The crypto community saw history being scripted yesterday. The judge in the SEC-Ripple case gave a mixed verdict, but the main takeaway was the declaration of XRP as a non-security. The sales on exchanges; sales by employees; distributions to developers, charities, etc. were off the radar. However, the judge ruled that the institutional sales of the tokens violated federal securities laws. Nevertheless, this will be contested in court again during subsequent proceedings.

Also Read: Spot Bitcoin ETF ‘Rejections’ Might Not Stop BTC’s Bull Run: Why?

Coinbase volume spikes: Courtesy XRP?

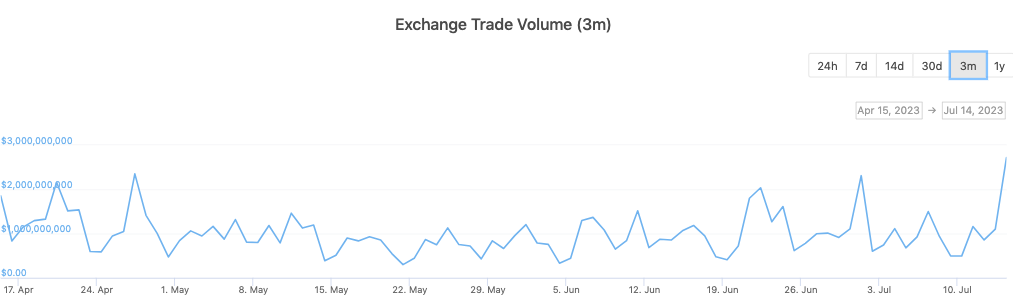

On the heels of the landmark ruling, several exchanges started considering re-listing the asset. Coinbase, however, took a giant leap by directly listing XRP right after the ruling. The exchange’s Chief Legal Officer, Paul Grewal, revealed that the Coinbase team “carefully reviewed” their analysis after the court verdict and came to the conclusion that it was “time to re-list.” Subsequently, the exchange trade volume registered a huge spike to claim a 3-month high level. Over the past 24-hours, $2.7 billion worth of crypto buy-sell transactions took place on Coinbase.

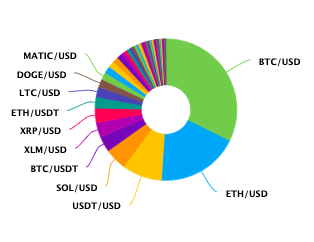

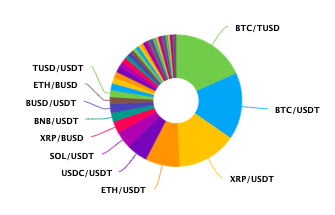

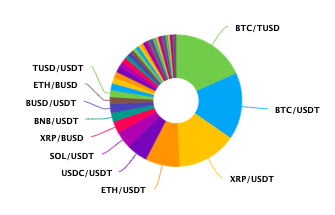

Now, it would seem obvious that the spike was caused by XRP. However, that was not essentially the case. Data from CoinGecko pointed out that the XRP/USD pair volume only accounted for 3% of the total 24-hour volume. Bitcoin and Ethereum constituted the major chunk, accounting for 32.4% and 18.7% respectively.

It has been less than 24-hours since XRP made it back on the exchange, and it is perhaps a little premature to make any assertion. It will probably take a couple of more days for the masses to realize that the asset is available on the exchange. Consequentially, XRP’s volume share could end up rising. Nevertheless, the community is excited about the re-listing. Additionally, they feel that Coinbase has a leading edge now in its case against the SEC. The positive sentiment did rub positively on the price of the stock. COIN registered a 24.49% rally, and after yesterday’s close, the shares were trading at $107.

Also Read: Bitcoin: This Could Be Investors’ ‘Golden Chance’ to Buy BTC

Other Exchanges’ XRP activity

XRP managed to command a much higher share of the trading volume on other platforms. On Binance, the XRP/USDT pair accounted for 14.6% of the volume over the past day. In fact, the asset’s share was quite close to that of Bitcoin and Ethereum which commanded 18.3%, and 16.3% each.

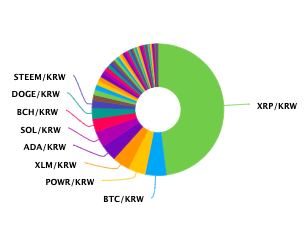

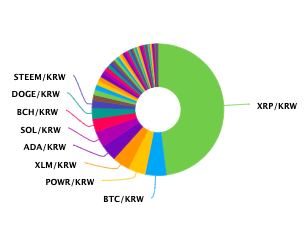

On Korean exchanges, the XRP hype was back as well. Investors from this region did buy the asset in masses pre-ruling itself. However, that has not stopped them from participating in the latest celebration. Korean traders were seen to continue scooping out XRP from local exchanges. On Upbit, almost half the trades conducted over the past day were XRP-related. Specifically, the volume share of this asset against the won pair has now risen to around 47%.

Also Read: Ripple: Is XRP Making Noise Because of Korean Investors?