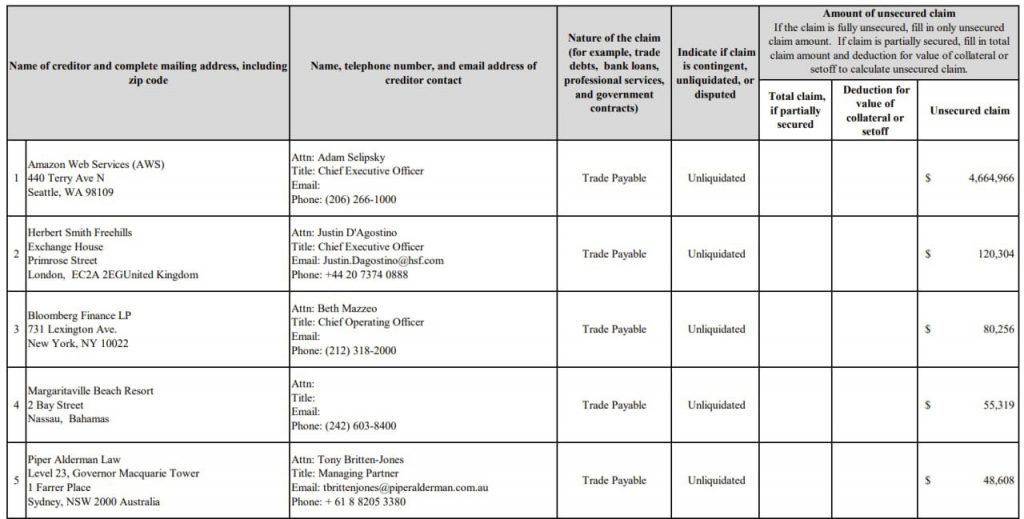

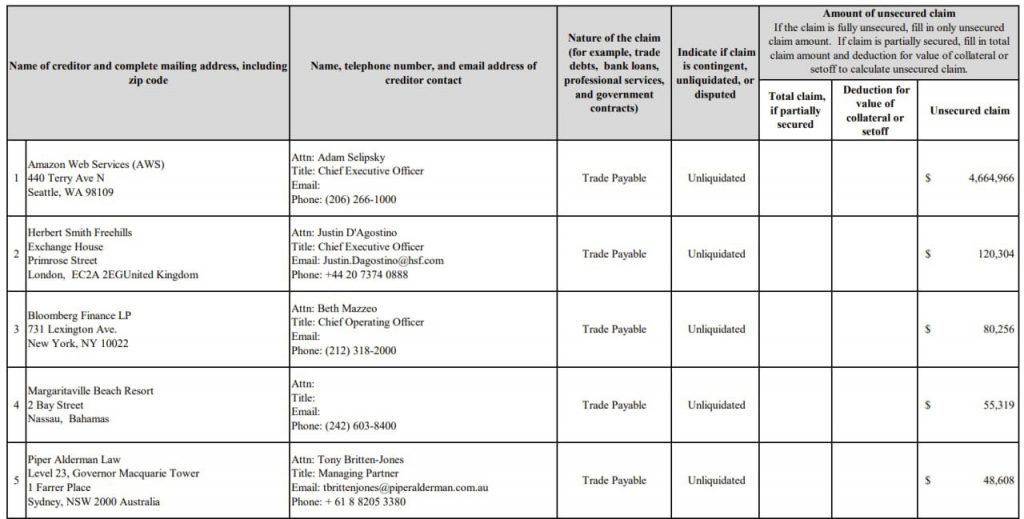

The FTX exchange and Alameda crypto fund is throwing new surprises every day on how they managed their finances. Alameda has a long list of creditors as they owe money to an array of service providers. While most of them are necessary spending, the others are a waste of user funds spent in the wrong way.

Among the long list of creditors, Alameda apparently owes an in-house resort bar in the Bahamas $55,000 in unpaid bills.

Also Read: How Long Did Previous Crypto Bear Markets Last Compared to 2022?

The list of creditors Alameda owes money also includes Amazon Web Services, Bloomberg Finance, and Piper Alderman Law firm. While these are part of the day-to-day functioning of the firm, the bar bill seems to be no small amount.

The bar that Alameda owes $55,000 is located at the Margaritaville Beach Resort in the Bahamas. The Margaritaville is an upscale beachside resort in the Bahamas that boasts watersports, parties, relaxation, shopping, and entertainment. It is not known if Alameda will return the money it owes to the creditors.

Also Read: Ripple: XRP Falls 8%, Here’s Why the Crypto is Crashing Today

FTX & Alameda Bankruptcy

FTX and Alameda filed for bankruptcy this month and are unable to return the collateral they owe to their creditors. Cryptocurrency lender BlockFi is a victim of the FTX-Alameda fiasco as the firm revealed $680 million worth of bad loans to Alameda. BlockFi filed for bankruptcy and is now suing Sam Bankman-Fried over $575 million Rohinhood shares.

BlockFi is now demanding that SBF hand over his $575 million worth of Robinhood stocks. You can read more details about it here.

Also Read: Crypto Investors Cash Out $3.5 Billion in Stablecoins in 2 Weeks, Here’s Why

However, reports stated that SBF is trying to raise funds by selling his Robinhood shares after entering a collateral agreement with BlockFi. The collateral agreement was initiated before the downfall of FTX and Alameda.

The FTX contagion might take many more crypto lending firms down along with it. A handful of lending firms collapsed after the TerraUST and LUNA crash and FTX is leading the wave for the next fall.

Also Read: Why is Bitcoin Crashing? 3 Reasons Why BTC is Headed Towards $10,000