Over the past year, the value of multiple popular non-fungible tokens (NFTs) has drastically decreased. The pattern corresponds to the falling value of metaverse assets in 2023. Metaverse assets were regarded as the best virtual lands for investment last year.

The value of popular NFT projects including Doodles, Invisible Friends, Moonbirds, and Goblintown has decreased by up to 95%. Blue chip NFT collections alone have seen a value decline of over 40% on average. According to NFTGo data, the Blue Chip Index dropped from its high of 12,394 ETH in July 2022 to 7,446 ETH.

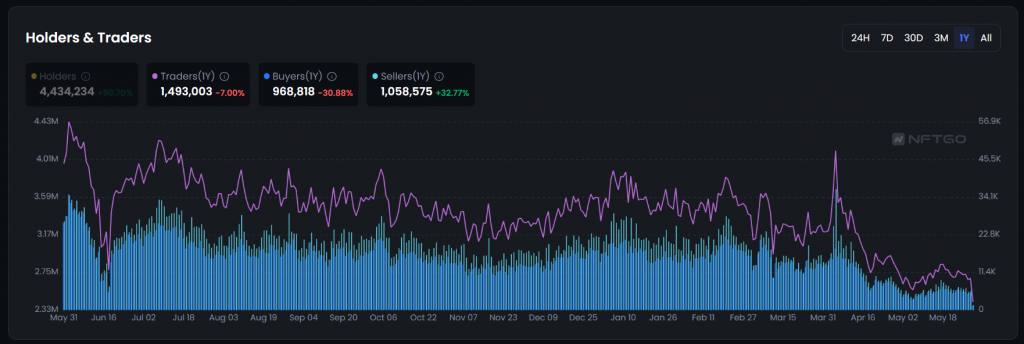

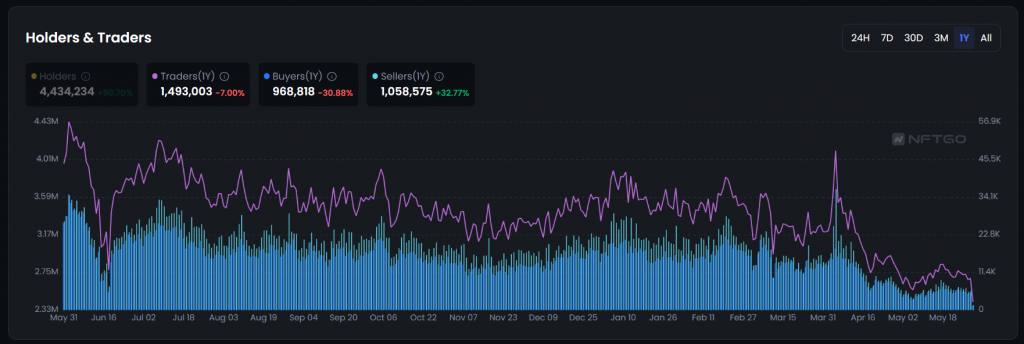

Nonetheless, investors in non-fungibles are unconcerned by the ongoing value drop. Over the past year, blue chip NFT holders have increased by more than 90%. The number of sellers climbed by 32% during this period, whereas the number of buyers fell by 30%.

Why is the number of NFT holders increasing?

While some forecast a long and deeper decline in NFT pricing, some investors think now is the ideal time to buy since they expect a recovery. Investors probably believe that the non-fungible hype of 2021 will make a comeback. Many are aware of the prices non-fungibles can reach in the right market. Therefore, the current decline in prices may appear to be a potential opportunity.

Furthermore, the NFT ecosystem continues to interest new investors despite the financial difficulties. Even crypto critic Peter Schiff used Ordinals to establish an NFT enterprise on the Bitcoin blockchain.

Regardless of the falling value of top collections, there is no denying the potential NFTs have in the future. The use cases of non-fungibles go beyond just artwork and gaming. Governments have begun looking into blockchain technology to better streamline their record keeping. Many events use NFTs as tickets. The tokenization of assets coupled with non-fungibles has a long way to go in the digital future.