According to a report by Nansen, user trust in CEXs (centralized exchanges) was severely affected by the collapse of FTX. Since the incident, users have begun demanding more security features and transparency. Binance and other industry giants such as Bitget, OKX, etc. have taken steps to ensure that their clients and funds are well protected.

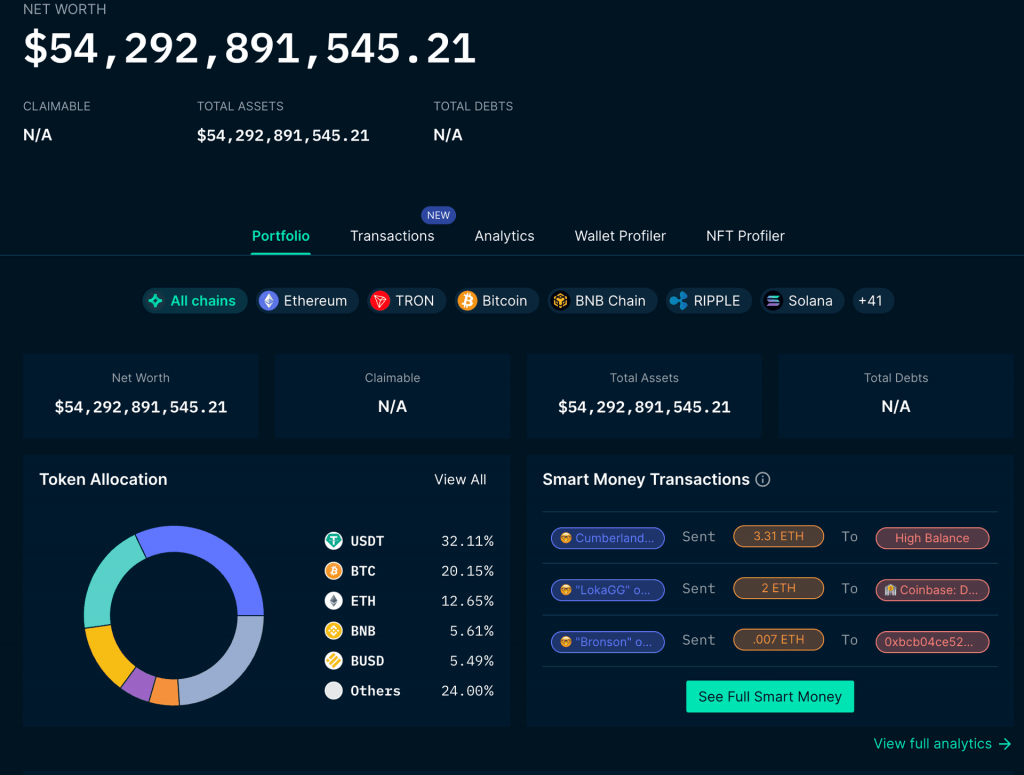

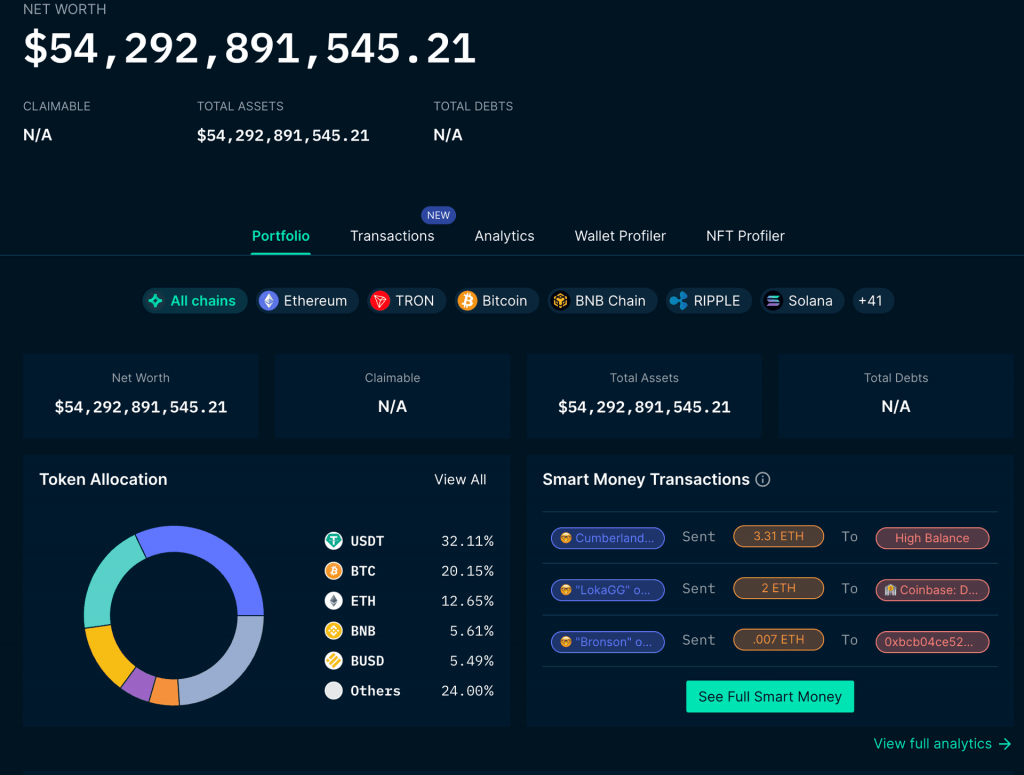

One of the first steps that CEXs have taken is showing their proof-of-reserves (PoR). A PoR is when an exchange publically discloses its reserve assets. Its goal is to offer clear, verifiable proof that an exchange has enough assets to support user deposits. According to Nansen, Binance’s publically available PoR shows that it has around $54 billion in reserve assets.

Another step that exchanges have taken is having protection funds. The aim of protection funds is to have a backup in the case of an exchange collapsing. Exchanges want to give their consumers the assurance that in the case of a hack, the exchange will have enough money to cover deposits.

According to Nansen, Binance has a protection fund, named Binance SAFU, of $1 billion. OKX follows in second place with $700 million. Huobi has two such funds, Security Reserve Fund and Investor Protection Fund. The Security Reserve Fund has 20,000 BTC, which amounts to around $528 million. Meanwhile, the Investor Protection Fund is 20% of the income, which goes for buybacks of Huobi tokens. These tokens will be used in the protection user fund.

Are the steps taken by Binance and others enough to ensure user protection?

Although the steps that exchanges have taken are in the right direction, they might not be enough. For example, a PoR does not show a firm’s liabilities, which is one of its major downsides. An improvement would be an additional Proof-of-Liabilities. However, it is off-chain and necessitates an external audit. Furthermore, audits themselves have been troublesome. Nansen noted that FTX received two audits before its demise.

Even with a protection fund, it is crucial to employ best practices in risk management, such as dispersing cash among several locations, to effectively lessen the impact of numerous hacking attempts. Following the FTX collapse, Binance increased the fund’s dollar worth from $735 million to $1 billion. And Bitget increased its protection reserve from $200 million to $300 million.

Hence, it is essential that exchanges employ more steps to increase user protection and transparency. Many believe that as time passes on, more protection measures will be taken to avoid another FTX-level disaster.