One of the best aspects of trading is that you get to earn in any market phase, provided the bets are calculative. With the macro bullish setup fractured, short traders have been on a roll over the past few months and have been fetching salivating returns.

Are crypto traders sailing on two boats?

The equity market and the crypto market have maintained an on-and-off relationship with each other throughout history. Nonetheless, as highlighted in an earlier article, it is usually the psychology of market participants that makes or breaks trends in the market. So, despite divergences noted on the micro-frame, they usually end up treading on the same path over the long term.

Of late, intersectional traders are the ones who have been able to benefit the most from the current state of the markets.

Per a recent analysis by data analytics firm S3 Partners, equity short-sellers in the US are up on average more than 30% for the year. Notably, automobile, software, media, and entertainment stocks have been able to fetch attractive returns [approximately 46%-54%] to such traders. However, none of them have been able to beat crypto.

This video highlighted,

“But none of these industries holds a candle to short sellers in the crypto sector, up 126% on an average short interest of $3 billion dollars.”

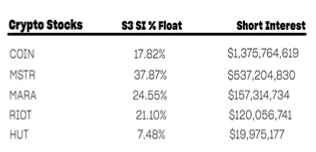

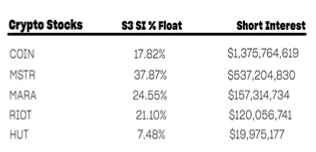

Coinbase, MicroStrategy, and Marathon Digital Holdings have managed to attract the highest short interest, per S3 Partners. As such, the stocks of all the three companies are down by 70%-80% each when compared to where they stood at the beginning of the year.

Even though the dip has been a blessing in disguise for short traders, it shouldn’t be forgotten that the crypto sphere’s dents are quite deep and investors are the ones paying the price for it at the moment.