The U.S. Securities and Exchange Commission (SEC) charged Hex and PulseChain founder Richard Heart on Monday for defrauding investors. The lawsuit called Hex and PulseChain unregistered securities and alleges that Heart misappropriated investors’ money worth millions of dollars. The SEC alleges that the founder siphoned investors’ money to purchase luxury goods such as cars and the Enigma diamond.

Also Read: 10 U.S. Sectors To Be Affected if BRICS Launch New Currency

The lawsuit also coincides with the release of The Highest of Stakes movie that showcases the rags-to-riches story of Hex investors. The movie is scheduled to release on August 4, in the United States, and could see an online release thereafter.

Hex & PulseChain Bleed After SEC Sues Richard Heart

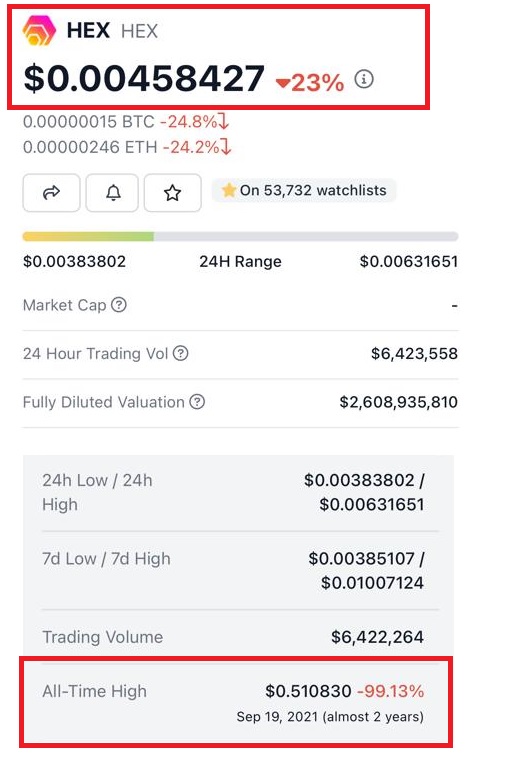

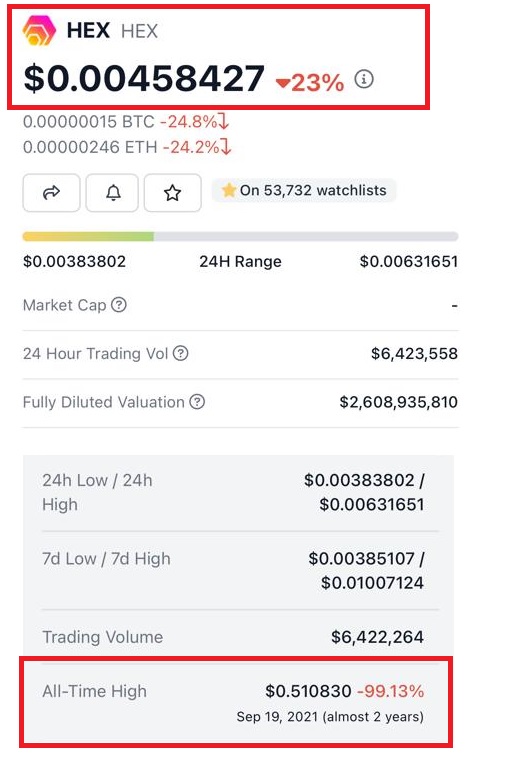

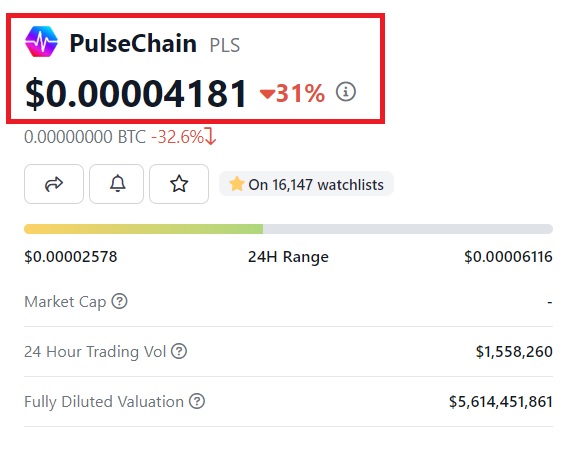

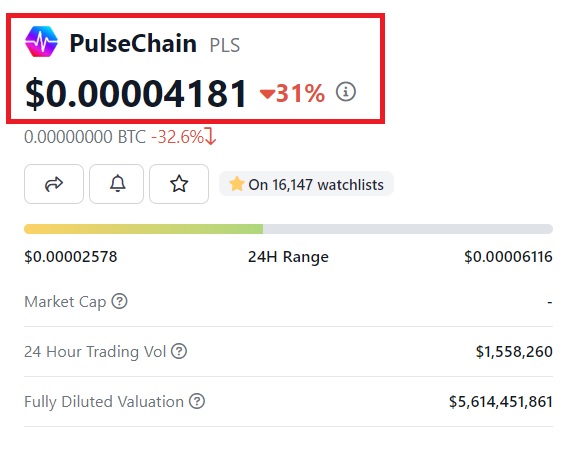

After the charges were filed, Hex and the newly launched PulseChain (PLS) collapsed like a pack of cards causing severe losses to investors. Both cryptocurrencies are bleeding double digits for two days showing no signs of a recovery. A handful of investors are dumping the token and jumping ship as the lawsuit could take years for an outcome.

Also Read: Russian Deputy Prime Minister Makes Huge Announcement on BRICS Currency

Hex slipped 23% on Wednesday, while PulseChain is down by 31% in the indices. If that wasn’t enough, Hex is dangerously down 99.13% from its all-time high of $0.51, which it reached in September 2021. On the other hand, PulseChain is down 86.01% from its ATH of $0.00029951, which it reached in May this year.

Also Read: Bitcoin: Microstrategy Plans $750 Million Stock Offering To Buy BTC

Richard Heart is considered a man with a ‘Midas touch’ in the Hex community but his larger-than-life personality is now facing a challenge. If Hex and PLS continue to bleed, investors’ trust in his projects could erode in the coming months.

Both the tokens are expected to crash further as the lawsuit intensifies and progresses toward the courtroom. This puts existing investors of Hex and PLS under pressure as holding on to the long term looks dangerous.