Cryptocurrency exchange-traded funds [ETF] have taken the front stage this year. While Bitcoin ETFs got a green signal from U.S. regulators, Ethereum is still waiting its turn. However, the optimism around Ethereum ETFs seems to be diminishing. More recently, Jan van Eck, CEO of VanEck, voiced skepticism regarding the approval of his firm’s spot Ethereum ETF application during an interview with CNBC on April 9.

The VanEck CEO noted that the application would most likely face rejection. This notion comes following a prolonged period of regulatory inaction from the Securities and Exchange Commission [SEC]. Several prominent figures from the industry including Cathie Wood’s ARK Invest previously exerted immense hope. However, the lack of communication between the regulators and fund issuers has cast doubts on the approval prospects.

The process that regulators have been taking with Ethereum ETFs starkly contrasts with the one leading to the approval of spot Bitcoin ETFs. The SEC took an active stance and engaged with issuers, provided feedback, and even shared specifics with the public before Bitcoin ETFs were approved. This level of engagement is missing with regard to Ethereum ETFs.

Also Read: Ethereum ETF: SEC’s Frosty Response Quashes User’s Hope

ETF Analysts Revise Odds

Eric Balchunas, Senior Bloomberg ETF analyst went on to revise his odds for an Ether ETF approval. He brought down the odds from 70% in May to a dainty 35%. Balchunas linked this drastic drop to the current “radio silence” from the SEC. Balchunas said,

“As we’ve said, need SEC to give comments on the filing documents (the “critical feedback” he mentions) and that still ain’t happening, even in person they offering nothing. Silence is violence.”

Another ETF analyst James Seyffart, echoed similar concerns about the lack of interaction between the SEC and applicants. He further noted that “zero comments/interactions is a bad sign.”

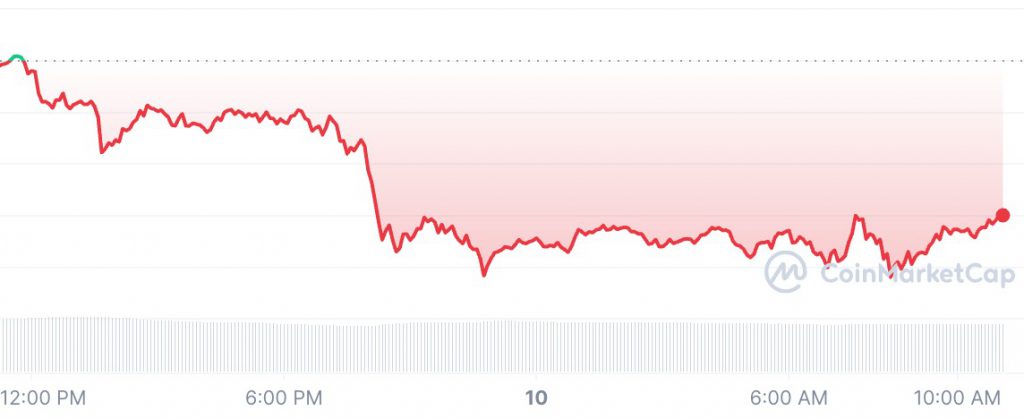

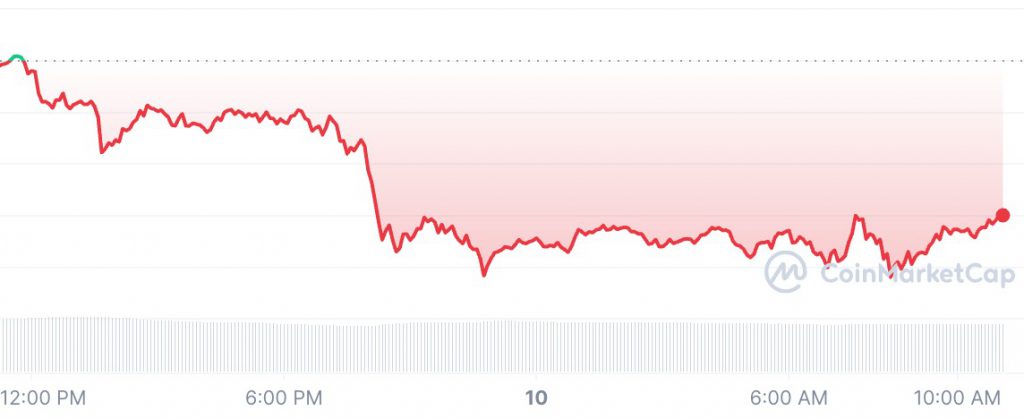

Amidst this, ETH was trading at $3,532.87 with a 4.31% surge over the last 24 hours. According to Changelly, the asset is slated to rise as high as $3,629.29 in April 2024.

Also Read: Fidelity Files for Spot Ethereum ETF With Staking