A recent study conducted by the Network Contagion Research Institute [NCRI] has exposed that Twitter bots may have a greater influence in manipulating altcoin prices. The study, which spanned from Jan. 1, 2019, to Jan. 27, 2023, also sheds light on the potential benefits for FTX and its sister company Alameda.

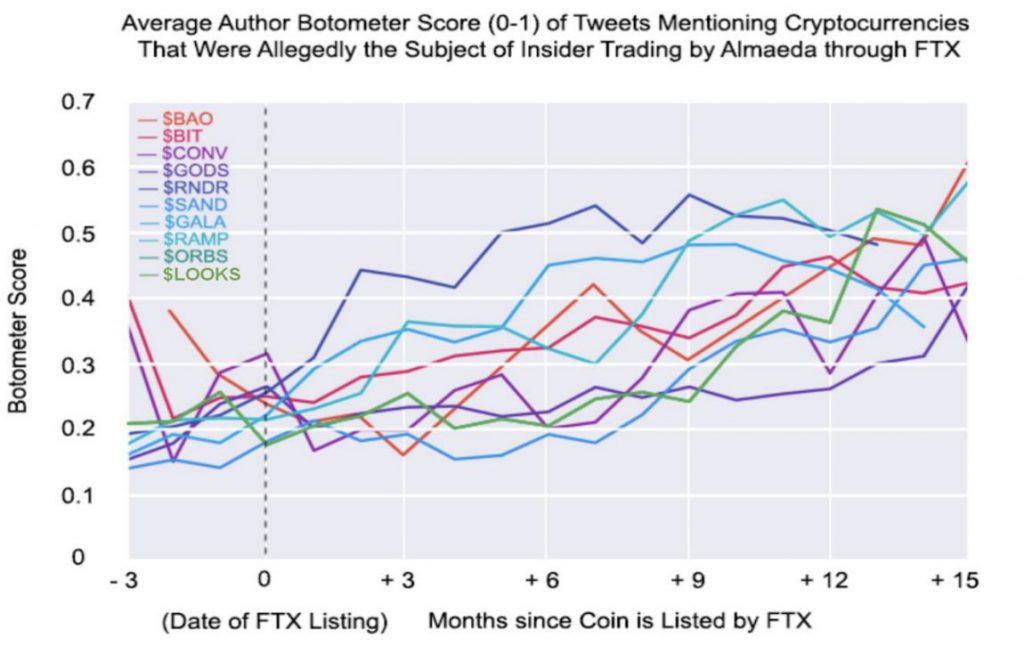

Between the specified time period, NCRI examined more than 3 million tweets on Twitter. By utilizing Botometer, researchers discovered that out of 182,105 distinct accounts that discussed FTX-listed coins, a majority of 172,451 accounts were flagged as potential bots. This means that about 20% of the online discussions related to FTX-listed coins were attributed to bot-like accounts. Botometer is a tool that evaluates the behavior of Twitter accounts and assigns them a score indicating their likelihood of being bots.

The report noted inauthentic activities on Twitter had a significant effect on boosting the prices of tokens listed on FTX. The researchers observed that six small-cap tokens on the exchange, including BOBA, GALA, IMX, RNDR, and SPELL, were particularly susceptible to manipulation through deceitful social media engagement. The study conclusively identified the deliberate and effective use of “inauthentic chatter” to manipulate the prices of these FTX coins.

As seen in the image, before these tokens were listed on FTX and Alameda had ownership of at least five of them, and their visibility was enhanced by bot-like activity on Twitter. The report further read,

“It begs the question, did FTX or Alameda engage in coordinated inauthentic activity on social media to artificially inflate market values?”

Also Read: FTX Confirms Plan to Relaunch Exchange

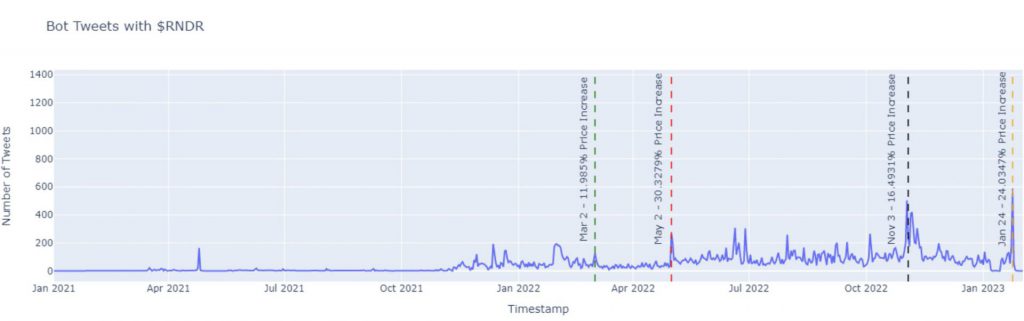

FTX and RNDR

The crypto asset RNDR experienced a rise in inauthentic posts and engagement on Twitter. This in turn led to substantial double-digit percentage increases in its price. According to the NCRI analysis, there were four specific instances between 2022 and 2023. During this period spikes in bot activity on Twitter were closely followed by price surges in RNDR. This ranged from 11% to 30% within a span of 24 hours.

Also Read: Twitter: Crypto Community Reluctant To Embrace Elon Musk’s ‘X’

Has there been a decrease in Twitter bots?

Prior to his acquisition of Twitter, Elon Musk frequently voiced concerns about the prevalence of bots on the platform. One of his motivations for purchasing the social media giant was to address and reduce bot presence. Musk has asserted that bot activity has significantly decreased since he took over. But there is a lack of concrete data to substantiate this claim.

However, according to Alex Goldenberg, the Lead Intelligence Analyst for NCRI, Twitter has been making API changes to discourage bot creation. This could potentially result in a decrease in cryptocurrency promotion and scams on the platform. But, there was one problem. “These changes come with trade-offs as they also hinder independent audits by third-party researchers,” he added. This means that independent researchers would have a tough time checking and reviewing the platform. The NCRI analyst further suggested,

“[X Corp. to] consider stricter account verification, machine learning for bot detection, and special permissions for certified researchers to ensure transparency while combating malicious bot activity and other forms of online harm.”

Also Read: Elon Musk To Enable Dogecoin Payments in Twitter’s X?