May was a relatively calm month for the cryptocurrency market. Goldman Sachs recently released a report that delves into the on-chain statistics and market dynamics of Bitcoin [BTC] and Ethereum [ETH] during that period. The report painted a varied picture in terms of adoption and activity, offering valuable insights into fluctuations in address balances, profit taking, exchange holdings, network congestion, and hash rate performance.

Bitcoin Profit Taking

According to the report, the changes in ETH balances across different cohort groups showed little variation in May. However, the report highlighted a noteworthy development in Bitcoin addresses holding over 100,000 BTC. This experienced a significant monthly decline of 31%. The decline suggested a potential shift in the distribution of wealth or a trend of profit-taking among major Bitcoin holders during that period.

SOPR

In May, the spent output profit ratio [SOPR] for Bitcoin, which measured the degree of realized profit, displayed notable fluctuations. The SOPR reached levels that had not been observed since December 2020, indicating significant profit-taking activities in the spot markets. The analysis mentioned that these spikes in the SOPR reflect instances where investors sold their Bitcoin holdings to capitalize on the gains they had accumulated.

Exchange Supply

There was a notable decrease of 12% in the supply of Bitcoin held on cryptocurrency exchanges during May. On the other hand, Ethereum supply experienced a slight increase. This suggested a possible trend of Bitcoin being moved away from exchanges. This could potentially be for the purpose of secure storage or alternative investment approaches. Such a movement is generally viewed as a bullish indicator of the market.

Network Congestion

Moreover, the report highlighted that network congestion had an impact on user activity in both the Bitcoin and Ethereum networks. As a result of higher transaction fees, there was a decline of 13.8% in monthly address activity for Bitcoin and a 16.7% decrease for Ethereum. The congestion led to a downfall among users, resulting in reduced engagement and transactional activity on both blockchains.

Will the latest lawsuit against Binance slow down the Bitcoin ecosystem in June?

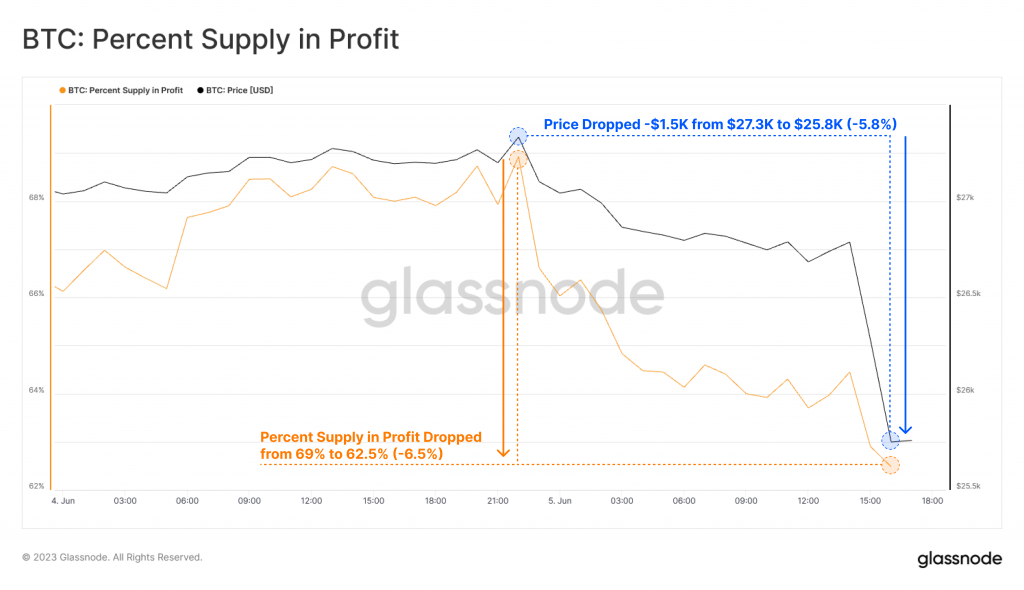

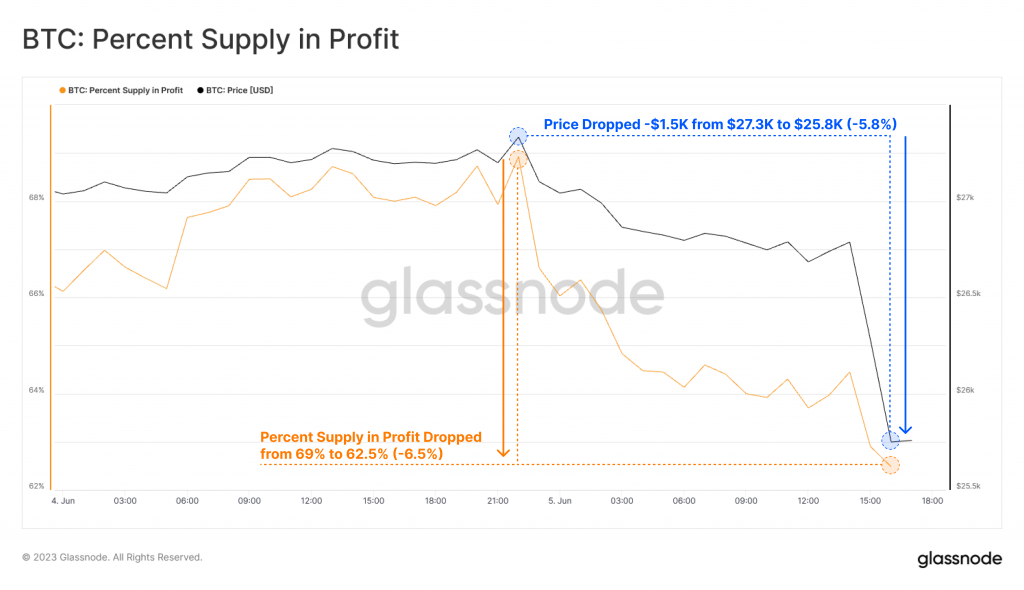

After the lawsuit was filed, the crypto exchange observed a surge in outflows, with a net outflow of 10.5K BTC. As a result, the price of BTC declined to a low point of $25,445. This decline also led to a decrease in the percentage of BTC supply in profit, dropping from 69% to 62.5%.

Elaborating on the same, Glassnode wrote,

“The recent #Bitcoin move downwards from $27.3K to $25.8K (-5.8%) has caused the percent supply in profit to decline from 69% to 62.5% (-6.5%), plunging a further 1.26M coins into loss.“

Taking this into consideration, Bitcoin holders are likely to see a drop in the profits they would be accumulating this month. The month of June will be important for Bitcoin as it will be the end of Q2 2023.