On July 17, Chainlink announced a major upgrade after its Cross-Chain Interoperability Protocol launched on Ethereum, Avalanche, Polygon, Arbitrum, and Optimism under early access. Aimed at improving cross-chain access to data and transfer of value between both public and private chains, the upgrade received a positive reception. It is important to note that Chainlink’s solution utilizes Swift’s data infrastructure. Over 11,000 financial institutions used the same network to facilitate international remittances. According to the United States Financial Crimes Enforcement Network, Swift settled over $1.8 quadrillion in transactions in 2021.

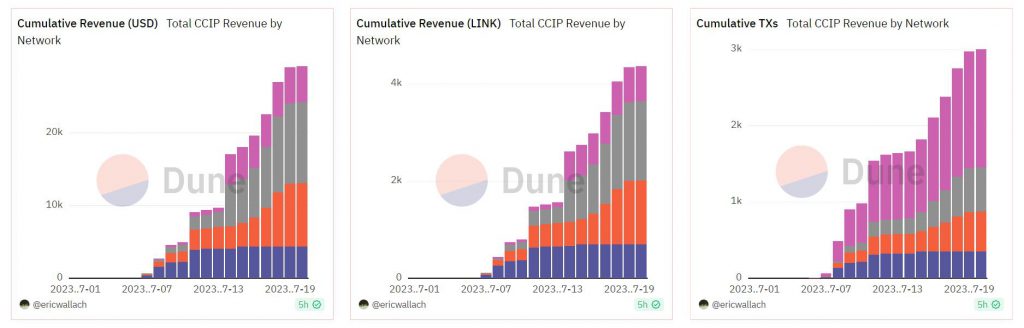

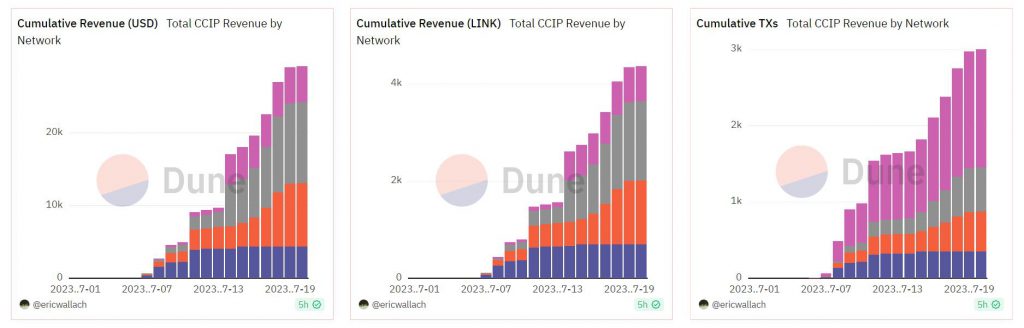

The technical bits can be a little hard to comprehend but the initial CCIP activity on various blockchain networks is evident. According to Dune analytics, the CCIP cumulative revenue on Optimism, Avalanche, Ethereum, and Polygon has progressively increased.

The community is acknowledging CCIP’s potential and market projection with respect to annual revenue is exponential. According to Max Safarin, Owner of Scruffur Capital Web3 Consulting,

“At the moment, CCIP is producing at a $10.5M annual revenue projection for Chainlink Labs There is going to come a point where $LINK is the highest revenue producer across products in web3 and people are still going to question how it’s in the top 3. My bags are loaded.”

Also Read: Assessing the Odds of Chainlink, Fantom Pumping 100% in July

Chainlink Price Analysis

Consequently, Chainlink is currently witnessing a massive rally at the back of CCIP’s initial hype. At press time, LINK is up by 17.14% for the day, reaching $8 for the first time since April 15th. However, there are a couple of other bullish signs observed on LINK’s daily chart.

At press time, LINK has breached above an ascending channel, which invalidated any bearish notion associated with the pattern. After breaking past the channel, the asset also established a position above crucial Exponential Moving Average (EMA) levels. The price is currently above 200-EMA(orange line), 100-EMA(red line), and 50-EMA(green line). Over the next few days, if the 50-EMA manages to position itself above 100-EMA and 200-EMA while LINK maintains a higher price range, the possibility of LINK reaching $8.40 and $8.80 increases drastically. Continued bullish momentum might also lead to LINK reaching a new yearly high at $10 and above.

At the moment, resistance at the aforementioned range of $8.40-$8.80 is crucial, and investors should be keeping a watch on the current market structure.

Also Read: Bitcoin Has a ‘Clear Direction’ After It Breaks Bollinger Bands