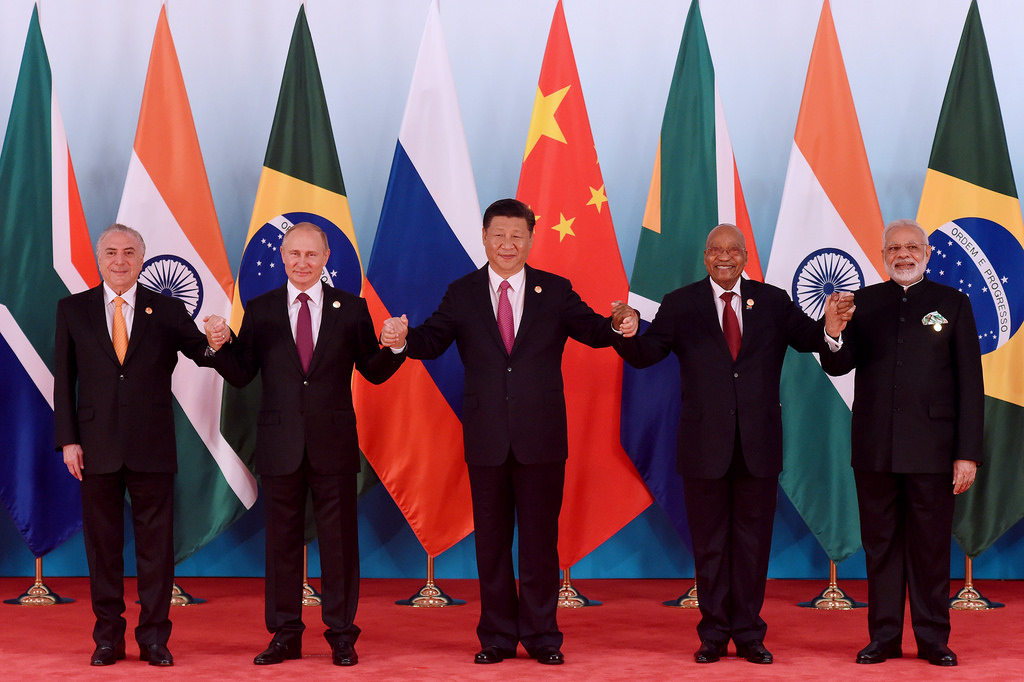

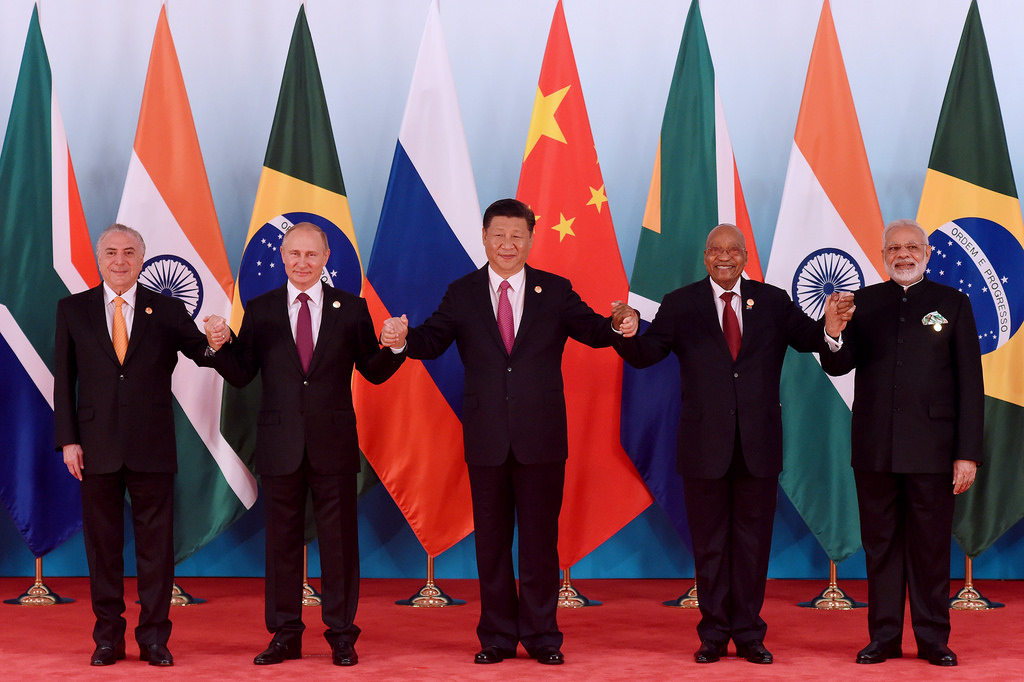

The BRICS alliance is advancing at a rapid pace to outperform the G7 nations’ GDP in purchasing power parity (PPP). BRICS accounted for 19% of the global GDP in purchasing power parity terms. However, the new BRICS Plus, an 11-member bloc gave it a boost and now accounts for 36% of GDP in PPP this year.

Also Read: BRICS: Dangers Emerge for Import-Export Sector as US Dollar Rises

According to the latest report, BRICS plus GDP in PPP could reach 45% of the world’s economy in 2040, reported Bloomberg. The rapid rise of BRICS could potentially pose a threat to G7 nations and the Western-backed financial world. BRICS looks ambitious to dethrone the US dollar and replace a new currency as the world’s reserve status.

Read here to know how many sectors in the US will be affected if BRICS stops using the dollar the trade. The move could send the US economy crashing and also lead to hyperinflation in the homeland. The next few decades remain crucial for the US dollar as external forces are advancing to dethrone the greenback.

Also Read: BRICS Intra-Trade Reaches 37% of The World’s Transactions

BRICS: GDP Aims To Lead in Global GDP & PPP

A recent report from Goldman Sachs highlights that the U.S. GDP could drop to third place by 2075. BRICS countries China and India will have a bigger GDP than that of the US, according to the investment bank’s analysis. China and India’s GDP could reach $57 trillion and $52.5 trillion, respectively. However, the US GDP could remain at the third spot at $51.5 trillion, the investment bank estimates.

Also Read: Indian Man Finds $3 Million US Dollars on Railway Tracks Marked to UNO

Therefore, the US could be $1 trillion behind India and $5.5 trillion behind China. The move gives BRICS leverage to control the global finances and sideline the US and other Western allies. The development could end the traditional financial order as we know it and lead to a new world order. The next few decades could tilt the power from the West to the East and limit America’s domination in the global sphere.