Binance and BNB are currently the first and third trending topics in the industry. The discussions have been sparked over the allegations that Binance sold Bitcoin to uphold the value of BNB tokens. The world’s leading exchange is the top holder of Bitcoin. Obliquely, this comes with the power to manipulate the price of the asset.

Amid the dumping speculations, several members of the community, including Peter Brandt, have outrightly called out Binance and its founder, Changpeng Zhao [CZ]. Additionally, this section of the community is bracing for BNB’s price to break below $200.

Also Read: Thailand Seeking to Shutdown Facebook over Crypto Scam Ads

Binance Wallet Activity

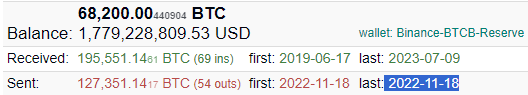

Several Binance wallets make the cut to the top holders’ BTC rich list. The last outflow transactions associated with the largest wallet, dated back to Jan. 7, 2023, and Nov. 28, 2022. On the third largest wallet, zero outflow transactions have been registered until now. On BitInfoCharts, the ninth largest wallet was labeled Binance-BTCB-Reserve. The last time Bitcoin moved out of this address was on Nov. 18, 2022.

Also Read: South Korea: Cheongju to Seize Crypto From Tax Evaders

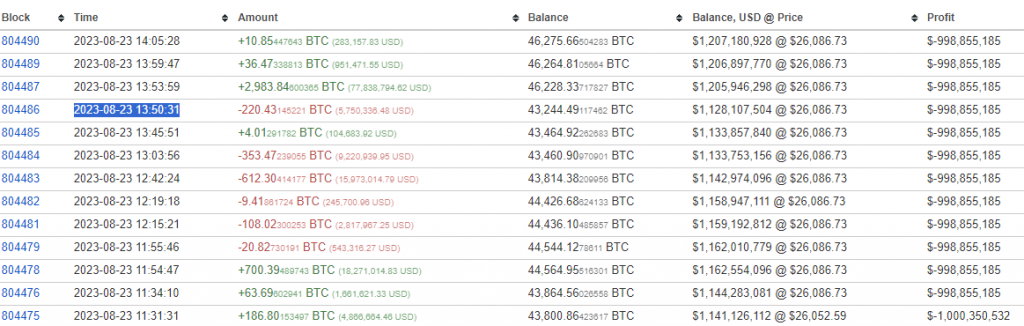

On the fourteenth largest wallet, outflow transactions have taken place lately. The last one transpired on Aug. 23, 2023, at 8:20 UTC. Nevertheless, this was accompanied by other inflow transactions. Such activity on this wallet has not been sudden. It has been recurring in nature. Community member David Ellis posted a similar observation on X [formerly Twitter]. He noted,

“I know there’s been a lot of chatter about a Binance dump, but I just don’t see any evidence of it. Of all their wallets, only one has moved any coins in the past 30 days and it actually has added coins over that time.”

Also Read: Ethereum Whale Sells 10,600 ETH: Suffers $3 Million Loss

Pressure Mounts on Binance

At the moment, there is a liquidation threat for a crypto loan backed by more than $130 million worth of BNB on the DeFi protocol Venus. As per a recent Venus governance vote, BNB Chain is coordinating with the DeFi protocol to knock out the loan to avoid “cascading liquidation” and “unnecessary damage to the market.” In fact, Adam Cochran recently asserted that Binance is trying to liquidate in small numbers. Elaborating on the same, he said,

“So far, it looks like Binance is trying to liquidate this in really small chunks to stave off large liquidation, but people keep pushing BNB to test it further. Since its OTC and they claim to have already set aside the money on the books, why not just get it over with?”

Analyst Summer Decree, recently pointed out that the market cap of BNB is roughly equal to 1.2 million BTC. However, Binance does not possess so many coins. Retrospectively, if BNB’s value drops, Binance could liquidate Bitcoin to support BNB’s price. Commenting on the feasibility of this strategy and drawing parallels with the FTX situation, he added,

“This strategy is sustainable until it’s not. If it fails, we could see a situation reminiscent of FTX but magnified.”

Also Read: Binance Powered Weeknd Concert in Australia, NZ to Tap On Web3

Similar allegations were made against Binance a couple of months ago as well. At that time, CZ confirmed that the exchange had neither sold BTC, BNB, nor FTT. However, the Binance executive has not yet given any official word regarding the latest allegations.

Also Read: Coinbase: Base Scammers Earn $2 Million Profit From 500 Scam Tokens

FUD or No FUD?

Skepticism has only been mounting. Dylan LeClair recently explained why branding this whole development as “FUD” did not make sense. He pointed out that, just like FTX, even Binance does not really have red flags when it comes to its core operations. However, he cast doubt when it came to the company’s balance sheet holdings, equity assets, and liabilities. Cautioning the community, he said,

“I think the reality is that people should just recognize, understand, and entertain the possibility that it’s not FUD. It’s just probabilistic thinking and asking questions.”

This is not the first time LeClair has expressed cynicism with respect to Binance. During the June FUD, he claimed that “BNB is clearly a fake market.” In fact, he also asserted that the exchange served as a “beta” bull market, and then started trading with less realized volume than BTC right after. He claimed that CZ was the “only buyer,” and added that OI was coming more from other exchanges than ever before.

Regarding the latest assessment, several from the community have appreciated LeClair for “asking the right questions,” and raising “great points.” However, only time can tell if the allegations are spot-on or not.

Also Read: Whale Accumulates Bitcoin Worth $3 Billion: Becomes 3rd Largest Holder