As per a new report by Morning Consult, consumers are still holding on to their crypto. This comes amid Bitcoin (BTC) plummeting 70% since November 2021.

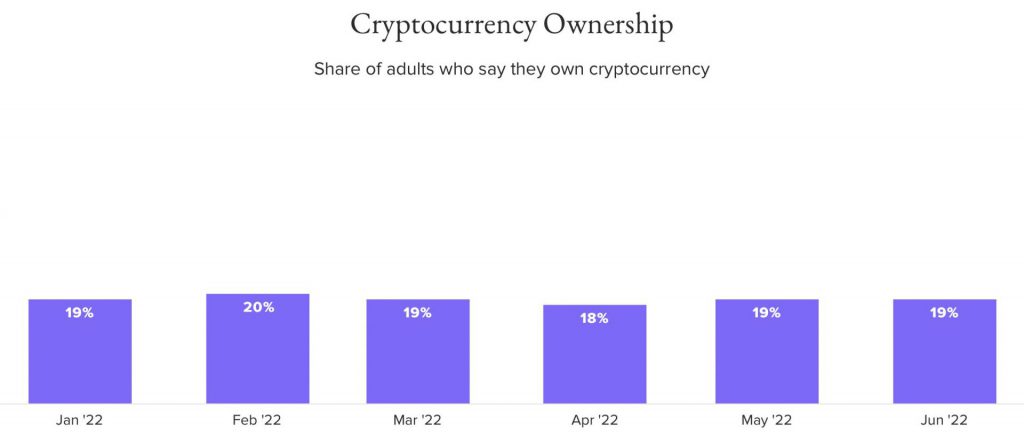

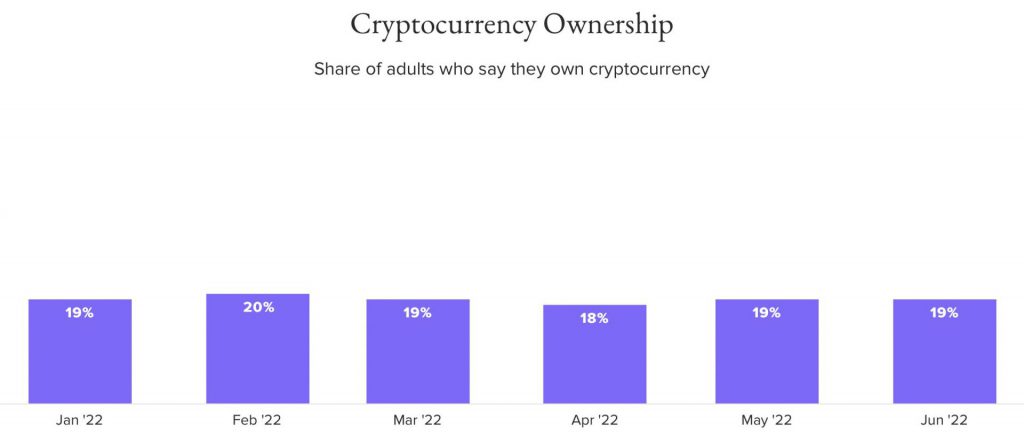

According to Morning Consult’s findings, 19% of American adults hold some form of crypto, even when Bitcoin (BTC) dipped below the $20k mark. The report found that the number of holders in January of 2022 was the same. This leads to the fact that consumers are still bullish on the industry and prefer holding to selling.

Compared to May, reported Bitcoin sales are down four percentage points, while predicted purchases are down three percentage points. As per the report, owners of cryptocurrencies appear to be preparing for a crypto winter. They want to cut back on transactions as they limit purchases of risky assets due to inflation and the prospect of a recession.

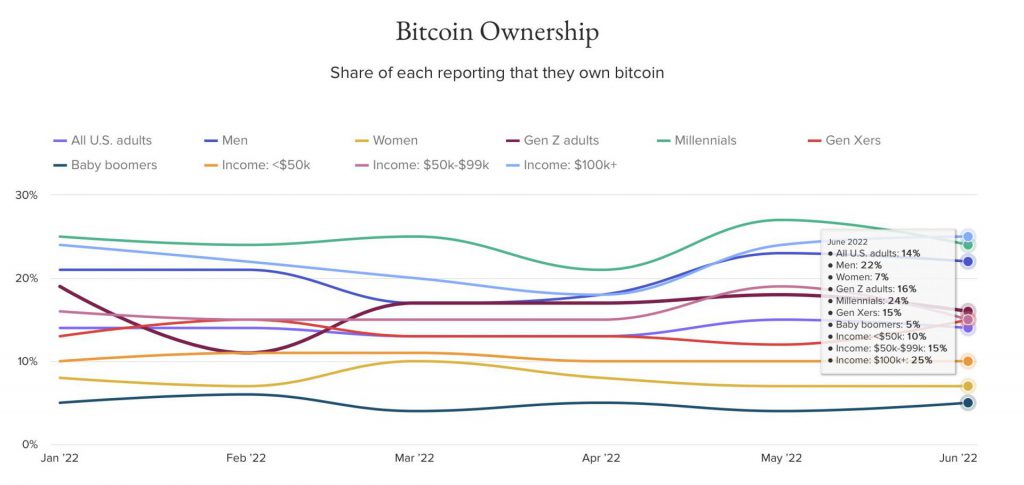

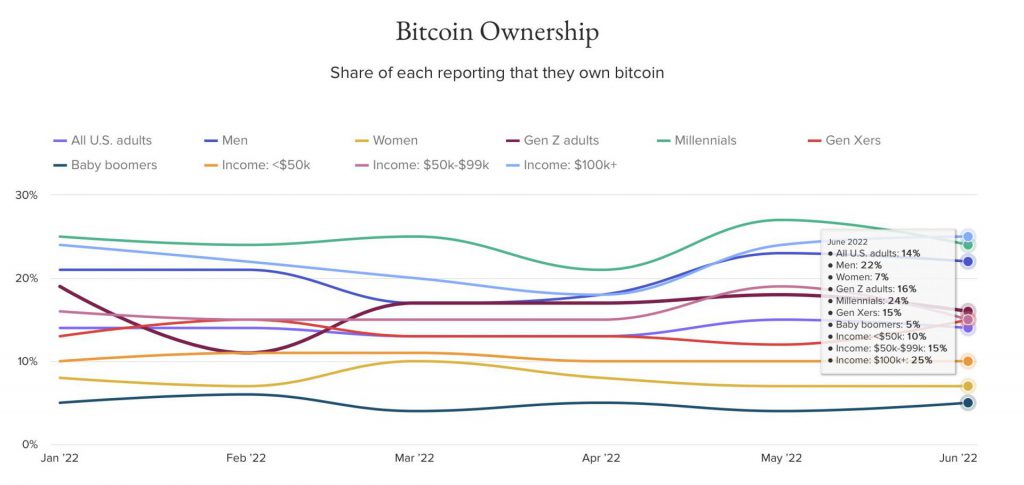

Morning Consult’s report also states millennials make up the largest share of BTC holders among those polled.

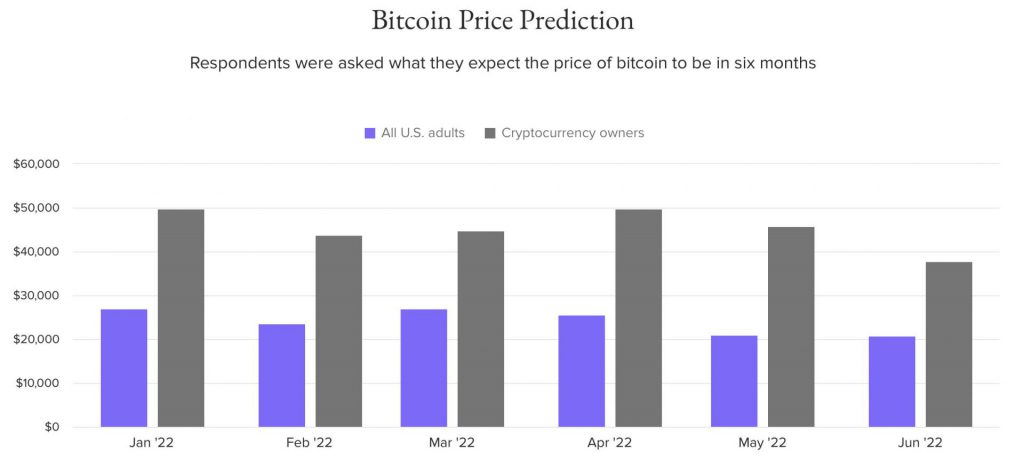

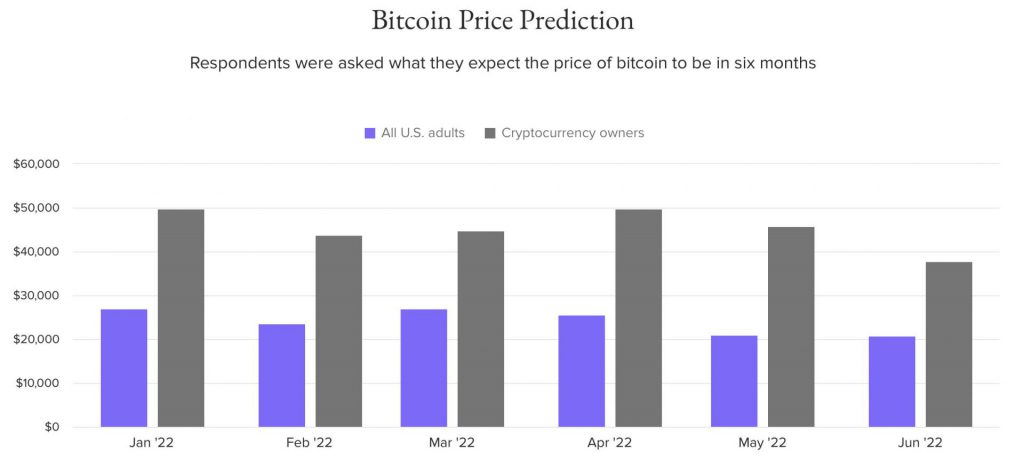

BTC price expectations from cryptocurrency owners are still upbeat but cautious. The typical adult cryptocurrency owner expects the price of Bitcoin to be under $38,000 in six months. This is the lowest projection since Morning Consult started keeping track. However, it is still higher than the expectation of the broader public.

Bitcoin at the bottom?

BTC took a severe beating in the latest crypto crash. A widespread crypto fall in 2022 has been sparked by tightening monetary policy, waning speculative fervor, and collapsing digital-asset ventures. However, there are faint signs that the pricing pressures driving interest rate rises may be reaching their peak, causing the tone in global markets to become less gloomy.

According to Glassnode, Bitcoin’s historical downturns have taught us that it may be close to its bear-market bottom.

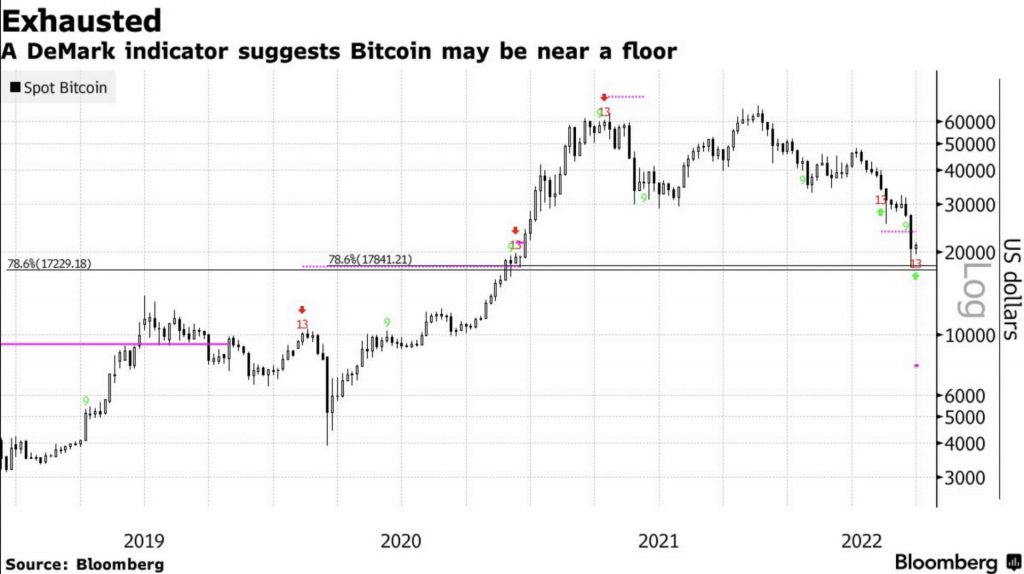

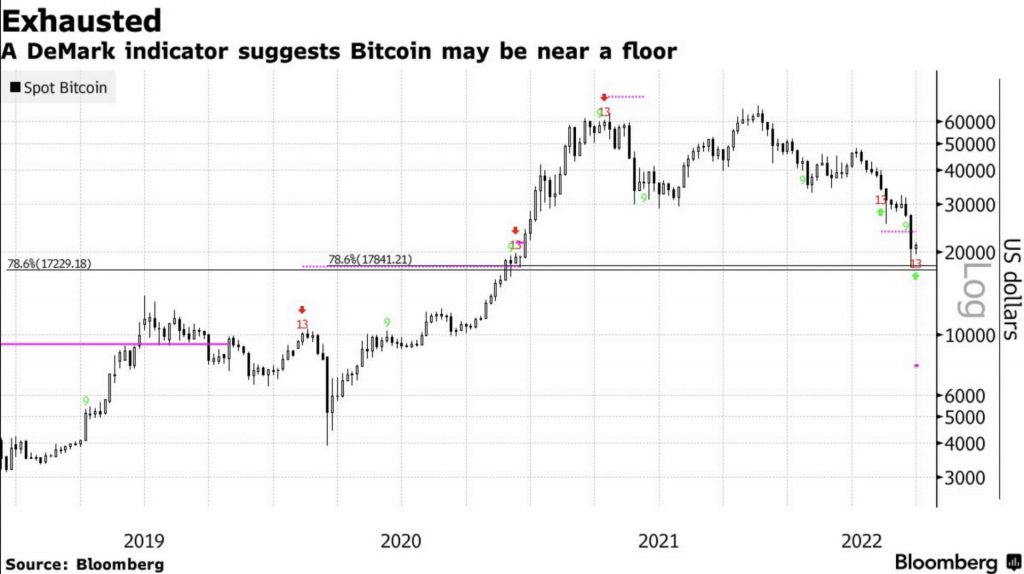

A popular DeMark technical indicator called TD Sequential implies that most of the Bitcoin selloff has already passed. The study uses a counting technique to chart patterns to determine when a market trend has peaked. According to supporters of the research, Bitcoin has printed the maximum 13 downward counts, which indicates a reversal is imminent. Previous DeMark analyses have noted changes in Bitcoin’s general trend.

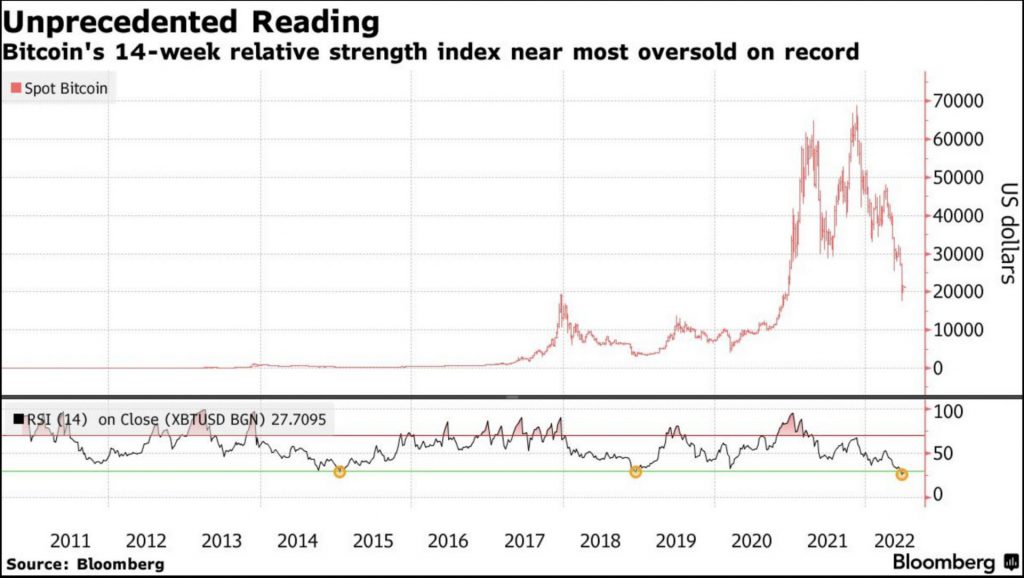

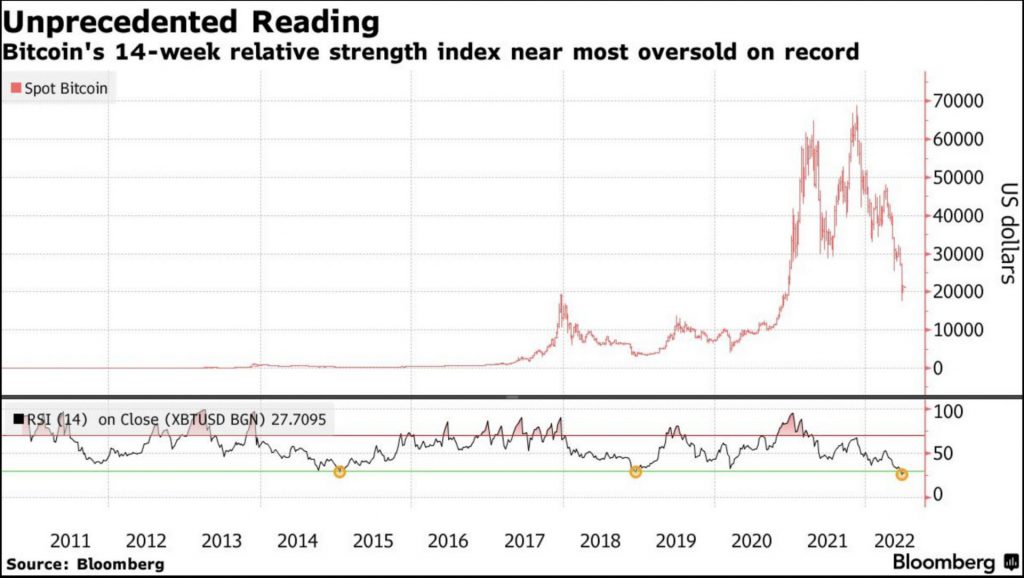

Additionally, the relative strength indicator shows that the current selloff in Bitcoin should stop. The indicator is currently near its lowest point in Bloomberg records from 2010. It has entered the “oversold” area below 30 every week. The token staged a significant rise when the indicator last flashed “oversold” in 2018.

At press time, BTC was trading at $20,872.81, down by 2.3% in the last 24 hours.