People usually view dips as an opportunity to enter the market. As crypto prices kept rolling down over the last couple of weeks, participants from all across the board were busy accumulating Bitcoin.

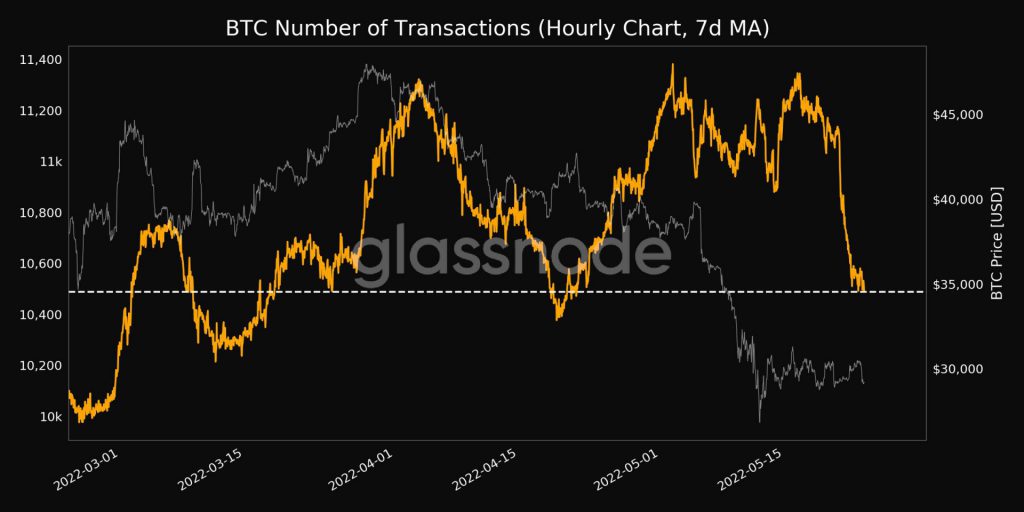

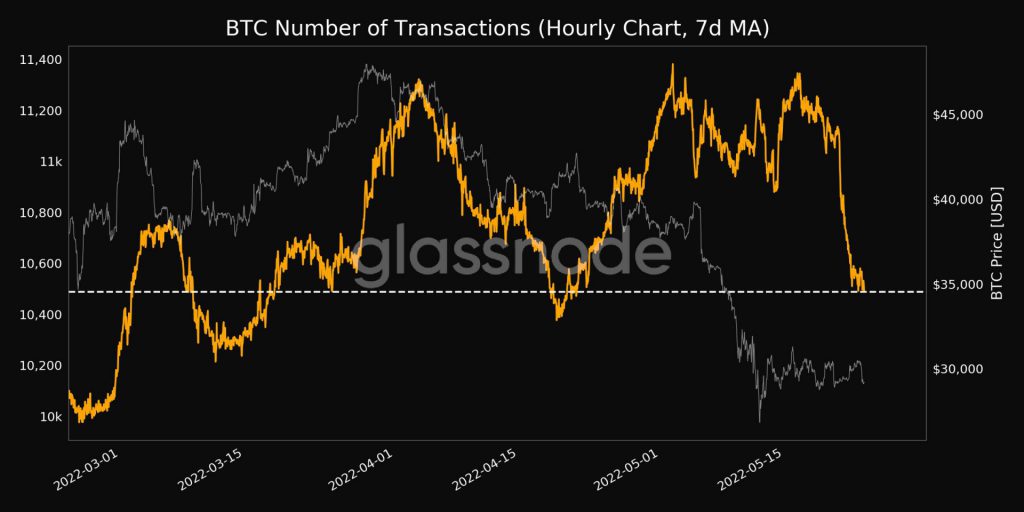

However now, the tables have already turned. Consider this – The number of Bitcoin transactions stooped to a new local bottom earlier today. Per data from Glassnode, this metric had reached a 1 month low of 10,488.345 at press time.

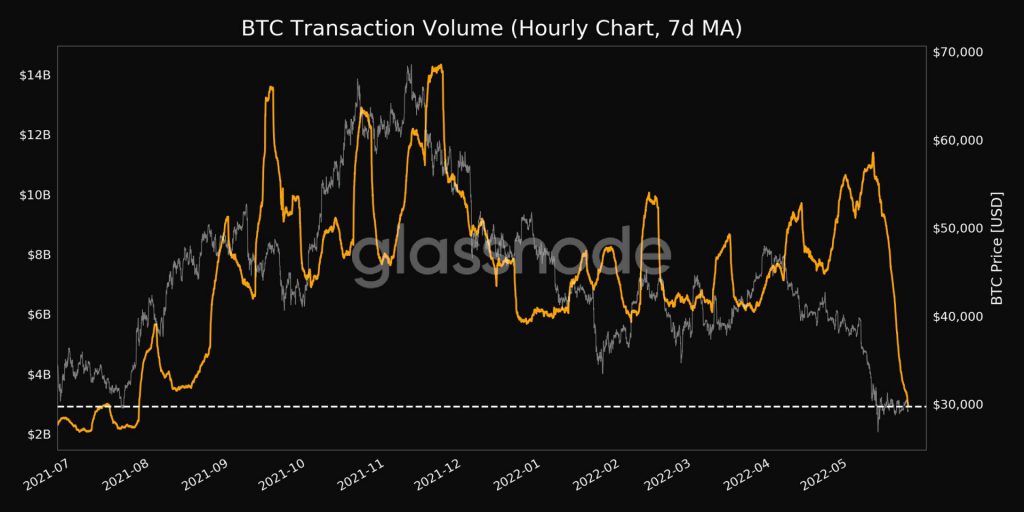

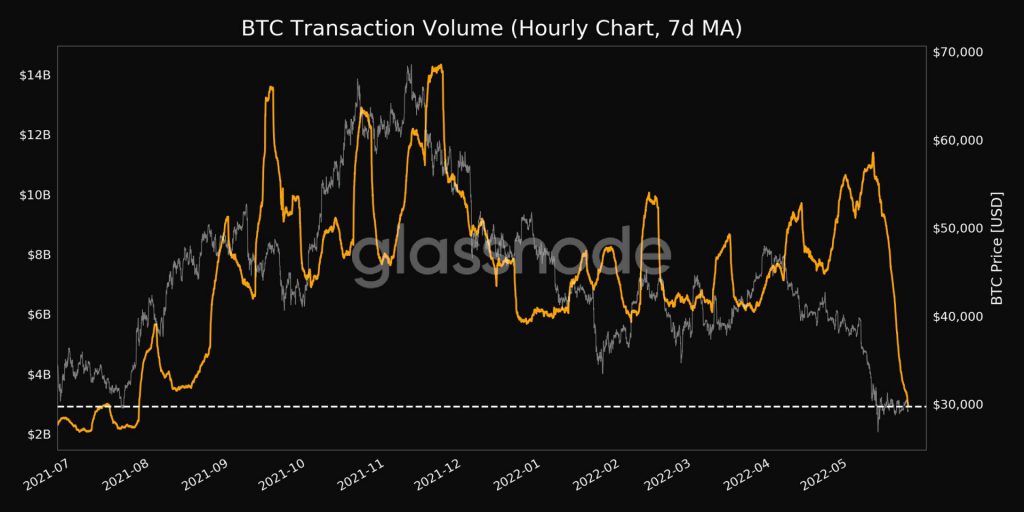

Alongside, the transactional volume had also massively shrunk. Via its recent tweet, Glassnode pointed out that the same is currently at its 9-month low of $2,913,219,145.55.

Well, the aggregate number and volume of transactions reducing clearly point out the shriveling interest of market participants towards Bitcoin, and that is not a welcoming sign on a given day.

Institutions rub salt on Bitcoin’s wounds

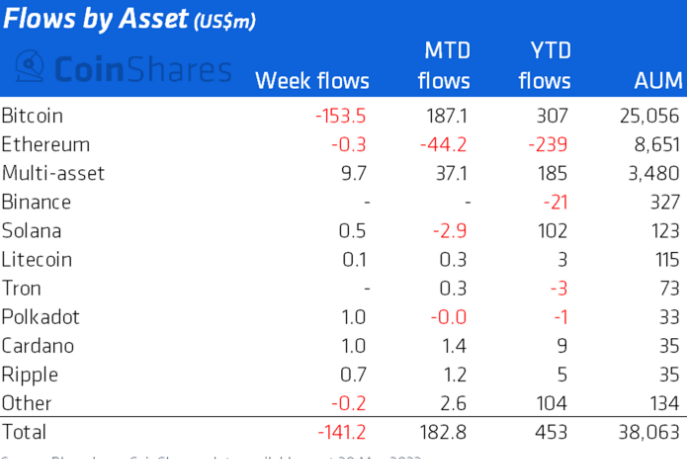

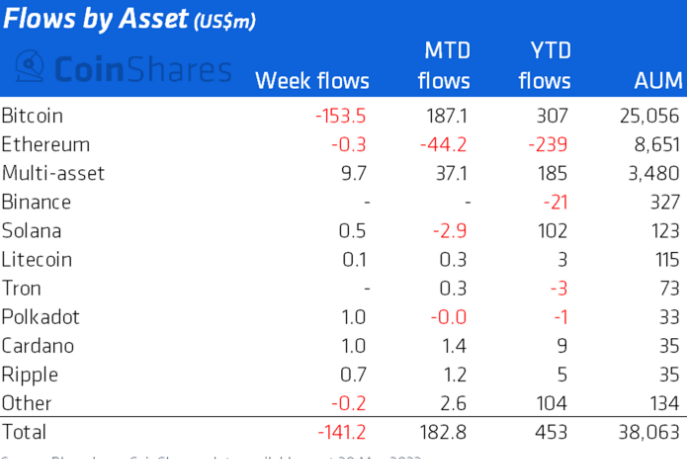

Along with the deteriorating on-chain activity, it is crucial to note that institutions have started abandoning their Bitcoin as well at this stage. Per CoinShares’ latest weekly report, digital asset funds noted one of its largest outflows, summing up to $141 million, last week and Bitcoin was essentially the biggest contributor.

Outlining the same the report highlighted,

“Bitcoin was again the primary focus with a swing from inflows the prior week to outflows totaling US$154m last week.”

Most other alts like Solana, Litecoin, Polkadot, Cardano, and Ripple noted minor inflows in the $0.1 million to $1 million bracket. Even so, the bearishness associated with Bitcoin has managed to dent the aggregate sentiment.

Highlighting the same, CoinShares noted,

“The ongoing volatility has led to fickle investors with some seeing this as an opportunity while the aggregate sentiment is predominantly bearish.”

Bitcoin had already let go of the psychological $30k level on Tuesday. At press time, it was seen exchanging hands at $29.3k. With the bearishness intensifying with every passing trading session, it doesn’t look like institutional dumping and the state of the on-chain activity would improve anytime soon.