2022 was discouraging for the market sentiment. While some managed to get through it, others barely made it. Nevertheless, the ones that did, went on to endure huge losses throughout the year. Binance, the world’s largest cryptocurrency exchange wasn’t spared either.

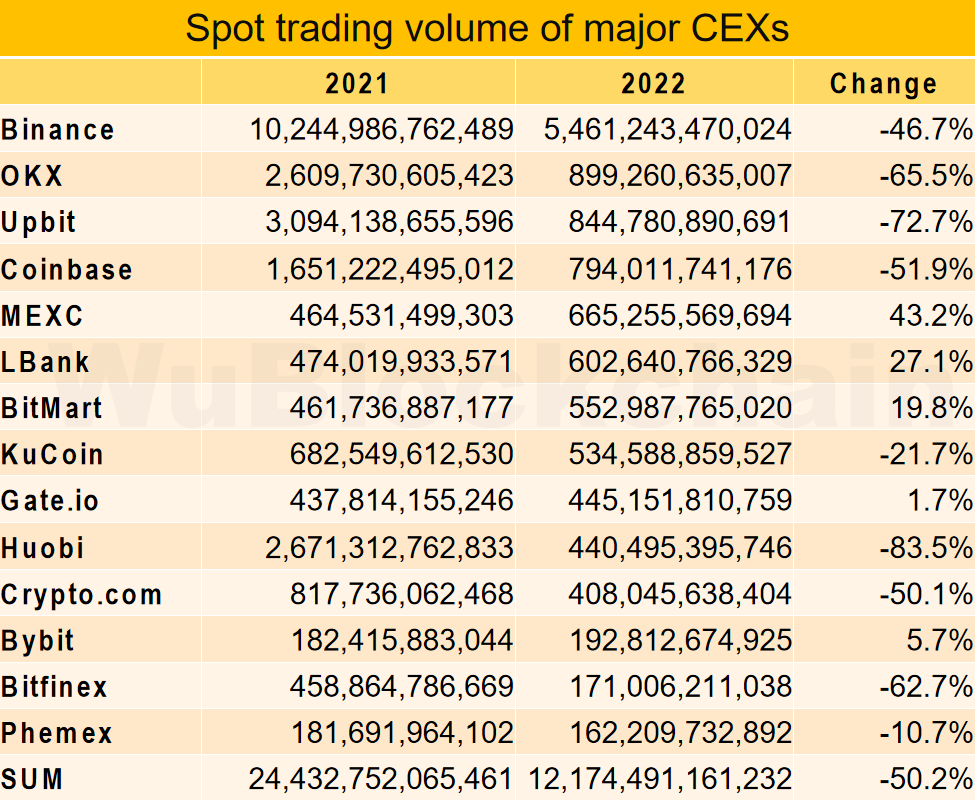

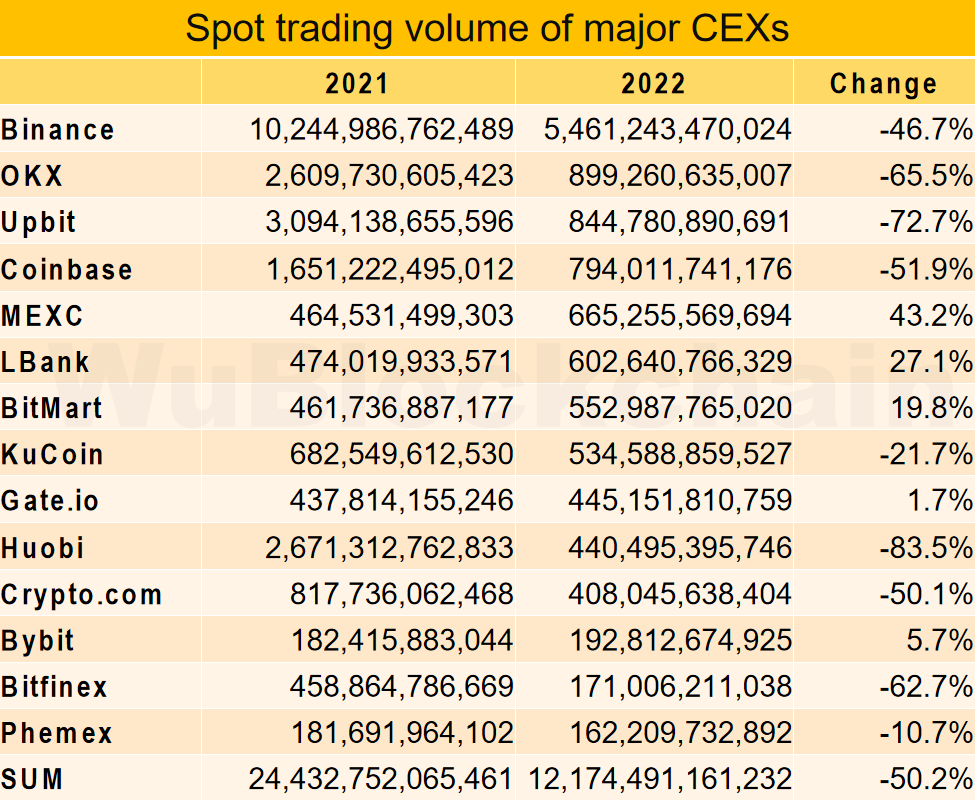

According to Chinese journalist Colin Wu, the spot trading volume of cryptocurrency exchanges took a major hit in 2022. Most firms witnessed an average plummet of 50% since 2021. While Binance continued to top the list, the exchange underwent a 46.7% drop since 2021. This fall signifies how the bear market outweighed Binance’s global takeover.

Huobi and Upbit were hit the hardest with 83.5% and 72.7% decline, respectively.

Surprisingly several exchanges recorded an increase in stop trading volume as well. MEXC, for instance, rose by 43.2% since 2021. LBank and BitMart followed suit with a 27.1% and 19.8% increase.

Furthermore, ByBit, despite its controversial 30% layoff, managed to surge by 5.7% in 2022.

Binance Bitcoin Supply Slashed By 25%

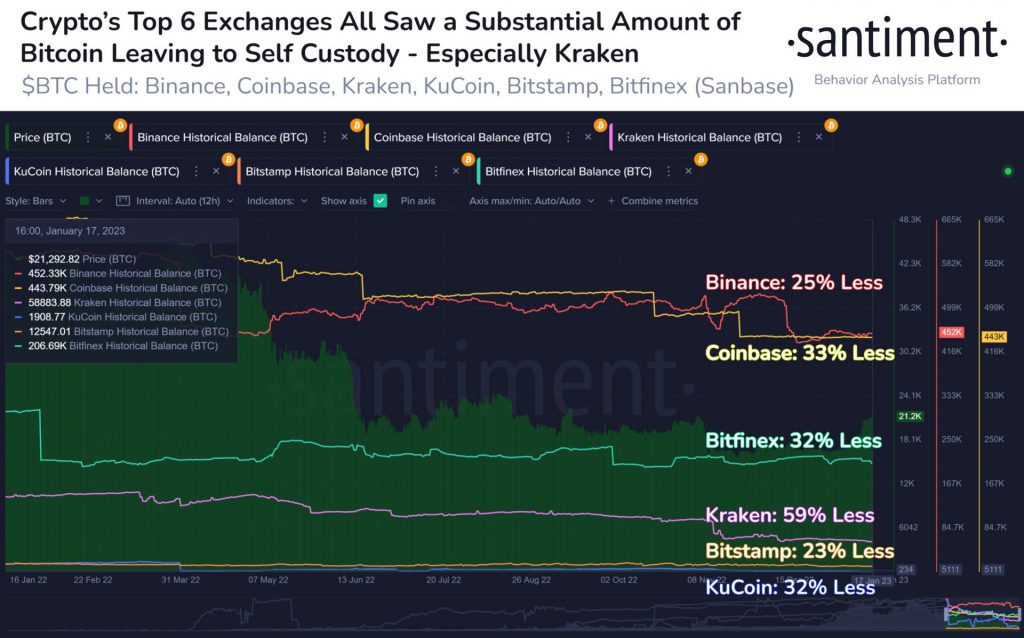

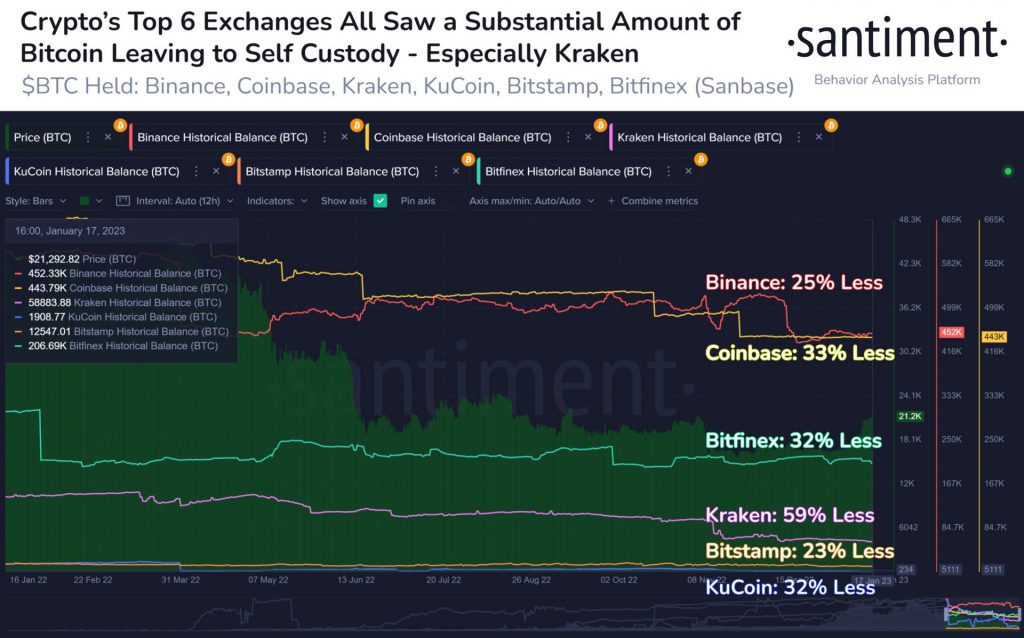

The on-chain analytics platform Santiment noted that Bitcoin’s overall supply on exchanges dipped from 11.85% to 6.65% throughout 2022. Deemed to be a “historic drop”, Santiment believes that the focus is slowly shifting to self-custody. It seems like self-custody will become more prominent throughout 2023 considering the downfall of a plethora of firms in 2022.

Binance Bitcoin supply is now 25% lesser than it used to be. Currently, Binance’s Bitcoin balance is at 518,136.41. This is the highest among all the other exchanges. Bitcoin’s supply on Coinbase dropped by 33% and it holds 487,582.61 BTC at press time. Kraken recorded the highest dip. The exchange’s Bitcoin supply recorded a 59% decline and its BTC balance is at a dainty 68,963.93.

Additionally, at press time, Bitcoin was seen recording a 2.29% daily fall. As BTC broke its winning streak, the asset dipped to $20,791.