The crypto markets took a heavy beating over Tuesday night. The global cryptocurrency market cap fell by 5.7% in the last 24 hours, currently standing at $953 billion. Many expected the markets to rebound after a brief moment of relief in August. Additionally, some even expected Ethereum’s transition to a PoS (Proof-of-Stake) model to have a positive impact on its price. But that was not the case.

Now, September has historically never been a good month for the crypto markets, commonly known as the “September Effect.” This year things are no different. Albeit this time around there are other entities at play than any average year. The Russia-Ukraine conflict and post-pandemic corrections are all major contributors to the current scenario.

Nonetheless, there is one crypto project that is in the greens at the moment: Quant (QNT). QNT is an Ethereum token that powers the Quant network’s Overledger, a blockchain operating system.

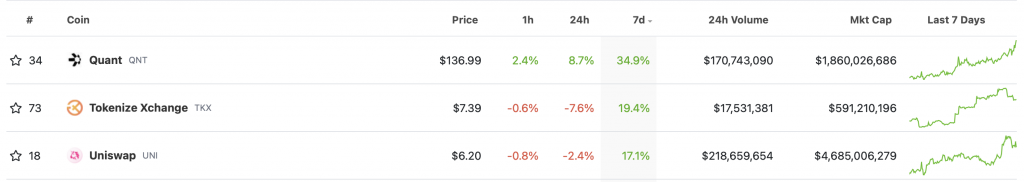

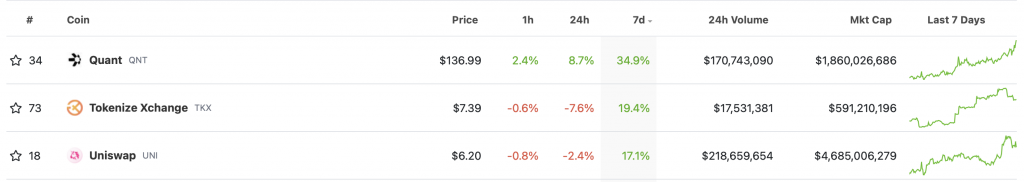

Quant (QNT) is the only crypto token that is rallying in all time frames. At press time, the token was up by 8.7% in the last 24 hours, up by 34.9% in the last week. Moreover, the token is up by 41.6% in the last 14-days, and up by 48.3% in the last month.

Quant is followed by Tokenize Xchange (TKX) and Uniswap (UNI) both of which are in the reds for the last 24 hours. According to CoinMarketCap, Quant’s volume has also surged by 224%, and its market cap has increased by 12.8%.

How is QNT dominating the crypto markets right now?

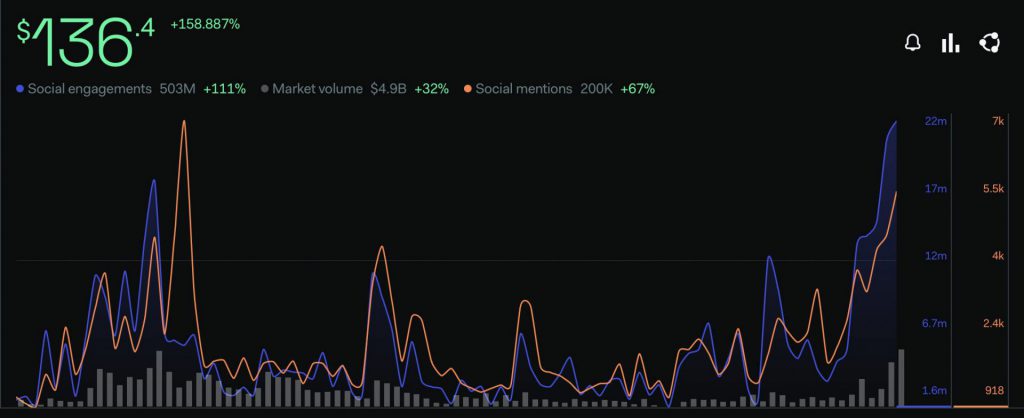

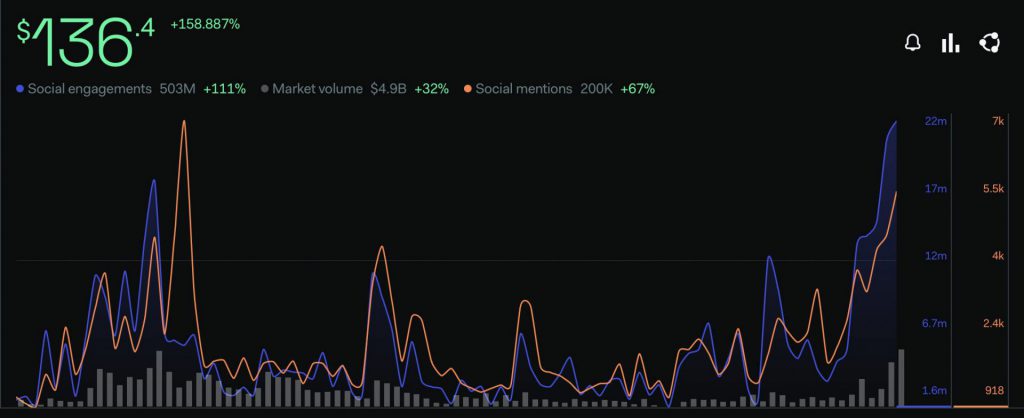

Apart from its price, Quant’s social metrics are also on the rise. According to the data on LunarCrush, Quant’s social engagement is up by 111%, while its social mentions is up by 67%. QNT’s social engagement is the highest it has been in three months.

Some have speculated that the US government would want Quant’s Overledger technology for its own CBDC.

Nonetheless, social sentiment regarding Quant is high at the moment. At press time, QNT was trading at $138.65, up by 2.6% in the last hour.