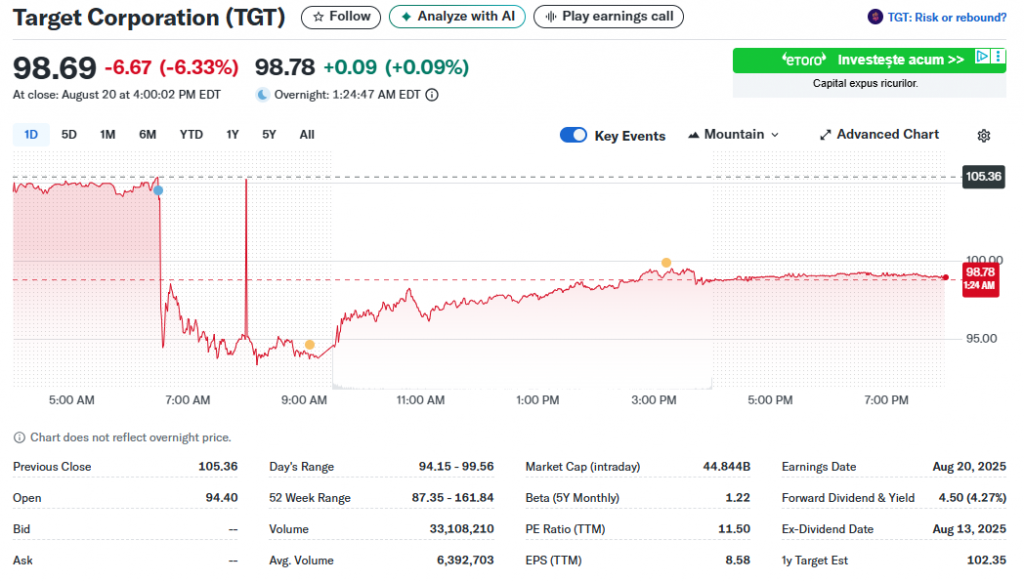

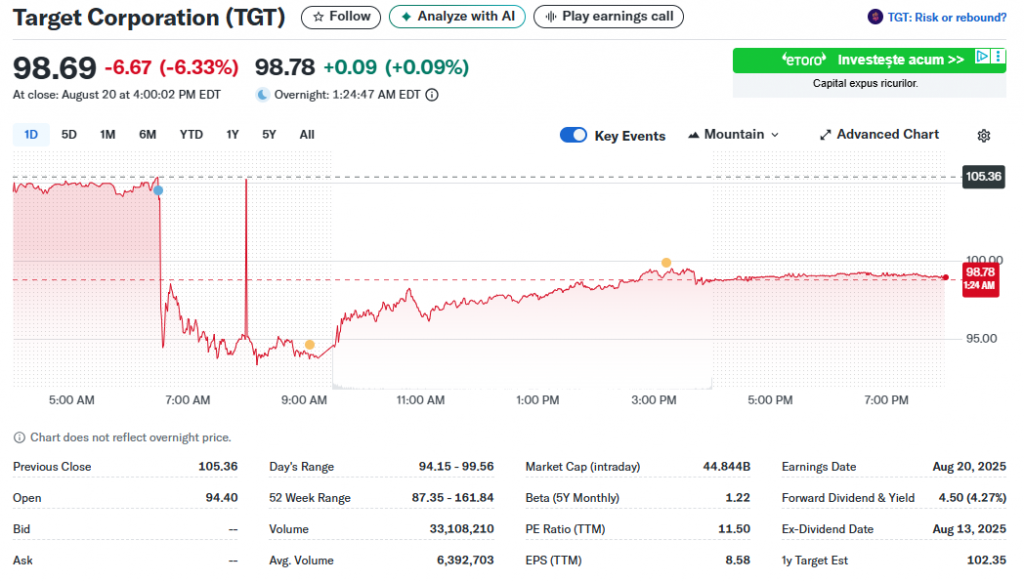

Target stock got hammered on Wednesday, dropping a solid 7% after the retailer announced that Michael Fiddelke would be replacing CEO Brian Cornell. The TGT stock decline actually caught a lot of investors off guard, since many were hoping for some fresh blood from outside the company to tackle Target’s ongoing sales problems.

Also Read: Bloomberg: Employee Stock Sale at $42B Valuation – Canva’s Quiet Move Before IPO?

Target Stock Price Drops as CEO Brian Cornell Steps Down for Fiddelke

Right now, Target CEO Brian Cornell is preparing to step down on February 1 after running the company for 11 years. Michael Fiddelke, who’s been the chief operating officer and has worked at Target for about 20 years, will be taking over the top job. The Target stock price reaction was pretty brutal – shares were down more than 8% in early trading before settling around that 7% drop.

Wall Street Expresses Disappointment with Internal Pick

The TGT stock plunge really shows how disappointed Wall Street was with this decision. Target stock has been struggling lately, with declining sales in nine out of the past 11 quarters, which is not exactly what investors want to see.

Stacey Widlitz, who’s the president of SW Retail Advisors, had this to say:

“The Street was looking for a fresh pair of eyes that might bring a solution to two years of stumbles.”

Even Gerald Storch, who used to be Target’s vice chairman and also ran Toys R Us, was pretty blunt about it. He stated:

“The stock price reflects that there won’t be change when change is needed. The sales are negative and they are bleeding market share.”

Fiddelke’s Plan to Turn Things Around

Michael Fiddelke actually acknowledged that Target has been facing some real challenges during recent earnings calls. The company reported a 1.9% drop in comparable sales along with a 21% decline in net income in the latest quarter, which isn’t great news.

During a call with reporters, Fiddelke stated:

“When we’re leading with swagger in our merchandising authority, when we have swagger in our marketing and we’re setting the trend for retail, those are some of the moments I think that Target has been at its highest in my 20 years.”

The incoming CEO has outlined three main priorities that he wants to focus on: getting back Target’s merchandising leadership, making the customer experience better, and investing more in technology. At the time of writing, these seem like reasonable goals, but investors haven’t totally bought into the plan yet.

Analysts Still Have Concerns About Target Stock

Neil Saunders from GlobalData Retail criticized the board’s decision to promote from within. He said:

“While we think Fiddelke is talented and has a somewhat different take on things compared to current CEO Brian Cornell, this is an internal appointment that does not necessarily remedy the problems of entrenched groupthink and the inward-looking mindset that have plagued Target for years.”

David Silverman, who works as a senior director at Fitch Ratings, also weighed in on Target’s struggles. He stated:

“Target’s value positioning should be yielding better results than the low single digit revenue decline we expect for Target this year.”

Target stock is also being hurt by some other issues right now. The company has been dealing with consumer boycotts over diversity initiatives, and there have been problems with store cleanliness and merchandise selection. Customer transactions actually dropped 1.3% while the average amount people spend per visit fell 0.6%.

Also Read: JPMorgan Launches New Stock Market Forecast Model, Shocking Signal

The TGT stock performance really reflects broader concerns about whether Target can compete effectively with Walmart and get back to its “Tarzhay” positioning under this new leadership. Even though Fiddelke has been with the company for two decades, many analysts think Target needed someone from outside to shake things up.