2021 witnessed the emergence of various digital assets. From scalability protocols such as MATIC, to meme coin extraordinaire Shiba Inu. While these assets grew multi-fold, a recent survey highlighted the rising importance of continued growth of Bitcoin adoption.

The survey indicates several key differences between 2020 and 2021’s growth curves in crypto. One of the key factors is the store-of-value narrative during an inflation-riddled period. A majority of investors also considered BTC as an investment rather than a currency.

55% of Bitcoin investors started in 2021

Grayscale carried out an online survey with 1,000 U.S consumers aged between 25 to 64. These individuals had primary or shared responsibility for financial decisions. The responders involved had at least $10,000 invested assets, and another $50,000 in household income.

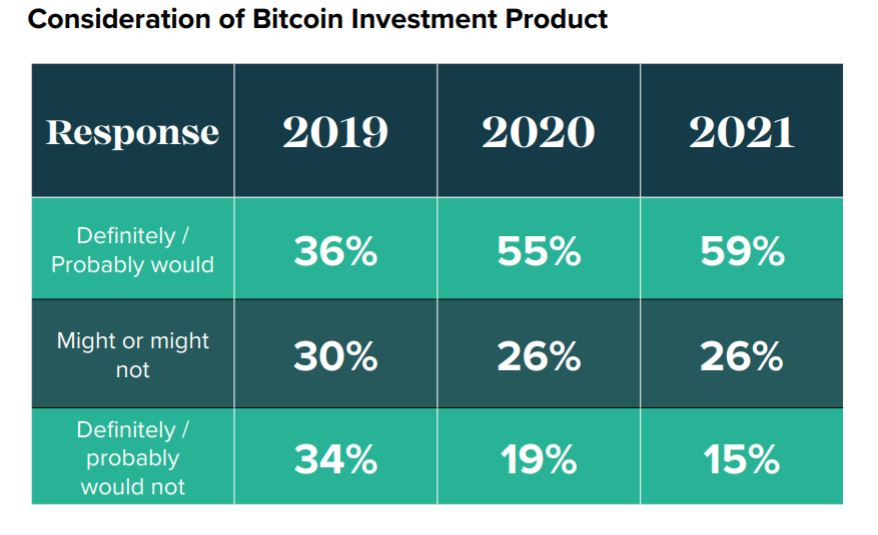

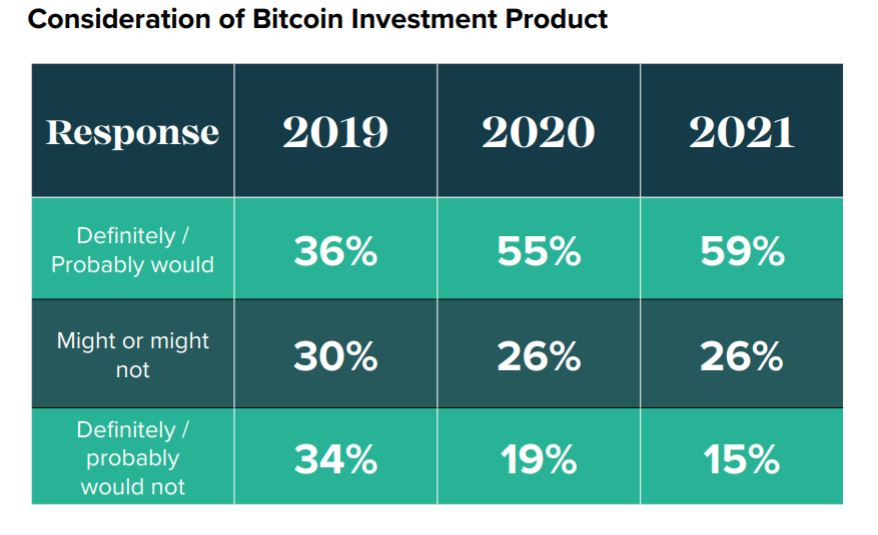

After analysis, it was determined that investors are more approving of Bitcoin in 2021 than in 2020. 26% of the investors were Bitcoin holders already and from that group, 46% and 44% jointly invested in Ethereum and Dogecoin.

READ ALSO: Australian Regulators Give the Go-Ahead for Bitcoin ETFs

In addition to that, more than 59% of these investors used cryptocurrency trading applications, shifting from a massive 77% inclination towards exchanges in 2020. Similarly, more than 66% of those who bought BTC more than 12 months ago are still holding, inferring a higher long-term sentiment with the digital asset. With more than 91% of the investors still in profit, it is not surprising that BTC still accounts for 46% of the total value of crypto markets.

Moreover, investors believed that a Bitcoin ETF should be the way to go forward. While a Bitcoin futures ETF received approval in October 2021, surveyors would prefer a spot BTC ETF backed by Bitcoin and not futures.

Investment vs Currency?

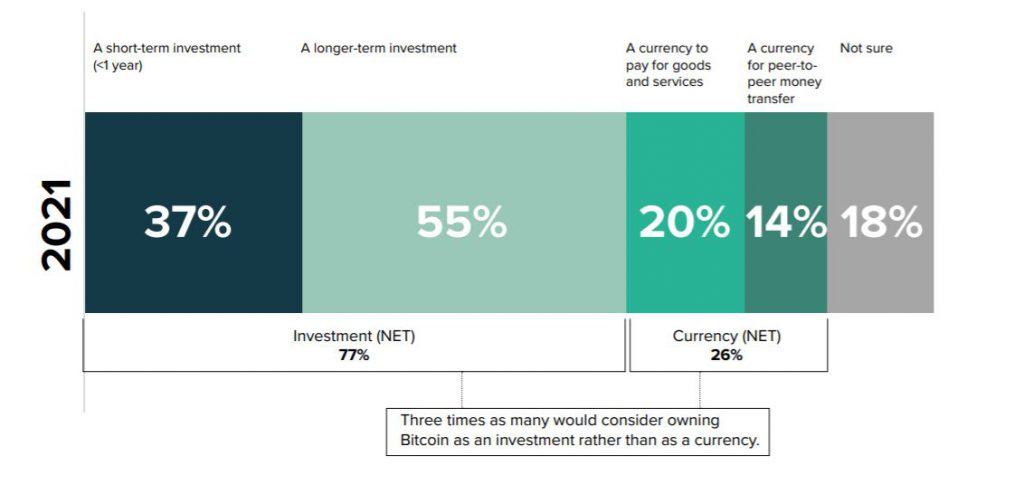

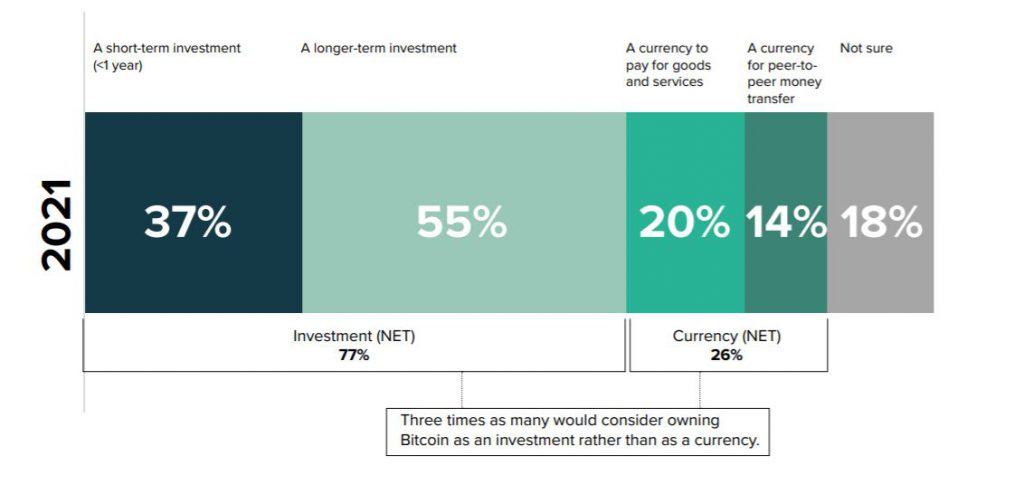

The crypto industry is no longer a wild-west ecosystem. The understanding towards Bitcoin and other assets has evolved but the direction is still developing. While most BTC proponents like to elevate its credentials as a currency, most of the respondents considered it as an investment over the medium of exchange.

El Salvador might have legalized Bitcoin as a legal tender but according to the survey three times as many investors owned BTC from a store-of-value narrative. In a detailed breakdown, 37% believed its a short-term investment. While 14% looked at it from a money transfer method.

READ ALSO: Ethereum Will Be The Next To Explode: Frank Holmes

Overall, the landscape remained quietly evident. Bitcoin’s adoption curve continues to outperform other assets where it matters. While its price may not reflect astronomical surges, its institutional and retail capital flow remains consistent.