattern could threaten some holders to cash in their gains.

Nonetheless, not all hope was lost for the bulls as per the 4-hour indicators. The RSI was trading close to 60 – a desirable reading for positive price action, while the MACD just broke above the mid-line, showing a favorable market trend.

Price Strategy

The disparity between ApeCoin’s external and internal factors called for a more cautious approach while trading APE tokens. Instead of an immediate buy or sell trade, entries can be made once APE closes above $12.4. Take-profit can be set at $14.5 while a stop-loss can be maintained at $10.5. The hypothetical trade setup carried a 1.11 risk/reward ratio.