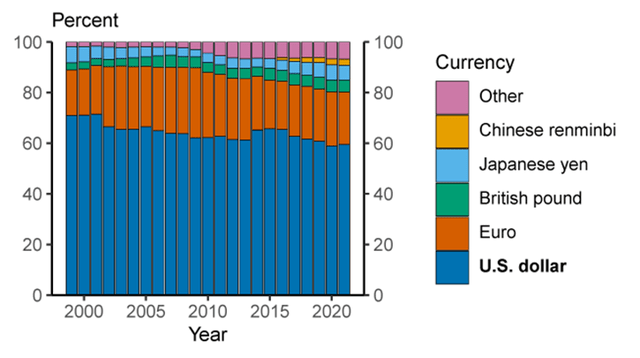

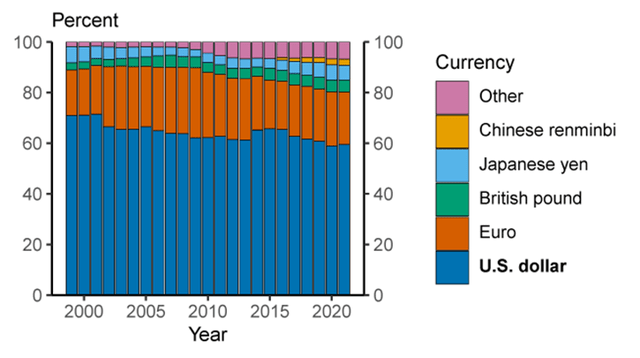

As the BRICS economic alliance has continued its commitment to de-dollarization, the US dollar’s (USD) reserve status has continued to decline amid its poor performance. Although the greenback still accounts for 51% of central bank reserves, data released shows that the figure is decreasing.

Data compiled shows that since 2015, this number has continued to fall, despite USD accounting for almost 60% of all global banking deposits. Moreover, data has also shown that last year’s interest rate hikes have had a negative effect on the overall developing economies of the world. Subsequently, it reinforces the BRICS’s motivations for decreasing US dollar usage in international trade.

Also Read: China Dumps Another $22 Billion in US Treasuries & Stocks

BRICS De-Dollarization Taking Hold, as Data Shows USD Performance Impact on Developing World

The US economy has certainly had a difficult year thus far. With national debt reaching an all-time high and surpassing $33 trillion and inflation ballooning, the country has struggled financially. Subsequently, its currency has also struggled, which has seemingly reinforced global efforts to lessen reliance on it.

The BRICS economic bloc has consistently sought to de-dollarize international trade. Yet, as many perceive the stance as an anti-Western statement, data has shown it may be more than that. Specifically, amid BRICS actions, USD reserves are on the decline amid their own poor performance.

Also Read: Chinese Yuan Surpasses Euro, Becomes Second Main SWIFT Currency

A report from Seeking Alpha states the evidence that interest rate increases throughout this year have an effect on developing economies. Specifically, with every 100 bps increase, there is a 1% decrease in GDP for those countries. Therefore, middle-income countries like Brazil, Mexico, and South Africa have no benefit from relying on the US dollar in trade.

Countries have long needed to exchange their own local currencies for or against the dollar. However, the BRICS ecosystem could be slowly changing the narrative. As the currency has struggled with its performance, the BRICS bloc is seemingly committed to establishing another way.

Whether that be a BRICS alternative currency or a new payment system that better optimizes local currencies, the bloc as a whole has seemingly identified that US dollar reliance is not conducive to global flourishing. Subsequently, central banks utilizing the US dollar as global reserves will only continue to dwindle as the greenback struggles.