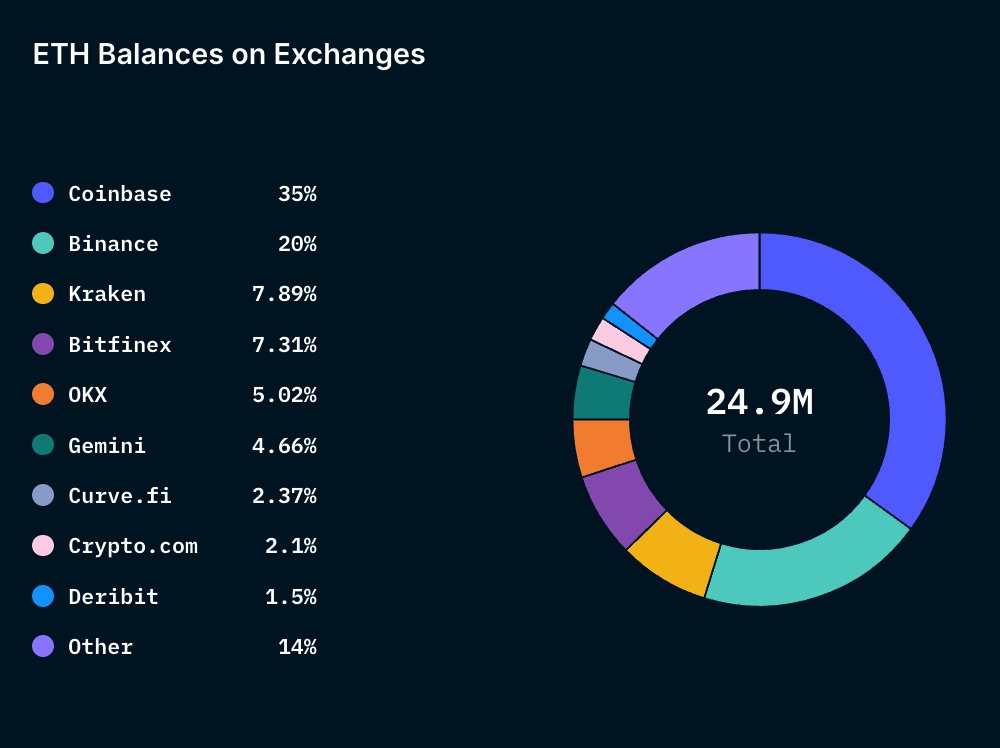

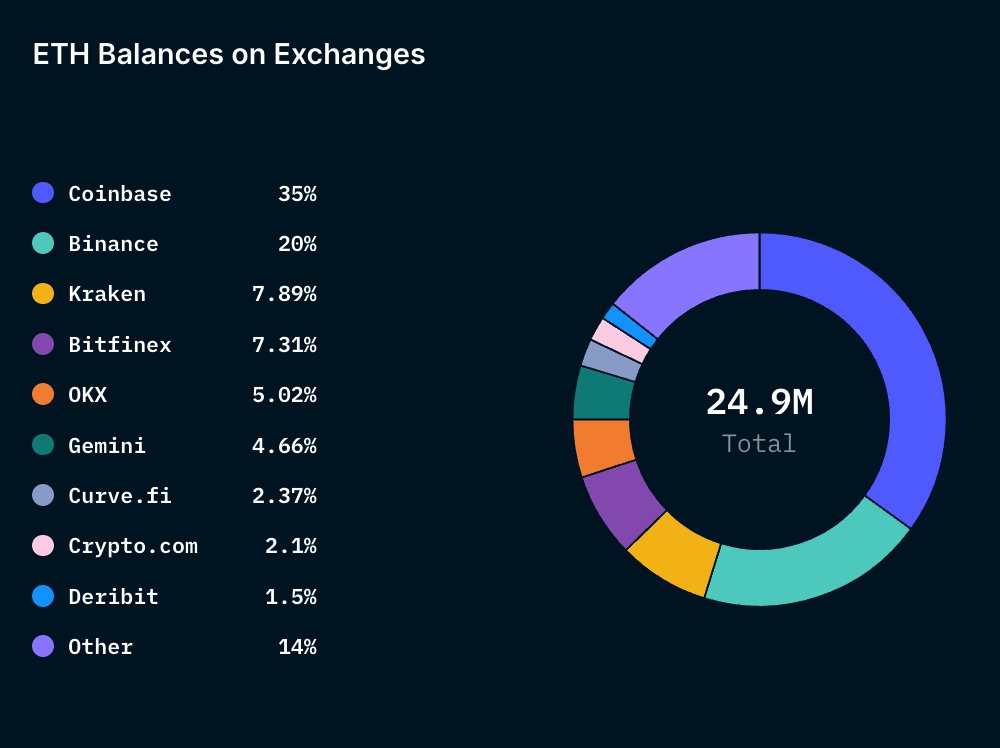

The Ethereum [ETH] network is still trying to steer away from accusations about the network becoming centralized following its shift to proof-of-stake. Amidst this, new data shows that 55% of Ethereum exchange holdings were on two prominent cryptocurrency exchanges.

Nansen statistics show that 8.72 million, or 35%, of the total amount of ETH stored on exchanges, are kept on Coinbase. Binance followed suit by 20%, and the two of them account for 55% of the market. Kraken has a meager 7.89%.

Even though Binance is the largest cryptocurrency exchange in the world, it only has 4.94 million users. The aforementioned exchanges now have a combined total of 24.9 million ETH.

Meanwhile, the total number of ETH staked went on to hit an all-time high of 15.9 million over the weekend. At press time, the total amount staked is over $25.18 billion, which is also 13% of the asset’s supply.

Here’s how Ethereum [ETH] has been faring

Earlier today, ETH was trading at a high of $1,653.73. However, at press time, following a correction, ETH dipped to $1,582.73 with a daily drop of 1.55%. However, Glassnode revealed that ETH’s realized price hit a monthly high of $1,364.28.

The total worth of ETH at the price at which it was purchased divided by the total number of ETHs in existence is the realized price of Ethereum. Ethereum holders will be bearing paper losses if the current market price falls below the realized price.

This wasn’t all. Ethereum’s network value to transactions or NVT has reportedly hit a 2-year high. This metric sheds light on the market cap against the number of transactions on the ETH blockchain. Currently, ETH’s NVT is at 2,181.222.

If the NVT is high, it usually means that the network is overvalued. When the NVT is lower, it is considered to be bullish as the network is undervalued.