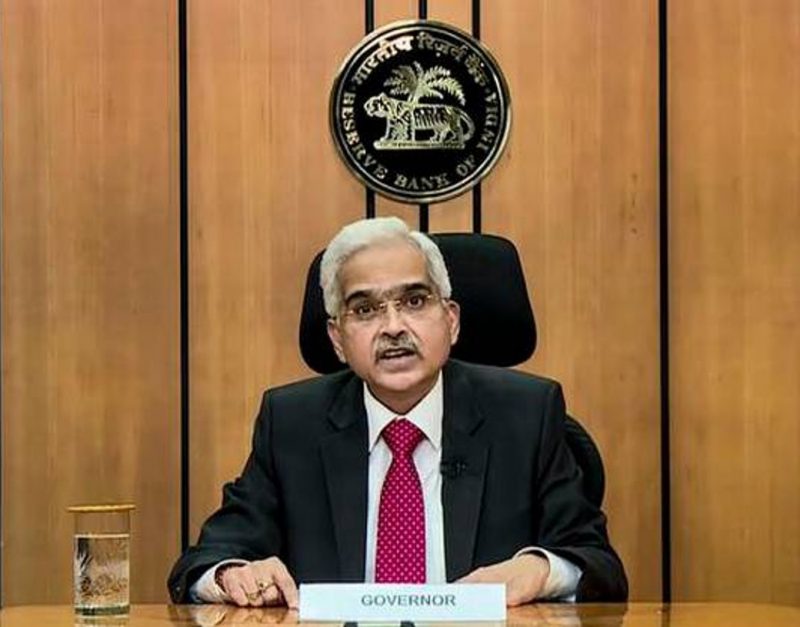

The Reserve Bank of India (RBI) Governor, Shaktikanta Das labeled cryptocurrencies as completely ”worthless”. He compared the crypto market to the 17th century Tulip mania and said it’s much worse than the Tulip bubble.

For the uninitiated, Tulipmania was a phenomenon in 1634 where Dutch farmers’ annual income rose tenfold by growing tulips. It beat the national average income of the skilled workers at that time and everyone began cultivating tulips. However, the market collapsed under its feet in 1637 as its bubble finally broke.

Read Also: Bitcoin is not Controlled By Banks, That’s the Point, Says Tucker Carlson

The Governor warned crypto investors that they might face similar consequences when the crypto bubble bursts. He also called the crypto market a big threat to India’s macroeconomic stability.

“Cryptocurrency is a big threat to India’s macroeconomic stability,” he said and continued, ”Private cryptocurrencies are a big threat to our financial and macroeconomic stability. They will undermine RBI’s ability to deal with issues related to financial stability.”

Das stated that it’s his ”duty” to inform investors about the dangers of investing their money in cryptocurrencies. He highlighted that cryptos have no underlying value and taunted that the market has no underlying asset of even a single tulip.

Read Also: What is DAO in the Blockchain Technology? Pros and Cons, Explained

“I think it is my duty to tell investors that what cryptocurrencies they are investing in, they should keep in mind that they are investing at their own risk. They should keep in mind that these cryptocurrencies have no underlying asset. Not even a tulip!”

RBI’s War Against Cryptocurrencies

This isn’t the first time that the RBI has slammed cryptos. Former RBI Governor, Raghuram Rajan had previously compared the cryptocurrency market to ”chit funds.” He also predicted that the majority of cryptos currently trading in the market will not exist in the long run. Rajan, had also compared the crypto market craze to the Tulip mania.

Coinospy, a website that tracks the number of dead coins has reported that 2,094 cryptos have gone bust.

“Do we really need 6,000 cryptocurrencies to do payments? One or two, may be a handful, that is going to survive to be used for payments even if the technology is so useful that it is a substitute for cash and currency. That would suggest that most cryptos are unlikely to survive with high values going forward,” Rajan told CNBC-TV18.

India placed a flat 30% tax on cryptocurrencies along with a 1% TDS tax, which includes both buying and selling.