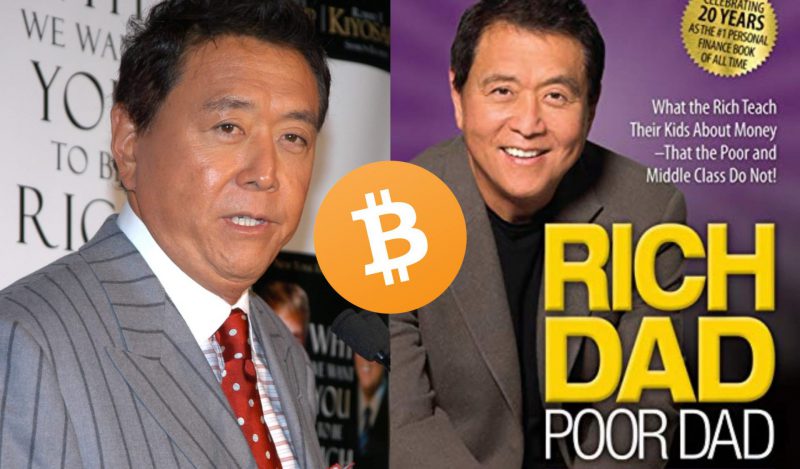

The best-selling author of “Rich Dad, Poor Dad,” Robert Kiyosaki, has prophesied that US President Joe Biden’s executive action to regulate bitcoin and other cryptocurrencies will be the asset class’ demise.

Earlier this week, a White House correspondent confirmed that the Biden administration was planning to issue an executive order requiring federal agencies to develop a framework for regulating crypto assets.

Following the announcement of the executive order to regulate digital assets, Kiyosaki informed his 1.8 million Twitter followers that he expects all cryptocurrencies will be seized and incorporated into “government crypto.”

Is there any truth to the statements made by Kiyosaki?

The cryptocurrency community slammed Kiyosaki’s position, with several users claiming he didn’t “truly understand” Bitcoin (BTC) if he thought it might be seized by the government.

Only six hours prior, Kiyosaki had advised investors to save Bitcoin (BTC) in addition to gold, silver, and firearms.

The author has long been a proponent of cryptocurrency and has frequently suggested purchasing Bitcoin and Ethereum ETH as an inflation hedge.

A few days ago, Kiyosaki had Tweeted;

“Bitcoin defies Putin. Let’s go bitcoin. Let’s go crypto. Stand up to tyrants. Stand up to tyranny. Fight back.”

So clearly Kiyosaki has had a change of heart, or as the community puts it, doesn’t fully understand how cryptocurrencies work.

In November 2021, as concerns about inflation grew, he said he was buying more gold, silver, bitcoin, ethereum, rental real estate, and oil.

Biden’s Bitcoin and Crypto bill

Treasury Secretary Janet Yellen and her team recently discussed the ever-increasing popularity of cryptocurrencies. Yellen, on the other hand, avoided big reforms. She stated that the government would prepare reports and investigate the risks associated with cryptocurrency. Specific material action details were not included in the illustration.

The executive order has yet to receive Biden’s signature. Which is thought to be simpler than anticipated.

The Treasury would also engage with “interagency partners” to create a study on the future of money and other payment systems, according to the press release.

Bitcoin and other cryptocurrencies have no geographical boundaries. As a result, the Treasury would allegedly cooperate with foreign partners to improve “strong standards and a level playing field” in order to address cross-border dimensions.

At the time of publication, BTC was trading at $41,450.44, up by 8.0%.