The crypto market has seen several bear markets come and go, but the ongoing one seems to be the most stressful. More so, because it has managed to fracture the fundamentals of the space. Top coins like BTC have been able to cope by staying afloat, but investor losses have been mounting up.

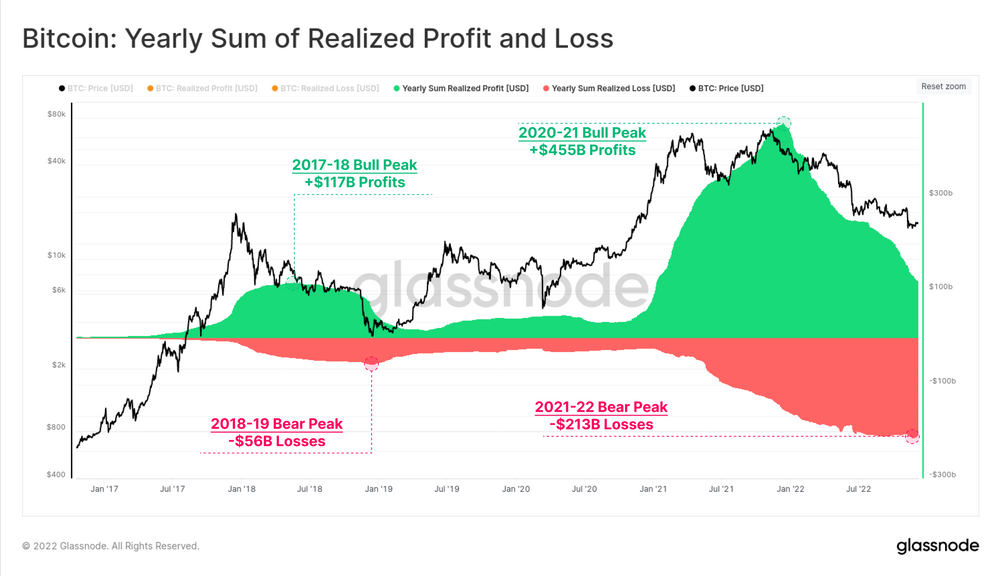

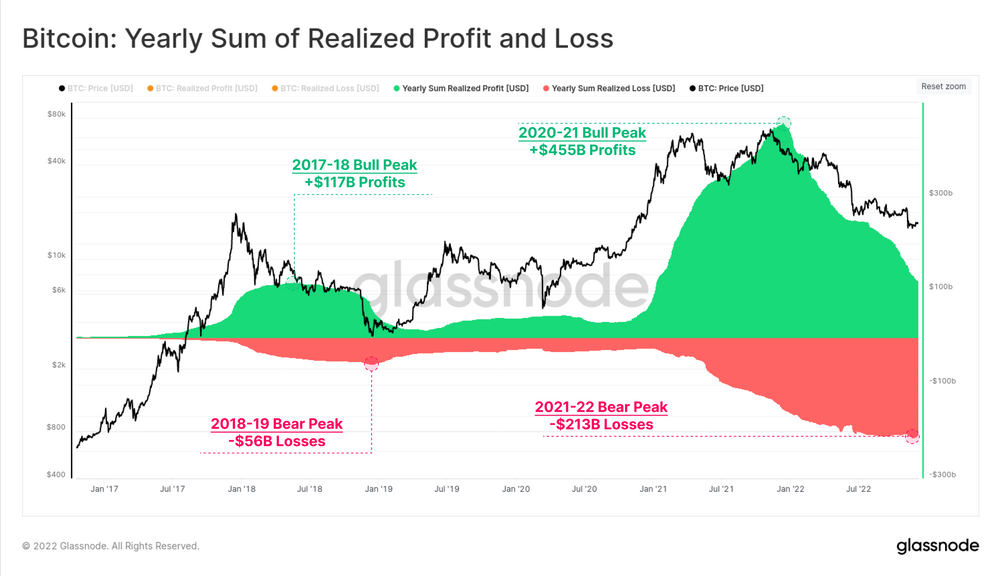

A recent report from Glassnode revealed that the excess liquidity from the 2020-21 period created a yearly record of total realized profit on-chain. Notably, around $455 billion in yearly profits were taken by Bitcoin investors moving funds. As depicted below, the realized gain peak was attained soon after the November 2021 ATH.

Post that, the market stepped into its choppy phase. Per Glassnode, the market has given back over $213 billion in realized losses. Elaborating on the same and drawing parallels with a past precedent, the report noted,

“This equates to 46.8% of the 2020-21 bull profits, which is very similar in relative magnitude to the 2018 bear, where the market gave back 47.9%.“

Also Read – Bitcoin: Are Institutions Tired Of Shorting BTC?

In fact, the Sharpe Ratio justified the said narrative. Barring a handful of instances, the reading of this metric has hovered in the negative territory this year, indicating that market participants were not fetched with adequate returns for the risk borne by them.

Nevertheless, with the asset’s price seen recovering at press time, the ratio flashed a neutral reading of 0.31.

Also, Read – Bitcoin: Are Affordability & Accumulation Going Hand In Hand?

State of Bitcoin Long-Term HODLers

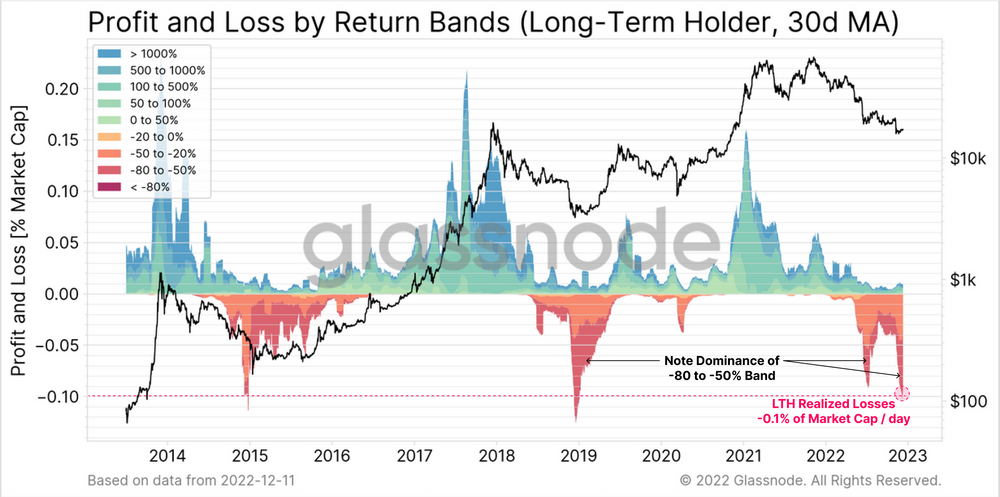

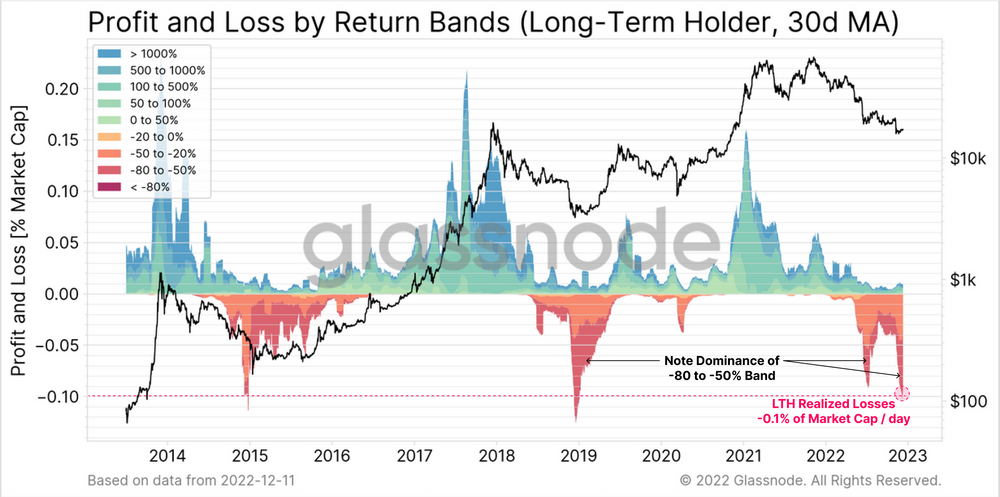

Long-term HODLers, on their part, realized two of the largest relative loss spikes in history. As illustrated below, LTH losses peaked at -0.10% of the Market Cap per day through November. Similar magnitudes have been seen only during the 2015 and 2018 cycle lows.

Glassnode outlined that the sell-off in June was similarly impressive at -0.09% of the Market Cap per day, with heavy dominance of LTHs locking in 50% to 80% losses.

Also, Read – Will Bitcoin, Ethereum Turn a Bullish Page in 2023?