Ethereum moved from proof-of-work (PoW) to proof-of-stake (PoS) consensus last month and the transition is dubbed the Merge. The PoW algorithm previously rewarded miners for validating blocks of transactions and the PoS algorithm eliminates the need for miners. The miners consumed high electricity to validate blocks and the PoS systems considerably reduces energy consumption by nearly 99%. This makes ETH more scalable and energy-efficient giving opportunities for investors to earn passive income with Ethereum. In this article, we will guide you on how to earn passive income by staking your Ethereum coins.

Also Read: Will Ethereum Reach $1800 This Week?

ETH: How to Earn Passive Income With Ethereum Staking

The cryptocurrency markets allow investors to earn passive income by staking their cryptos for a set period. This allows investors to reap financial rewards steadily while making their tokens get to work.

Coming to earning passive income with Ethereum, the only way to attain it is through ‘staking’ ETH. Ethereum staking is the most popular way to earn passive income but the development comes with a catch.

Staking Ethereum to earn passive income isn’t easy, as it requires a minimum of 32 ETH to be staked. Accumulating 32 ETH remains to be unaffordable to the average investor as it comes above $50,000 currently. Staking 32 ETH allows an investor to run a full validator node and participate in staking.

Also Read: Ethereum Price Prediction: ETH to Break Above $3,000 By Early 2023?

So how do you stake Ethereum to earn passive income if you own less than 32 ETH? There’s a solution for that. Third-party apps allow users to stake their ETH on their platform, and the apps initiate the staking on behalf of the user. You don’t need to invest 32 ETH upfront and the third-party apps allow users to stake any amount of ETH.

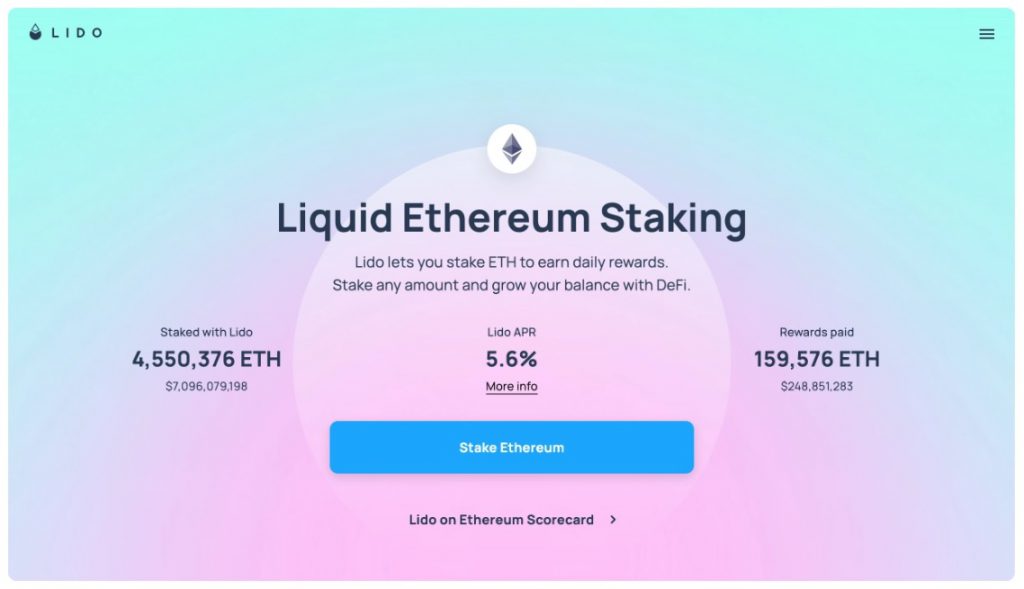

Third-party apps such as Lido, StakeWise, among others stake your ETH so you can earn passive income. However, the DApps charge a fee upfront of 10% to stake your Ethereum.

Also Read: Ethereum’s Deflationary period completes 30-days

This would cut into your profits and the passive income will be reduced considerably. However, it saves users from investing 32 ETH upfront, which the average person might find it hard to accumulate.