The market has been devoid of momentum over the past few days. Owing to the same, asset prices across the board remain to be stagnant. With a 1.8% depreciation over the past day, the cumulative value of all the assets in the crypto market stood at $840 billion at press time. Bitcoin, the largest crypto by market cap, was trading at the brink of $17k after noting a 1.4% downward deviation in the same one-day period.

The stagnated price has made Bitcoin more affordable to accumulators. As analyzed recently, the number of HODLers possessing 1+ BTC has been on the rise and claimed a new ATH. Now, a recent tweet from Santiment revealed another similar trend. Bitcoin’s number of addresses HODLing 10 to 1k coins have officially reached their highest level since 2020.

Elaborating on the exact numbers, the on-chain analytics platform noted,

“There are now 151,080 addresses that hold between 10 to 1,000 BTC. After a massive decline that began in December, 2020, these addresses have increased significantly throughout 2022 as Bitcoin has progressively become more affordable.“

Also Read: Will Bitcoin, Ethereum Turn a Bullish Page in 2023?

Bitcoin Investors Working Their Way Up?

Affordability has played a critical role in fostering the accumulation trend. Institutions, as such, have been refraining from shorting BTC. As outlined in a recent article, ProShares’ short Bitcoin Strategy ETF BITI’s volume has been in a downtrend, adding weight to the said narrative. Alongside, short BTC-based products noted outflows from institutions the last week, while long products registered inflows.

Read More – Bitcoin: Are Institutions Tired Of Shorting BTC?

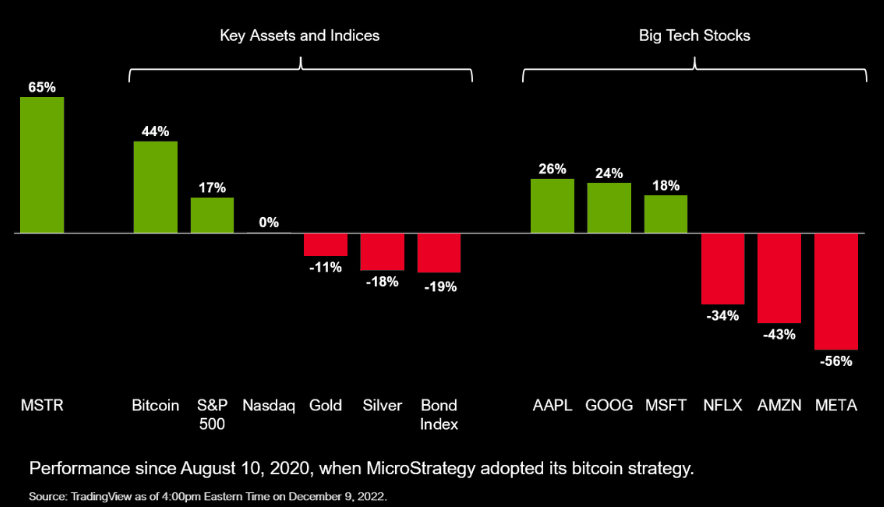

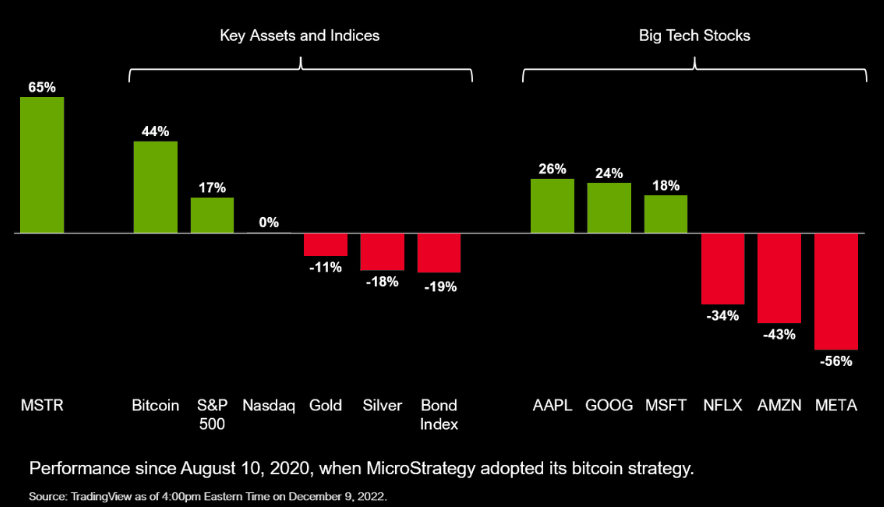

In fact, since August 2020, Bitcoin has been one of the best performers. From then to now, the asset is up by roughly 44%. The S&P index, on the other hand, has risen by only 17%, while the Nasdaq remains to be in a break-even position.

Gold, Silver, and the Bond index have fetched their investor’s negative returns in the said period. Stock-wise, Apple, Google, and Microsoft’s returns have been less than that of Bitcoin, while investors of Netflix, Amazon, and Meta reaped negative returns on their investments.

American Business Intelligence company MicroStrategy, which is heavily invested in Bitcoin, has appreciated the most. Per data from Coinglass, MicroStrategy HODLs 129,698 BTC on its balance sheet currently. Michael Saylor revealed on Twitter that its stock was up 65% since the time the company adopted its BTC Strategy. He exclaimed,

“The Winning Strategy is a Bitcoin Strategy.”

Also Read – Bitcoin: Is The Tight Crypto Correlation a Boon or Bane?