The FTX-induced bloodshed cost Solana the most as it plunged 55% in a week falling from $38 to $12. SOL was among the most hard hit after news broke out that Alameda holds $1.2 billion worth of the tokens. Rumors swirled around social media claiming that Alameda plans to dump SOL to avoid insolvency.

However, none of that occurred but the damage to Solana was already done. Investors sold their SOL holdings causing a domino effect of panic sell-offs last week. The dip made investors fearful of taking an entry position as users are currently unable to predict when it could bottom out.

Also Read: Ethereum Likely Headed towards $600 Levels, Here’s Why

Will Solana Reclaim The $30 Levels?

During the bear markets, slipping south is easy but heading north becomes a herculean task. For Solana to jump from its current levels of $14 to $30, it needs to double in price by increasing 110%. The correction post the FTX fiasco and the ongoing harsh bear market conditions could stunt SOL’s price in 2022.

Since May, Solana has been repeatedly rejected at $50 and is unable to push its weight above the resistance levels. Its price saw a decline in August falling below $40 and faced rejection every time it came closer to these levels for three months straight.

Also Read: How Long Will Bitcoin Take to Recover From the FTX Fiasco?

Solana has repeatedly failed to claw above its resistance levels in 2022 and the next two months could remain the same. SOL needs to breach the $20 mark first to consider moving above the $30 level. For that, it needs to jump another 50% from here, which seems to be a difficult task in this ongoing bear market.

Therefore, Solana reaching its previous levels of $30 by the end of December 2022 seems to be a challenge.

Also Read: Cardano Prediction: When Will ADA Recover From Its Slump?

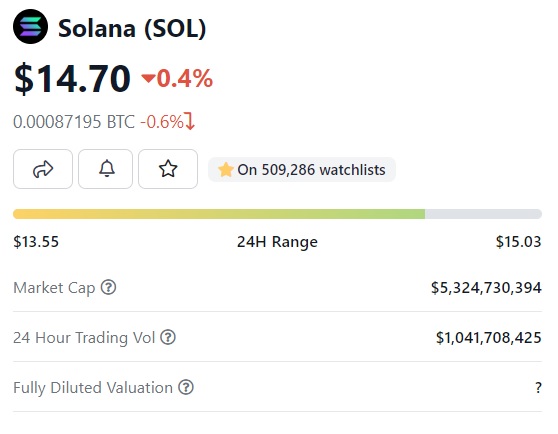

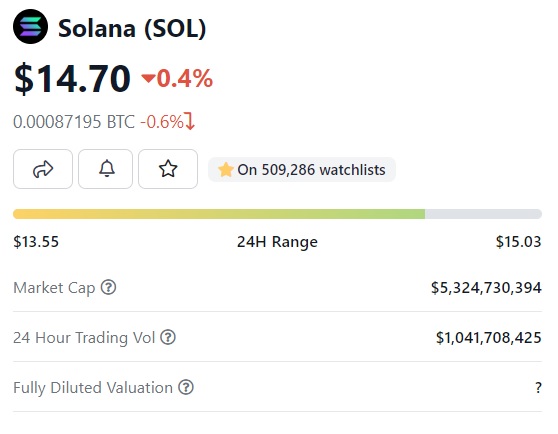

At press time, Solana was trading at $14.70 and is down 0.4% in the 24 hours day trade. It is down 94.6% from its all-time high of $259, which it reached in November last year.