PayPal recently unveiled its own stablecoin, PYUSD, 100% backed by U.S. dollar deposits, short-term U.S. Treasuries, and similar cash equivalents. This launch made PayPal the first major U.S. financial company to launch its own U.S. dollar-backed stablecoin.

Several other companies have been making developments on this front. Japan’s largest bank, Mitsubishi UFJ Financial Group [MUFG], is in talks with companies associated with prominent global stablecoins. Alongside, it is also discussing with firms about issuing such tokens via its own blockchain platform, Progmat.

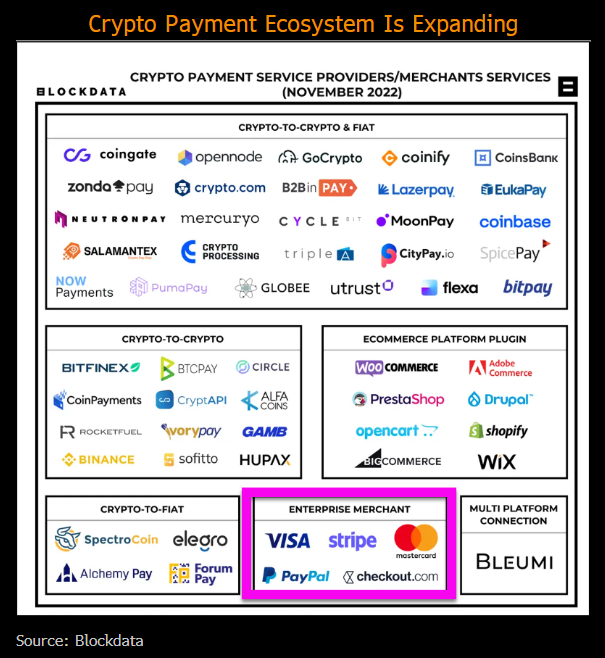

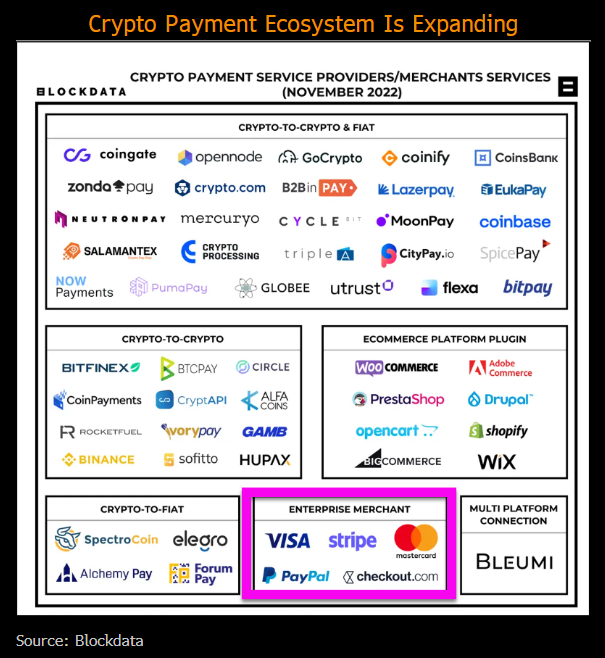

Evidently, the crypto payment ecosystem has been expanding. According to a recent graphic shared by Jamie Coutts, Bloomberg Intelligence’s Crypto Market Analyst, the enterprise merchant section now has a handful of major names including Visa, Stripe, Mastercard, and Checkout.com. Coutts acknowledged that Paypal’s stablecoin exposed many new users to Web3. However, for the blockchain economy to grow, apps have a long way to go before the onset of mainstream adoption.

Also Read: China: Metaverse Industry Expected to Grow to $34 Billion in Sichuan

What Could Drive More Engagement?

The analyst pointed out that in developing economies, stablecoins are crucial for NFTs, gaming, etc. However, at the moment, token speculation and payments are the key use cases. In emerging markets, on the other hand, stablecoins offer protection to citizens who are caught between persistent and severe currency debasement by governments. In fact, the weakening of emerging market currencies has paved the path for increased crypto adoption in several countries.

As analyzed in a recent article, the national currencies of Argentina, Turkey, and Egypt have been consistently falling against the U.S. dollar. Amid the devaluation acceleration, Bitcoin’s price against the Argentine peso, Turkish lira, and Egyptian pound ended up bumping and creating an all-time high value.

Also Read: Bitcoin Hits ‘All-Time High’ in Argentina, Turkey: Egypt Next?

Coutts further revealed that stablecoin transfers account for 86.6% of the on-chain value transfer. DEX activity, on the other hand, stood at 13%. NFTs merely contributed 0.15% and 0.03% respectively. Concluding with what was the need of the hour, the analyst said,

“In addition to bridges, the blockchain econ needs apps to solve for more uses cases & drive broader engagement.”