As Chainlink sits within a strong support zone, accumulation from large holders and ETH whales shape well for its price once Bitcoin recovers from recent lows.

Chainlink was subject to a massive sell-off on 11 April after Bitcoin lost ground on $42K. LINK’s price declined by as much as 14% between 11-13 April, tagging an unwanted monthly low of $13.6.

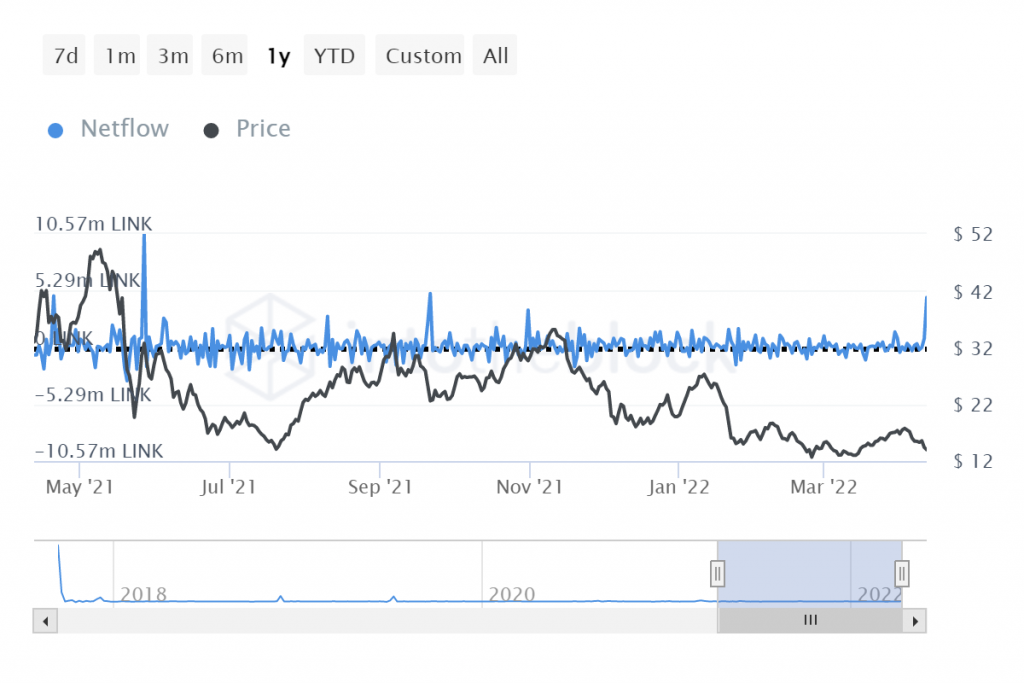

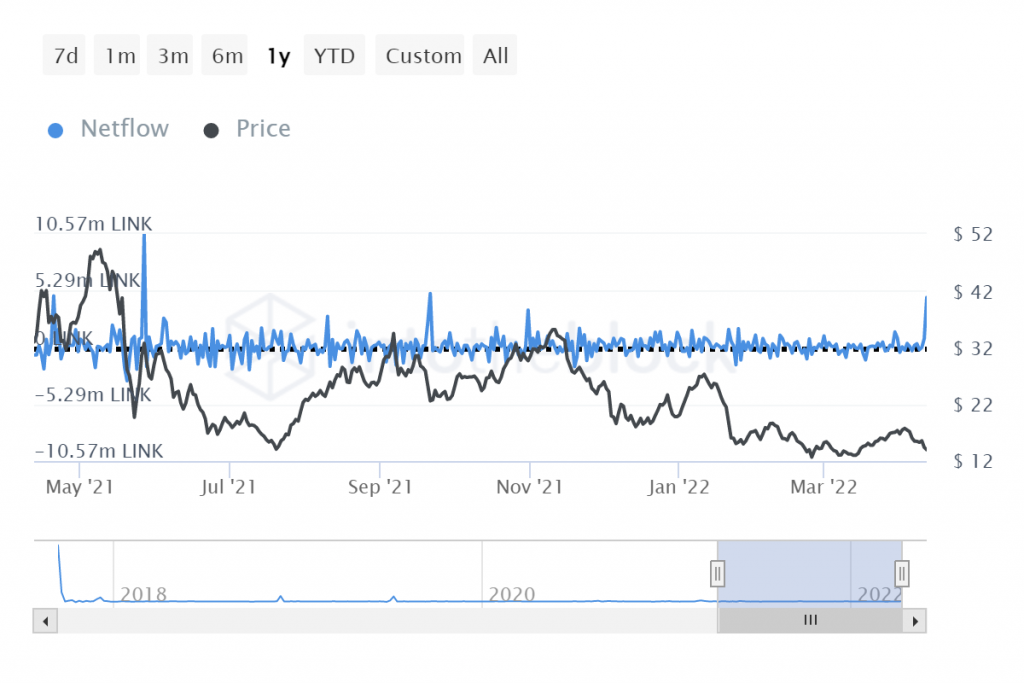

Intriguingly, large holders capitalized on a discounted LINK and ramped up the accumulation process. The chart above showed that large holders’ NetFlow (those holding over 0.1% of LINK’s supply) climbed to its highest level since September 2021.

Furthermore, top Ethereum whales also played a part in the accumulation. As per Whalestats, Chainlink was amongst the most purchased tokens by the top 500 Ethereum whales during the day.

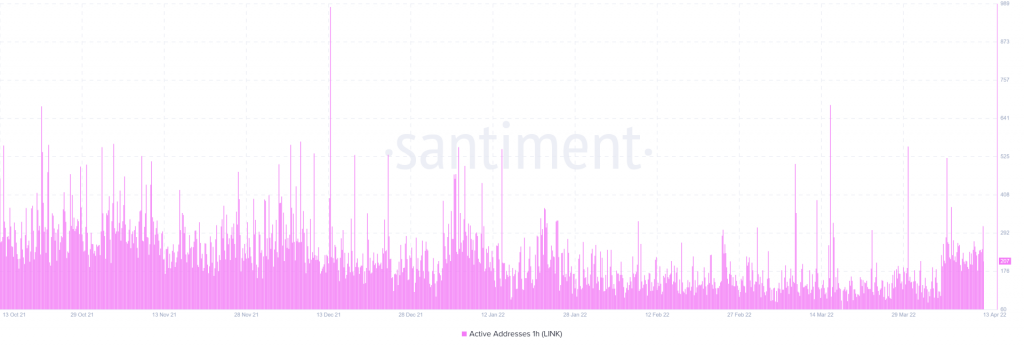

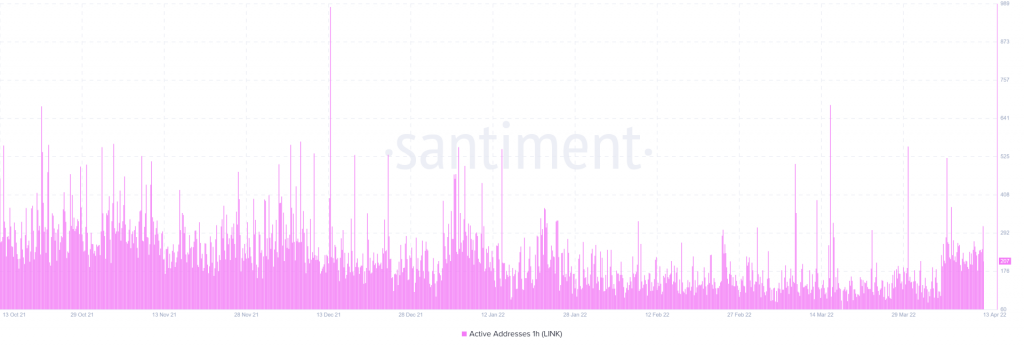

While the accumulation did bump up Chainlink’s hourly active addresses, the same has been generally higher in April as compared to February and March. A divergence between the price and hourly active addresses hinted that LINK was undervalued at its current level.

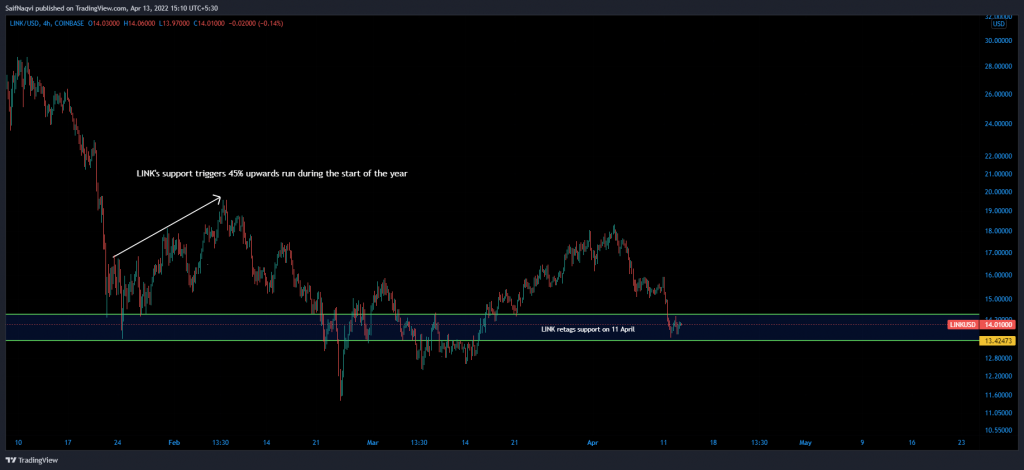

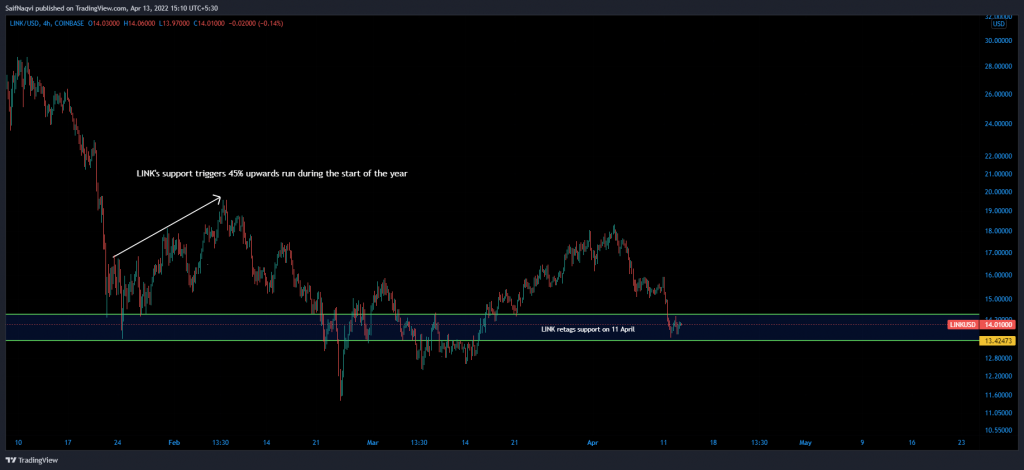

Chainlink Daily Chart

While healthy network activity and accumulation from large holders makes indicate positive price action, the same was amplified after considering LINK’s position on the chart.

Over the past few days, LINK’s price has traded within a strong support region of $13.4-$14.4, and chances of a bullish rebound were relatively high. Notably, the same area was responsible for a 45% systematic price increase earlier during the year.

However, LINK’s correlation with Bitcoin has increased by 0.97 during the recent market fluctuations – the highest value so far this year. With LINK heavily reliant on Bitcoin’s direction as well, market participants might just have to wait for the next Bitcoin pump to fully realize gains from their Chainlink investments.